Microsoft Reaches New All-Time High

Microsoft Reaches New All-Time High

By:Mike Butler

Microsoft AI Update Sends Stock Soaring—Earnings Next Week

- Microsoft announces $30 AI subscription service for Office 365.

- MSFT Stock reaches new all-time high of $366.78 ahead of earnings on July 25.

- Earnings-per-share (EPS) of $2.55 is expected, seeking fourth consecutive earnings beat.

- Revenue of $55.46 billion is forecast for the quarter.

Microsoft to the moon

When you look at a monthly, 20-year chart of Microsoft (MSFT), it screams "if I would have put $10,000 into Microsoft back in the day ... " On July 18 the stock reached a new all time high of $366.78—MSFT is up about 50% in 2023 and with such a strangle hold on tech and AI, it seems the sky is the limit for the tech stock that everybody knows about.

AI tools and gaming rules

The tech giant is abuzz with news and projects after announcing July 18 that subscribers to Office 365 will now pay $30 a month for access to the generative AI tools the product suite has to offer. It said this product has more security features to prevent data leaks for businesses with data sensitivity requirements. Given that most people with a computer have used or currently use products like Microsoft Word and Excel, the wide-spread infusion of AI tools makes these products even more seamless and helpful.

Microsoft is also inching closer to closing the Activision Blizzard (ATVI) acquisition deal, which the Federal Trade Commission fears would give the company exclusive access to ATVI games like Call of Duty. Microsoft CEO Satya Nadella said this isn't a concern of his, and I agree.

The gaming framework for all popular games these days calls for cross-platform play, which maximizes the user base and activity level for the game, especially for "freemium" models where gameplay is free but cosmetic items are not. I'd be lying if I said I haven't spent $10 to make my Halo character look cooler ... but I digress.

Microsoft will release earnings Tuesday, July 25, at 3:05 p.m. CDT, and EPS is expected to come in at $2.55 on $55.46 billion in revenue.

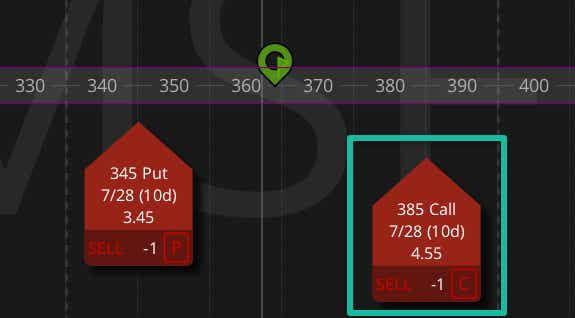

The weekly expected move, based on the implied volatility of the options market for MSFT stock, is +-$21.16.

This isn't that large an expected move, compared to other high-flier stocks in the sector, but when you compare the 10-day expiration cycle to the December 150 day cycle at +-$47.25, you can see that next week's expected move makes up almost 50% of the expected move through the rest of 2023. The market is expecting fireworks and a lot of information from the tech stock on Tuesday.

A bullish case for Microsoft

It feels downright wrong to buy MSFT at all time highs, but the call skew in the weekly cycle suggests the market perceives the risk of a high-velocity move to be to the upside for earnings. With the equidistant out-of-the-money (OTM) option price comparison, we can see which option is trading for a higher value to determine where the market is pricing in risk. This doesn't mean the stock price is going to move to the upside, but it does mean the market is pricing a high velocity potential move to the upside.

With so many positive news angles for Microsoft, it's hard to argue the top is in—from AI to the gaming world, it seems the stock has exposure in all the right places. It's hard to bet against the tech giant this earnings quarter, even with the stock reaching all-time highs before the earnings announcement even takes place.

A bearish case for Microsoft

With great success comes great pressure to continue to perform at a high level. That has been the case for other tech stocks that have fallen even after great earnings numbers and projections for the rest of the year. What's interesting about earnings reports is that it's not even about the numbers themselves. Sure, posting a strong EPS and revenue figure can usually be good for the stock long-term, but I've seen the story play out time and time again. A tech giant posts amazing numbers, but the market was expecting more, or to hear specific things in an earnings call that were not said, and the stock tanks. I can't tell you how many emails I've answered along the lines of "shouldn't the stock be rallying after such great earnings numbers?" We have to remember earnings announcements create implied and realized volatility for a reason—there is a large degree of the unknown, and profit taking at the top isn't out of the realm of possibility for such a quick move to the upside pre-earnings.

Tune in to Options Trading Concepts Live at 11am CDT on Tuesday, July 25, for a full breakdown of the MSFT earnings environment and options trade ideas as well!

Mike Butler, tastylive director of market intelligence, has been in the markets and trading for a decade. He appears on Options Trading Concepts Live, airing Monday-Friday. @tradermikeyb

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices