Gold Surges Again as Shorts Bet Against the Rally

Gold Surges Again as Shorts Bet Against the Rally

Commitments of Traders Report data comes into focus as prices climb

- Conflicting narratives are driving gold volatility as prices rise.

- Gold speculators grow the shortest since November 2022.

- The technical outlook for gold shows a retracement is in order.

Gold prices surge as geopolitical risk swell

Gold prices (/GCV3) surged over $30 per ounce, or +1.6%, this afternoon as geopolitical fears deepened following mass casualties at a hospital in Gaza. Both sides traded blame for the event, but for financial markets the impact weighed on risk sentiment.

That benefited gold prices, which typically react positively to events that stoke the potential for further military intervention. Gold is now on track to record its best monthly performance since March, currently at +5.4%.

Meanwhile, gold volatility—via the Chicago Board Options Exchange’s gold volatility index (GVZ), which is like the volatility index (VIX ) but for gold—is up 8% this month. This increase in volatility suggests traders are increasingly unsure about the direction of gold.

Fed tightening takes a backseat, for now

Gold traders seem unfazed by increasing Treasury yields, which is an interesting conflict because higher yields typically weigh on precious metals. The 10-year note’s yield rose four basis points through mid-afternoon trading.

The conflict between Israel and Hamas pushed oil prices higher, which is fueling Fed rate hike bets, as traders price higher energy prices into the inflation outlook. For now, however, it appears gold traders are more concerned with the potential for a wider war.

COT data shows speculators adding shorts

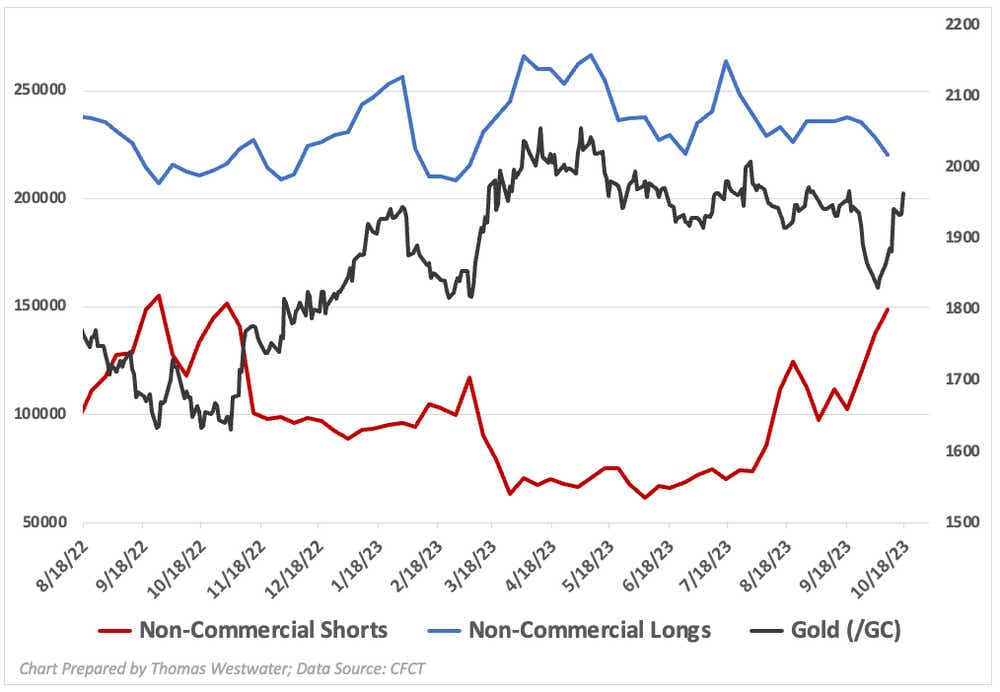

The latest Commitments of Traders Report (COT) from the Commodity Futures Trading Commission (CFTC), released Friday, showed some interesting developments for speculator positioning.

Non-commercial traders, a group that represents market speculators, cut their long bets by 8,046 contracts, while adding 11,719 short contracts. That pushed the total short position to the largest since November 2022.

Does that mean those speculators are correct and gold is about to sink? Not so fast. Gold prices rallied over 20% in the three months following November 2022. If we follow this type of historical context, we could see gold prices rally.

Gold technical outlook

The regression channel from the May high to the October low shows gold prices have run too high. A retracement to the mean is in order. Moreover, prices are approaching the 200-day simple moving average. This may represent a good place for shorts to establish a trade if prices have trouble eclipsing the key moving average.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.