Goldeneyes On Economic Data as Key Ratio Sends Signal to Traders

Goldeneyes On Economic Data as Key Ratio Sends Signal to Traders

Gold is outpacing silver but technicals are bearish

- Gold prices pace higher as silver lags.

- Economic data may shift the outlook on metals.

- Gold’s technical chart sees bearish signal.

Gold prices (/GC) are outpacing silver prices (/SI) on Monday as traders digest the latest comments from Federal Reserve officials, while awaiting some potentially high-impact economic data prints.

A modest pullback in Treasury yields, especially along the policy-sensitive short end of the curve, is allowing some upside for precious metals. The dollar is also weakening, making it cheaper for foreign buyers to purchase the metal.

Economic data in focus for gold traders

Gold prices have performed well recently as real interest rates fell, which makes gold more attractive to investors. With the Federal Reserve likely at or near the peak of its current rate hiking cycle, real rates may continue to fall, which would benefit gold further. The real interest rate is computed as the nominal rate of interest, less the rate of inflation.

At present, market sentiments are slightly inclined toward an additional 25 basis-point rate hike in November, with Fed funds futures pricing the probability slightly above 50%. The forthcoming economic data this week might sway these predictions, Hence, gold prices are expected to respond to any unexpected revelations in the data.

The U.S. second estimate for the second-quarter gross domestic product (GDP) is slated for release Wednesday, with analysts predicting a 2.4% rise from the previous quarter. On Thursday, the personal consumption expenditures index (PCE) is expected to register at 4.2% from July of the previous year. If this rate, or the core rate—a measure that excludes the volatile food and energy prices—surpasses expectations, it could strengthen rate hike bets, which could negatively impact gold.

Another significant data point to monitor is the U.S. non-farm payrolls report for August, which is due Friday. The consensus of +170,000 would signify a promising slowdown, bolstering the argument that rates should remain steady. However, if the headline figure exceeds that number, it could potentially exert downward pressure on gold and silver.

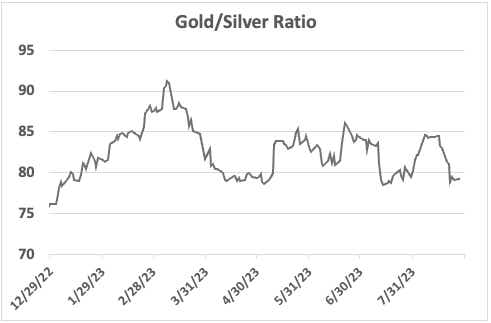

Gold/silver ratio says silver outperformance may be over for now

Gold is about 1.5% over the past two weeks, while silver gained nearly 7% during the same period. That has pushed the gold/silver ratio below the 80 level and near the lowest it has traded since January. This suggests silver may not continue to see outsized gains versus gold during the next rally.

Gold technical outlook

A bearish crossover between the 50- and 200-day Simple Moving Averages in the gold price chart is tempering the technical outlook. The crossover, known as a death cross, shows a decline in the short-term moving average that many traders see as bearish regarding future price action.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.