Is the US Economy in a Recession? It’s Complicated

Is the US Economy in a Recession? It’s Complicated

What is a recession?

The layman definition is typically “two consecutive quarters of contracting GDP.” But the official body that designates recessions in the US, the National Bureau of Economic Research (NBER), has a different definition, calling it “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

Concerns regarding a US recession have been percolating in recent months. The slowdown at the start of 2022, a surprising rebound in the second half of last year, and a 2023 banking episode (see: Silicon Valley Bank, Signature Bank, and First Republic) – not to mention the Federal Reserve’s interest rate hikes – have led to an avalanche of calls from financial analysts, pundits, and market participants that a 2023 recession is a fait accompli.

Here are three perspectives to consider on either side of the argument.

Recession: Not Now, Not Immediately

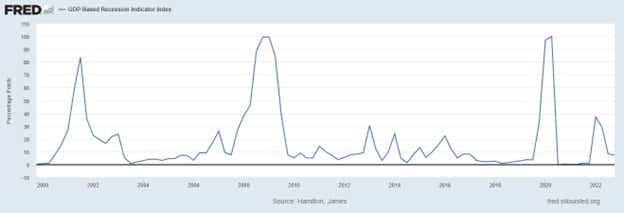

1) GDP-based Recession Indicator Index

The index corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data.

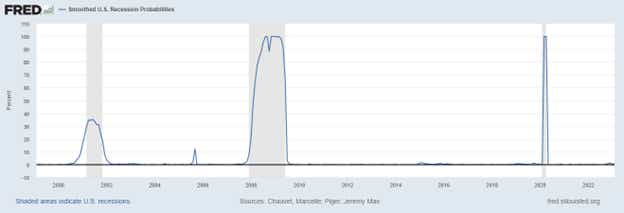

2) Smoothed US Recession Probabilities

Smoothed recession prob for the US are derived using 4 monthly coincident variables: NFP employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.

3) Real-time Sahm Rule Recession Indicator

The Sahm Recession Indicator signals the start of a recession when the 3-month moving average of the national unemployment rate (U3) rises by 0.50% or more relative to its low during the previous 12 months.

Recession: When, Not If

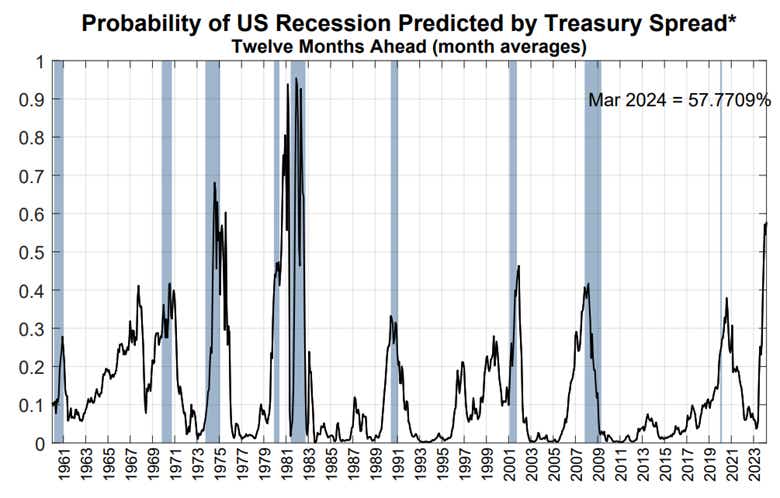

1) NY Fed 3m10s spread

Parameters estimated using data from January 1959 to December 2009, recession probabilities predicted using data through Mar 2023. The parameter estimates are α=-0.5333, β=-0.6330.

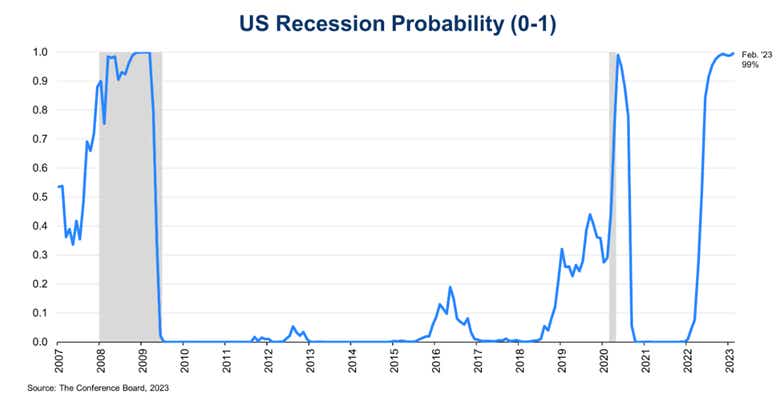

2) Conference Board Recession Probability

The probability is estimated using several leading indicators including: the yield spread; financial conditions; and the Federal Reserve’s balance sheet.

3) IACPM Credit Outlook Survey

The respondents are members of the International Association of Credit Portfolio Managers, seeing challenges posed by inflation, interest rates and geopolitics concerns are now met by a threat by credit risk concerns.

Signal or Noise?

The state of the US economy is clearly complicated. There is a clear schism between actual economic data and market pricing. In turn, an asymmetric situation has arisen: either the market is correctly positioned for a recession, and the data will sour in the coming months; or the data is resilient for a good reason, and the market is incorrectly positioned economic growth.

In the former scenario, downside for risk assets may prove limited. After all, /ES futures positioning is the most net-short since October 2011, per the CFTC’s COT report; the bear side is extremely crowded already.

In the latter scenario, if the US economy does prove resilient, then traders expecting a recession – and there appears to be quite a few – may find themselves on the wrong side of tedious, slow moving short covering rally in stocks over the coming months, marked by low volatility and low trading volumes.

--- Written by Christopher Vecchio, CFA, Head of Futures and Forex

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices