Major U.S. Stock Indices Eke Out Gains after Wild Day, but Russell 2000 Ends Lower

Major U.S. Stock Indices Eke Out Gains after Wild Day, but Russell 2000 Ends Lower

By:Diego Colman

US STOCKS TALKING POINTS:

- After a weak open, U.S. stocks manage to recover on news that the US Senate may reach a deal to raise the debt-ceiling

- S&P 500, Dow Jones, and Nasdaq 100 eke out small gains, but the Russell 2000 finishes in negative territory

- Traders will now turn their attention to the NFP report set to be released Friday

U.S. stocks opened with large losses on Wednesday on taper fears and concerns over a possible U.S. default amid gridlock in Washington to raise the federal government’s borrowing authority. However, selling pressure diminished and risk appetite rebounded in the afternoon after the Senate Minority Leader, Mitch McConnell, offered a short-term debt limit extension deal to avert a catastrophic national default.

After a tug of war between bears and bulls, the major equity indices closed marginally higher, with the S&P 500, Dow Jones, and Nasdaq 100 climbing 0.4%, 0.3% and 0.6% respectively in a session characterized by high volatility. Meanwhile, the Russell 2000 was unable to recoup earlier losses and finished the day in negative territory, sliding 0.6% to 2214, but off its daily lows.

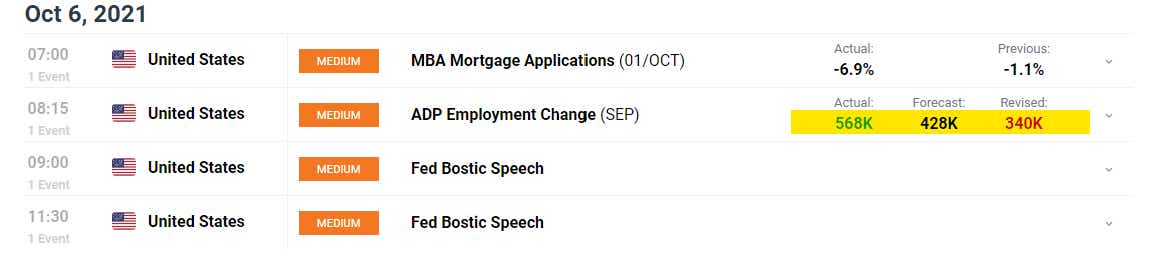

With a possible agreement to raise the debt limit between Democrats and Republicans in Congress, investors will now turn their attention to the September labor market data due later this week. Expectations are high after the ADP report beat forecasts this morning, showing 568,000 jobs created by the private sector versus an estimate of 428,000.

Focusing on the ADP numbers, the data revealed a robust recovery in business services employment, a sign that hiring may be normalizing in high-contact sectors after a weak summer on the back of delta-variant anxiety. This may pave the way for a strong NFP print on Friday. A good non-farm payroll report will seal the deal on a November tapering announcement, accelerating the transition towards higher rates in the long end of the Treasury curve.

The process to begin tapering asset purchases has been well choreographed by the central bank, so it is unlikely to be a significant source of panic selling or a major market shock, but it could certainly trigger volatility if nominal yields rise too much too quickly in response to policy normalization. As we saw in March and earlier this month, a rapid upward move in rates can be detrimental to stocks, particularly those in the technology sector.

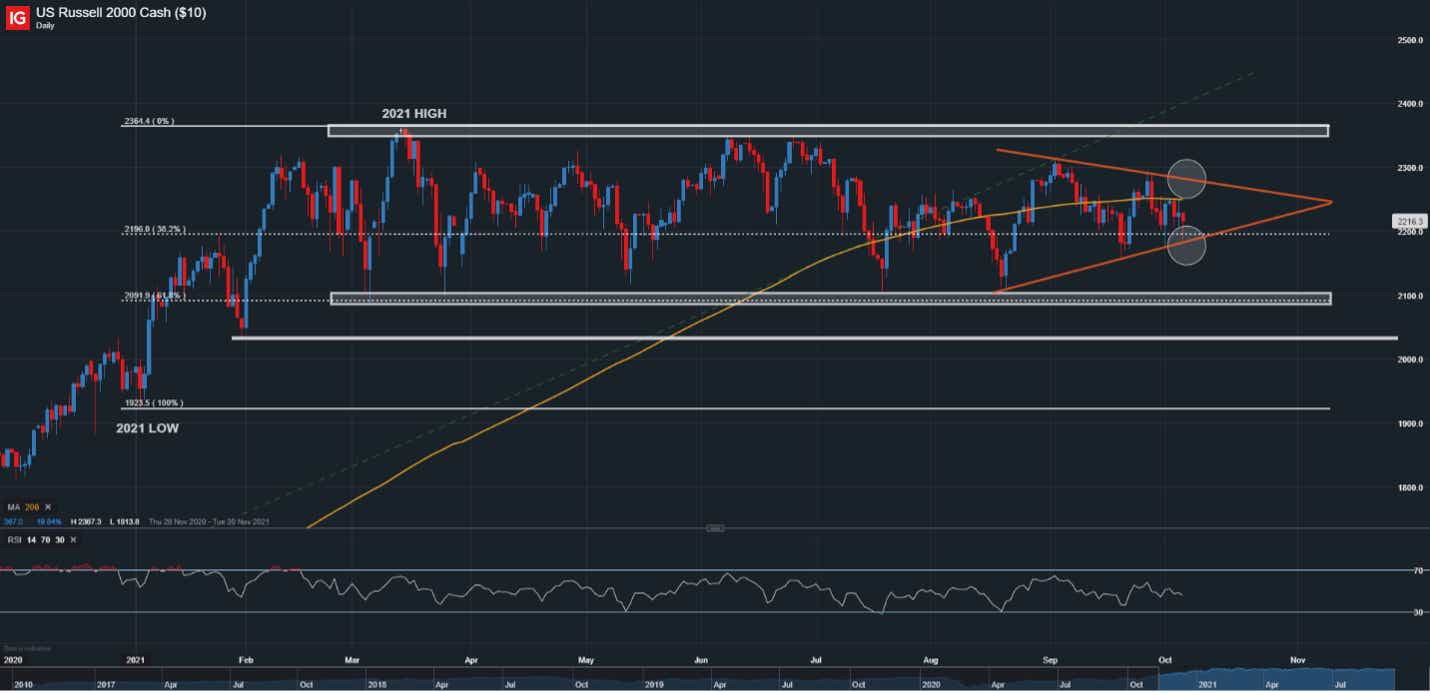

RUSSELL 2000 TECHNICAL ANALYSIS

The Russell 2000 has been in a consolidation phase since mid-August, setting lower highs and higher lows impeccably and trading inside what appears to be a symmetrical triangle, a pattern that can be bullish or bearish from a technical point of view.

For the bearish scenario to play out, price would need to break below the triangle support, now near 2196/2185 (in this area, we also have the 38.2% Fib retracement of the 2021 rally). If bears manage to push the small-cap index below this level, the 2091 area would become the immediate downside focus, followed by 2034.

On the other hand, for bullish resolution to materialize, price must climb towards the triangle upper boundary and breach this resistance decisively (2275). If this happens, the Russell 2000 could be on its way to retest its record highs.

RUSSELL 2000 DAILY CHART

Source: IG Trading Platform

Written by Diego Colman, Contributor

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices