How to Trade and Manage Your Portfolio During a Recession and Bear Market

How to Trade and Manage Your Portfolio During a Recession and Bear Market

Tips for trading through big down moves in a bear market:

- Diversify your positions.

- Make small trades.

- Take profits early.

- Keep more of your portfolio in cash than you normally would in a bull market so that you can absorb large moves.

Take Profits Earlier and Redeploy Your Capital

Bear markets are an opportunity to take advantage of elevated volatility. Managing your portfolio through a bear market requires nuance and defensive positioning. Often, bear markets allow you to make trades on more products because of the increased level of premium available in the options market.

Markets fall faster than they rise. For us to be able to manage our short premium strategies through a bear market we must be willing to make trades more often than we might in a bull market. Either to close a position that is currently profitable or to make a defensive adjustment to a position that we are managing.

Taking profits earlier in a bear market is a solid strategy since a new downward move will expand volatility and likely test your strike prices more often. If we take profits earlier in a trade, it will free up our capital to be able to redeploy after a strong down move when premium is high. If we hold onto a position and try to ride out bigger moves, we lose opportunities to take new trades on different products. We want to get in and get out and move on to the next opportunity.

Key Takeaways

- Bear markets present huge opportunities.

- Trade often and take profits earlier.

- Keep your powder dry.

Diversify Your Portfolio

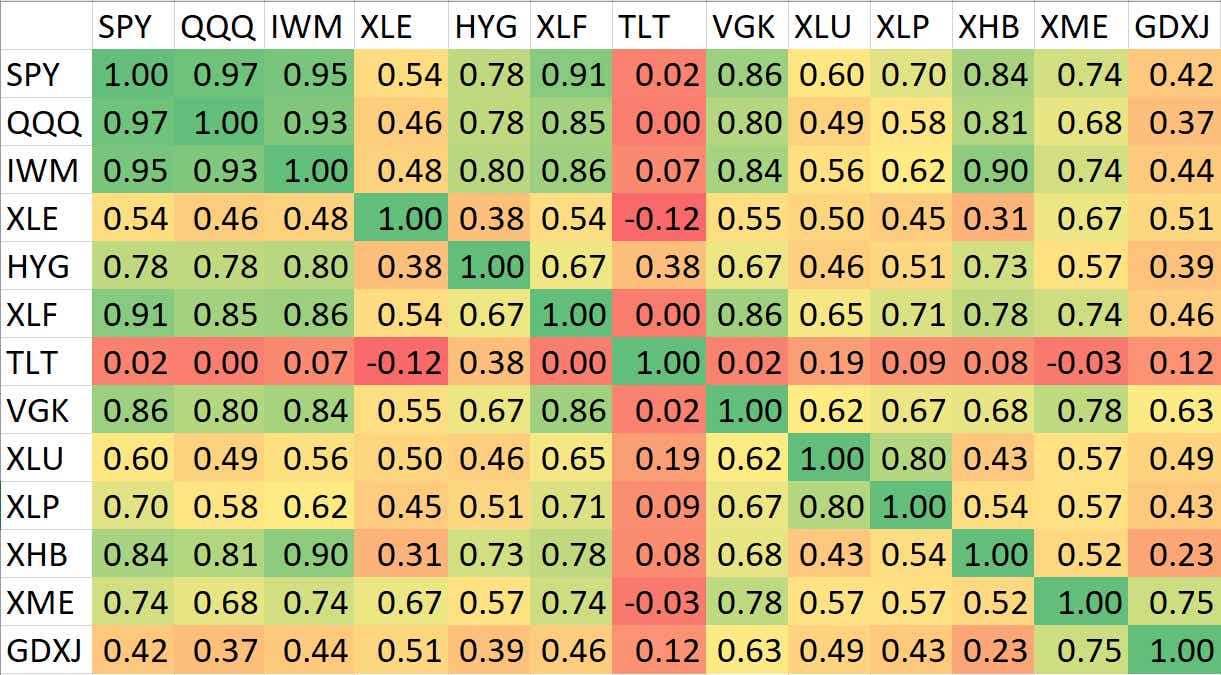

The catalyst for a bear market is often focused, with certain sectors taking much larger hits than others and dragging the market down with it as portfolio managers adjust. By taking positions in many different sectors, we can reduce the chance that all our positions react similarly to market events.

When looking for new trading opportunities, sort your options by sector. Once you have a position in a particular sector move to another sector and look for trades there. Do not fill your portfolio with positions in one sector, even if the premium to capital requirement is very attractive in that sector.

You’re much better off taking fewer positions in diversified sectors than loading up on positions in one attractive sector.

Recessions Will End

When you are battling through a bear market you will experience drawdowns often. It is important to remember that the market will get ugly and likely get worse, but then, eventually, it will get better. Keep your position sizes small so that big moves can be absorbed.

Big down moves will be followed by short-term rallies. Those opportunities are when we want to jump in and sell premium and then look for the near-term moment to close the position for a profit.

The market wants to find a price that participants are willing to transact at. Ideally, we get to that price level as fast as possible and let the bulls and the bears battle it out. We want to put our trades on right when the market finds a new level to transact at and then get out before the market swings to a new level.

This premium selling strategy allows us to take advantage of the premium expansion generated from a large move and then buy those positions back as the tug of war occurs at the new price level. We then look to get out early and take profits, keeping our powder dry and waiting for the next opportunity to make a similar trade.

Trading during a recession Key Takeaways

- Drawdowns are going to happen, keep your positions sizes small.

- Find opportunities in periods of consolidation.

- Put trades on after large moves and take profits early.

Interested in getting started? Create an account on tastytrade.

tastytrade, Inc. and tastylive, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.