Gold and Silver Stage Precious Minor Rebounds at Critical Support

Gold and Silver Stage Precious Minor Rebounds at Critical Support

Gold prices are down 0.72% for the month so far

- News of a halt in Chinese gold buying and hotter May U.S. payrolls sent precious metals spiraling at the end of last week.

- Gold dropped to a support level in a two-month range today before rebounding.

- Silver prices have returned to their one-month moving average.

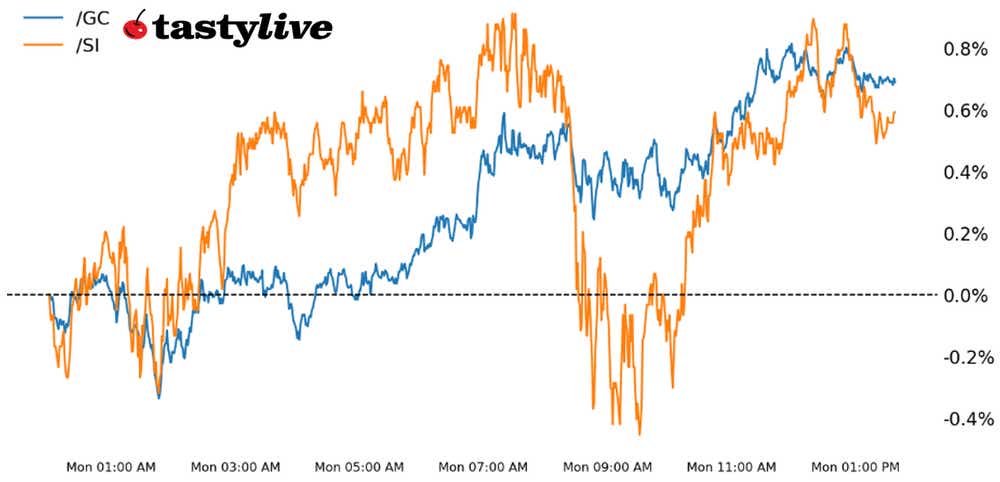

For all the sound and fury about precious metals in recent months, neither gold (/GCQ4) nor silver prices (/SIN4) have done anything consequential for some time

Gold remains in its two-month range. And silver is trading at levels seen in mid-May and mid-April. The price action underscores the shifting dynamics of the metals market.

Chinese central bank halts gold buying

On Friday, news that China’s central bank had halted its 18-month gold buying spree seemingly removed a potential fundamental catalyst off the table. Then, a stronger than expected U.S. jobs report for May stoked speculation that the Federal Reserve won’t be able to cut rates in the next few months and may not at all in 2024.

But then European parliamentary elections over the week rekindled memories of the fractured politics during the Eurozone debt crisis, giving safe havens like the Swiss franc and precious metals some reprieve. Like in the 2010s, strength in precious metals is seen alongside weakness in global bonds, evidence of market participants questioning the fiscal path of not just the Eurozone, but the U.S. as well.

Against this backdrop, even with the May U.S. inflation report and June Federal Reserve rate decision both due on Wednesday, it’s far too soon to declare the metals’ bull moves finished. After all, both /GCM4 and /SIN4 are sitting at a support level, having not yet broken below key thresholds.

Typically, it’s smart to buy at trend support during bull markets. And while that may be the prudent perspective today, it’s likewise important for precious metal bulls to have an alternative plan of action if price action turns even more modestly weaker.

/GC Gold price technical analysis: daily chart (September 2023 to June 2024)

Gold prices (/GCQ4) have been trading between in a two-month range, finding support near 2300 today. A consolidation following an uptrend is typically a continuation pattern, which warrants attempts to buy at range support. Given the volatility profile (IVR: 65), selling a tight OTM put spread (short 2300 p + long 2275 p) may be prudent so long as 2300 holds on a closing basis.

The alternative scenario is that a double top is forming. Given the distance between support and resistance, a break of 2300 would open a downside target of 2130 for /GCM4. Consistent with the uptrend from the October 2023 and February 2024 lows, this means support would likely be found closer to 2200 in a leg lower; a break below 2200 increases the odds of the double top playing out to the measured move of 2130.

/SI Silver price technical analysis: daily chart (July 2023 to June 2024)

Over the past several months, silver prices (/SIN4) have highlighted a reliable pattern: breakout higher, then quickly retrace to the daily 21- to 34-day exponential moving average (EMA) cloud. This happened in late-February; at the end of April; and now, at the start of June.

As the saying goes, “the trend is your friend,” and until the trend of buying into the daily 21-EMA (one-month moving average) fails, there’s no reason to fix what’s not broken. A drop below 29 would invalidate the breakout as well as the uptrend from the February and May swing lows, setting up a return towards 26.75.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices