Legging in Options Trading

Legging in Options Trading

By:Kai Zeng

Does legging into and out of options trades enhance results?

- The average daily price movement tripled over 15 months.

- Legging in and out is an impractical strategy.

- The legging approach did not enhance performance.

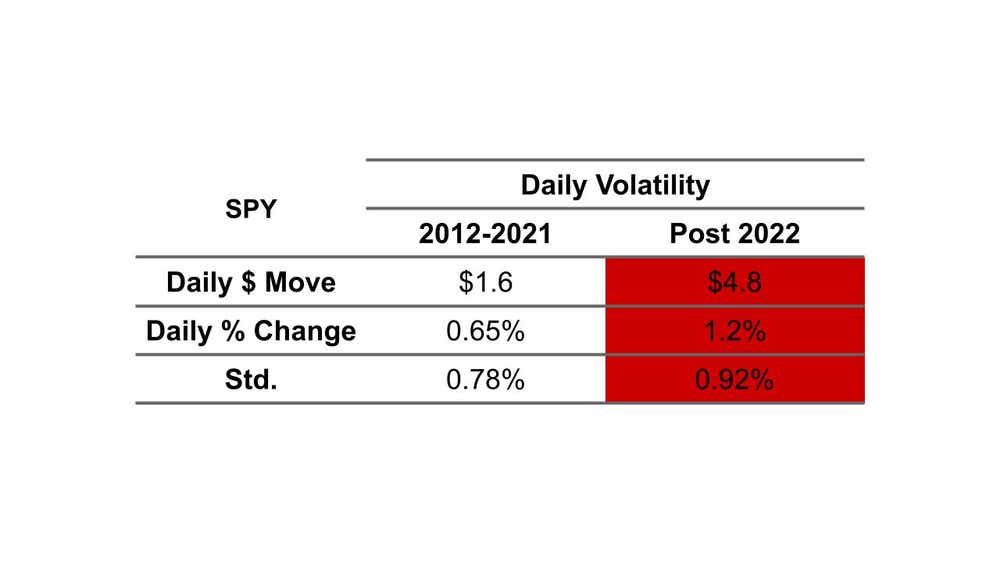

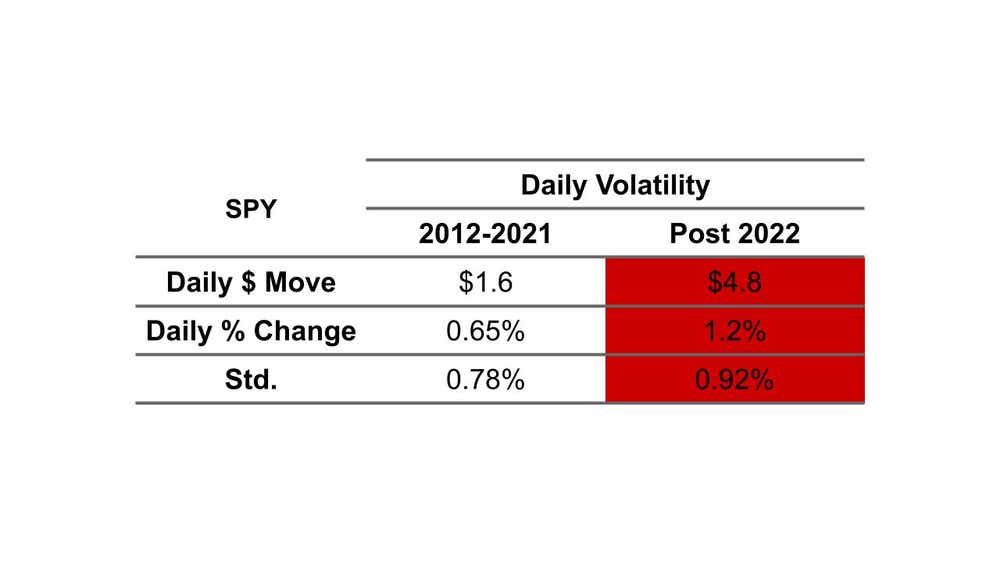

The market has been trading at a broad range since 2022, significantly impacting our option strategies and position management methods.

Over the past 15 months, we've seen the average daily price movement triple, with the daily percentage change nearly doubling compared to the 10-year average.

Many traders are questioning whether they should time the market by 'legging' in and out of positions to capitalize on this volatile market, rather than managing the entire position. "Legging" refers to independently managing multi-leg positions, such as exiting a put before a call, instead of closing both simultaneously as a strangle. The goal is to secure more winners with a shorter holding duration, if possible.

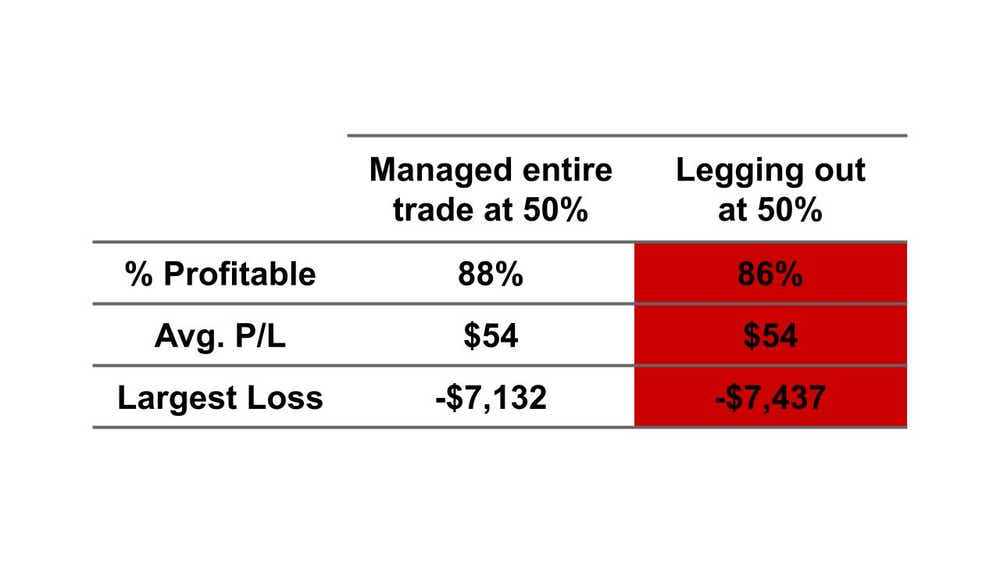

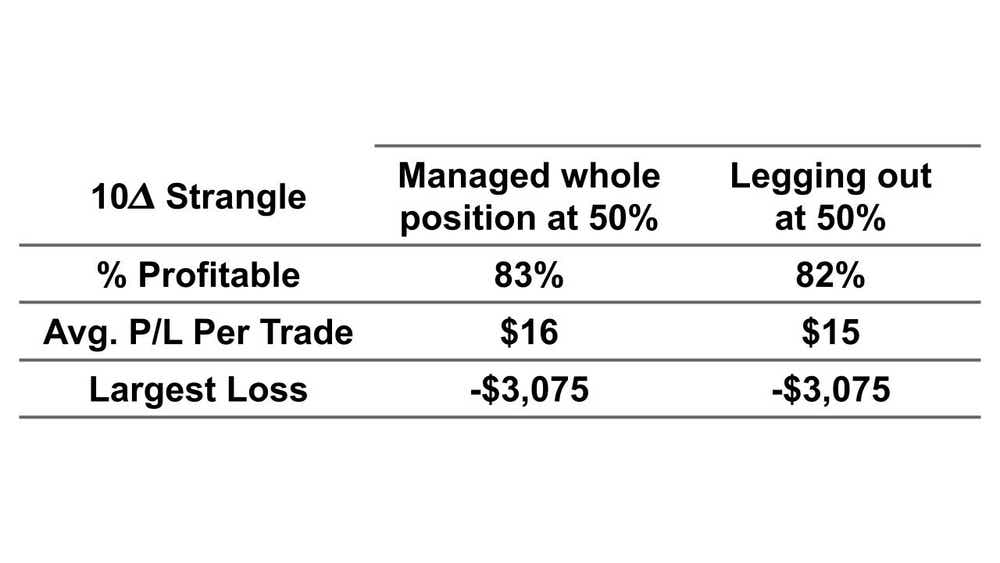

To investigate this, we examined the performance of selling S&P 500 ETF Trust (SPY) 45 DTE 1SD strangles using two management approaches: managing the entire position at 50% of the maximum profit and managing each side independently at 50%.

Our analysis revealed that the legging approach did not enhance performance. In fact, managing the entire position slightly outperformed legging out over the long term. Entering and exiting all legs at the same time can yield the same return while increasing the success rate and reducing the downside risk.

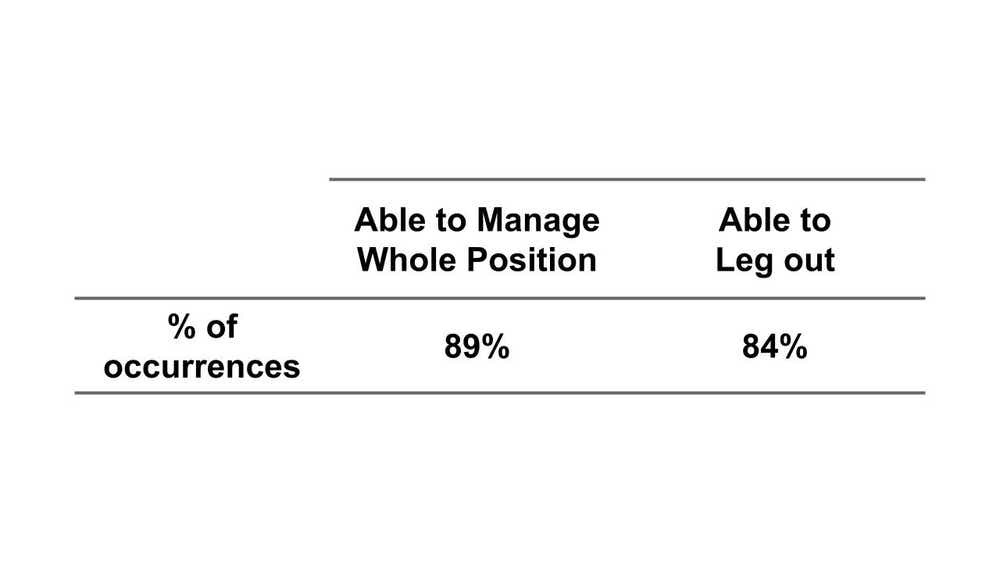

Moreover, managing strangles as a whole position yielded more opportunities. There is only an 11% chance that the position will not be able to reach 50% winners if managed together. However, we see 16% if managing independently.

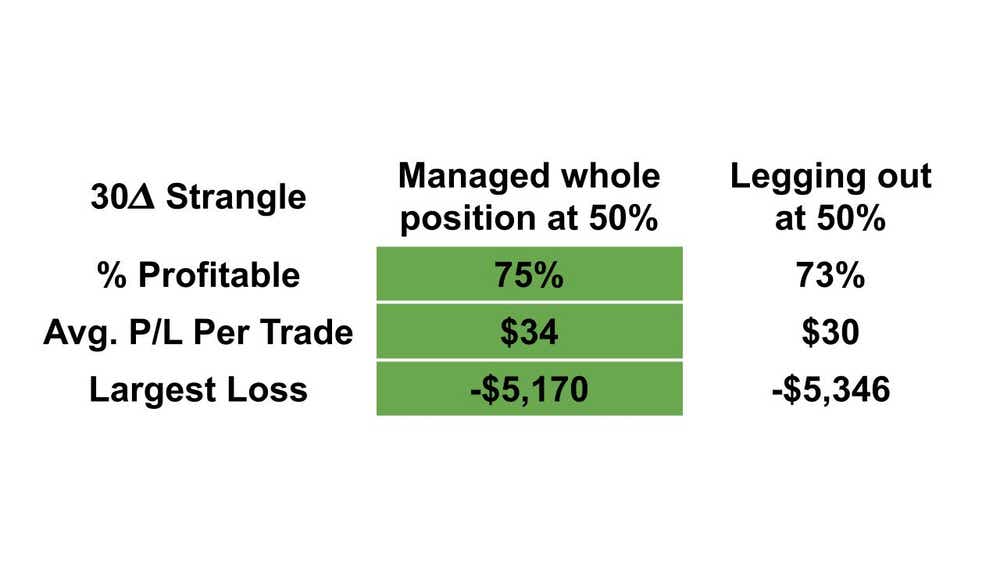

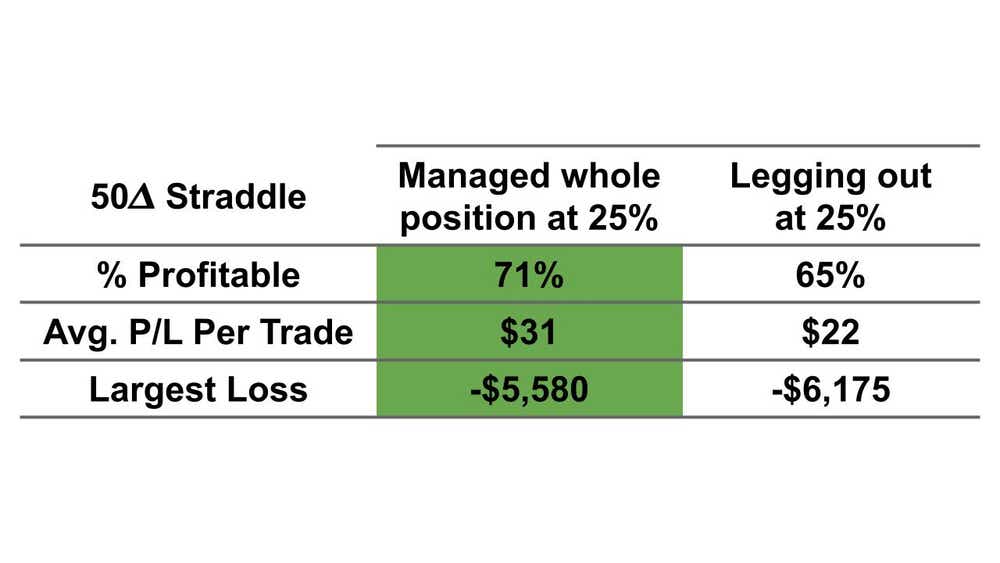

So, does this finding also apply to other strategies such as strangles with other deltas like 10, 30, and 50? In this test, we managed the 10- and 30-delta strangles at 50% of the maximum profit, but 50-delta ones (Straddles) at 25% of the maximum profit.

The result found that the small delta (10 delta) strangles produced almost identical results. While increasing the delta to 30 began to worsen the performance of legging positions, the differences remained relatively small. However, when we increased the delta to 50, turning it into a straddle, the options showed poorer results when legging, with more noticeable differences in success rate and volatility.

Overall, legging in and out has been proven to be an impractical strategy for portfolio management as it demands more effort and time to execute, while increasing complexity and requiring traders to take on additional directional risks. It has likewise not offered any advantages compared to traditional management techniques, and thus Managing strangles as a single position has been shown to be a more effective approach.

Kai Zeng, director of the research team and head of Chinese content at tastylive, has a 20-year background in derivatives trading and market experience. He cohosts several live shows, including From Theory to Practice and Building Blocks. @kai_zeng1

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices