Introduction to Precious Metals Futures

Introduction to Precious Metals Futures

Introduction

It's more than a little surprising that shiny metal dug from the ground still has such relevance in the modern economy.

Surprising, but true. Precious metals such as gold, silver, and platinum have maintained their strong association with global trade and finance for many, many years now.

Artifacts discovered from the remains of early human civilizations dating back as far as 4,000 B.C. illustrate quite clearly that gold has long been a valuable resource. A few thousand years later, archaeological evidence suggests that the first gold mines were founded in Egypt, a new chapter in humanity's desire to produce and store wealth.

The coinage of gold, another important milestone in the history of precious metals, has been traced back to 560 B.C. in the Greek state of Lydia. Coins such as these were used to pay the monthly salaries of the Roman legion; with one coin at the time roughly equivalent to 30 gallons of cheap wine, or 200 pounds of flour.

Amazingly, most modern workers would probably still welcome payment in the form of gold - clear evidence of the undeniable staying power of precious metals in our economy.

Given this rich history, it's no great surprise that precious metals still play an important role in modern finance and trading. Derivatives traded on modern exchanges, such as futures, boast a deep and highly liquid precious metals market.

Today we are taking a closer look at this particular niche of the futures market.

Background

To better understand the futures market for gold, silver, and other precious metals, a little more background is helpful.

Traditionally, gold coins were minted with a weight of one ounce, which may be the best reason that the value of gold is still quoted today per ounce. Along those lines, gold bars usually weigh 100 ounces, which also happens to be the amount covered by a standard gold futures contract.

With gold currently trading around $1,320/ounce, that means the notional value of a gold bar and a standard gold futures contract both stand at $132,000.

Silver, which has a market value substantially lower than gold, is also quoted by the ounce. The current market price for silver is about $17/ounce.

Because silver is so much less valuable than gold, most silver futures contracts are denominated in larger quantities. For example, the "big" silver futures contract covers 5,000 ounces, while the "mini" contract covers 1,000.

That translates to notional values of $85,000 for the "big" contract, and $17,000 for the "mini" contract, based on a silver value of $17.00/ounce.

While there are other precious metals, such as platinum, palladium, rhodium, and iridium, we are focusing primarily on gold and silver at this time because they are the most prominent and highest volume contracts in the group.

Precious Metals Futures Contracts

A precious metals futures contract is a legally binding agreement to take delivery of a specified precious metal at a future date for an agreed-upon price. Details of the contract, such as quantity, quality, time, and place of delivery are standardized by a futures exchange, with the price being the only variable component.

Precious metals futures are the type that require physical delivery upon expiration of the contract. Having said that, the majority of precious metals futures positions are closed prior to expiration through the establishment of an offsetting position, consequently eliminating the need for delivery.

Like other futures products, there are two different positions that can be taken via precious metals futures. Buying (going long) precious metals represents an obligation to accept delivery of the physical metal, while selling (going short) represents an obligation to make delivery to the buyer.

As discussed earlier, the specifications of precious metals futures can vary by contract, particularly as it relates to quantity. While the 100-troy-ounce contract is the most common, there is also a "mini" gold futures contract that covers 33.2-troy-ounces.

The two most common quantities of silver futures contracts are 5,000 ounces and 1,000 ounces. It's important to understand the quantity involved (and capital required), as well as any other contract specifics, prior to establishing a futures position.

Precious Metals Trading Strategies

Like other futures products, precious metals futures offer traders flexibility and diversity in their portfolios.

Futures are often viewed as attractive financial vehicles because they trade on centralized exchanges, which can offer additional leverage and financial integrity as compared to trading the actual underlying commodity. As a reminder, financial leverage represents the ability to trade and manage a high market value product with a fraction of the total value.

In the gold futures market, for example, traders have the ability to leverage $1 to control roughly $15. It’s important to remember that financial leverage cuts both ways - while the potential exists for greater returns, the associated risks are also higher.

From a strategic standpoint, the primary uses of precious metals futures are speculation, hedging, and spread trading - much like the rest of the futures universe.

Speculation involves the expression of a directional bias on the underlying future through either a long or short position.

Hedging in the precious metals arena is similar to other futures products, such as wheat, corn, and crude oil. Producers may use futures to lock in the price of future production/discoveries.

One unique aspect of precious metals futures is that market participants also choose to trade gold, silver and the like for reasons tied to inflation. Some investors/traders worry that holding an underlying currency (such as USD, Euro, or Yuan) represents an inflation risk - the possibility that a currency could depreciate over time as more is printed.

To mitigate that risk, some market participants choose to diversify their holdings using precious metals (physical or otherwise), which can theoretically increase in value as local currencies depreciate. The goal with this approach is to offset some degree of inflation risk.

In this regard, the precious metals futures market has an additional dimension for market participants - those that may be hedging against inflation, as opposed to hedging against future production/discoveries or other financial holdings.

This is one reason that the value of precious metals can also rise during periods of economic or financial instability, as investors and traders exit other riskier assets in favor of a holding they perceive to be more insulated from price depreciation.

Precious Metals Spreads

Aside from speculation and hedging, many market participants also use the precious metals futures market to execute spreads.

A spread is the simultaneous purchase and sale of two different futures contracts. Such a position is designed to profit from changes in the relative value of the two contracts, as opposed to outright speculation on the direction of one futures contract.

Precious metals futures spreads can be deployed in different maturities of the same underlying future (different points on the time horizon), or in two different underlying futures (different products). The former is known as an "intra-market" calendar spread, while the latter is known as an "inter-market spread."

Practically, an intra-market spread might be executed by purchasing a near-term maturity in gold futures, in favor of selling a longer term contract in gold futures. Alternatively, an example of an inter-market spread might be purchasing gold futures versus selling silver futures.

It's important to add that inter-market futures spreads are often executed in ratio fashion. This is done to help balance delta exposure across both legs of the spread.

The Gold/Silver Ratio

One of the best known inter-market spreads in the precious metals futures universe utilizes the relationship between the prices of gold and silver.

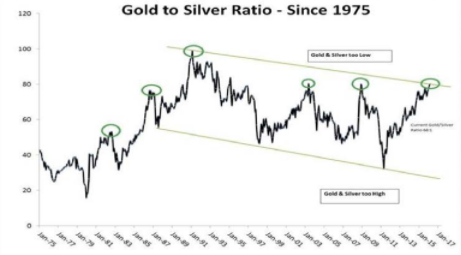

Known as the Gold/Silver Ratio, this is the amount of silver it takes to buy one ounce of gold. The ratio is calculated by dividing the current price/ounce of gold by the current price/ounce of silver. The result can then be compared to the historical range of the Gold/Silver Ratio in order to ascertain whether a potential trading opportunity exists.

Using the approximate prices for gold and silver introduced previously, we can calculate a sample value for the current Gold/Silver Ratio. With a gold price of $1,320/ounce, and a silver price of $17/ounce (both are close to current market prices), the Gold/Silver ratio would theoretically be equal to roughly 78.

In order to gain proper perspective on that value, we can now review a historical illustration of the Gold/Silver Ratio, which is shown below:

Looking at the graphic above, one can see that a Gold/Silver Ratio of 78 is closer to the higher end of the historical range.

Traders using the Gold/Silver Ratio to filter for potential opportunities traditionally prefer instances in which the Ratio is trading at (or close to) the extreme levels of its historical range (high or low).

If one is expecting the Ratio to go lower (revert toward its historical mean), the associated position would involve getting short gold futures in favor of getting long silver futures. Because this is an inter-market spread, the position would also be deployed in ratio fashion.

On the other hand, if the Gold/Silver Ratio is trading at levels closer to its historical lows, a trader might initiate the opposite position. This would involve getting long gold futures while getting short silver futures. A position that theoretically profits as the Gold/Silver Ratio expands. Again, this position would be executed in ratio fashion.

Traders seeking to learn more about setting up sample trade structures related to the Gold/Silver Ratio will find a previous installment of Futures Measures very compelling. This episode also walks viewers through the rationale behind using a ratio approach when pairs trading gold and silver.

Parting Shots

Precious metals futures offer traders diversity from traditional equity markets as well as deep liquidity, tight markets, and extensive trading hours.

If you are considering adding futures, but would like to learn more about their suitability in your portfolio, we recommend reviewing a previous episode of Closing the Gap - Futures Edition titled “Advantages and Disadvantages of Adding Futures.”

If you have any outstanding questions about precious metals futures, we also welcome you to reach out directly to support@tastylive.com with any questions.

The following links may also be helpful:

Thanks for reading, and we look forward to hearing from you!

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices