MicroStrategy’s Strategy Will Work … Until It Doesn’t

MicroStrategy’s Strategy Will Work … Until It Doesn’t

Why IBIT beats MSTR for Bitcoin exposure, silver catches up to gold, and fresh trade ideas on FSLR and crude oil amid surging volatility.

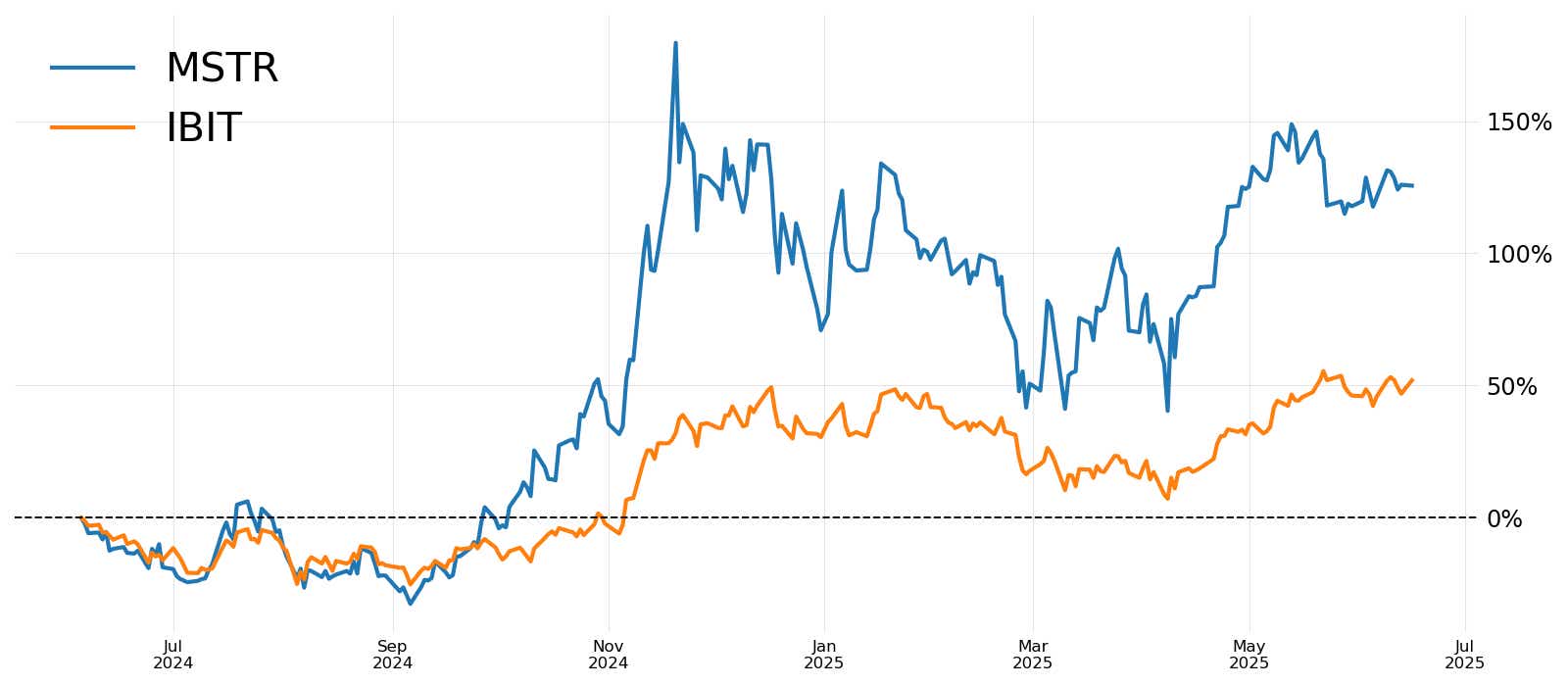

Last week in Cherry Picks we covered IBIT, the spot bitcoin exchange-traded fund (ETF), and explained why we prefer it to older vehicles like BITO. Now it’s time to talk about MicroStrategy (MSTR), a stock some traders still use to get bitcoin exposure. It actually just changed its name to “Strategy,” probably because “MicroStrategy” was too honest about the size of its software business.

The company’s executives have decided to stop selling software and instead become a bitcoin holding company. The entire strategy boils down to this: Issue equity and debt, use the proceeds to buy bitcoin and let the stock trade at a premium. It is financial engineering.

It trades at a premium. I took these stats from their website:

Bitcoin owned: ₿592,100

Bitcoin NAV: $63.6 billion

Market cap: $106.9 billion

mNAV (Market cap / NAV): 1.86

That means you're paying $1.86 for every $1.00 of bitcoin the company holds.

That is wildly inefficient. You’re not getting more bitcoin exposure by buying MSTR. You’re just paying extra for someone else’s leverage and hoping they don’t mismanage it.

Meanwhile, IBIT trades near NAV, gives you spot bitcoin exposure and now has listed options, too.

You don’t need MSTR.

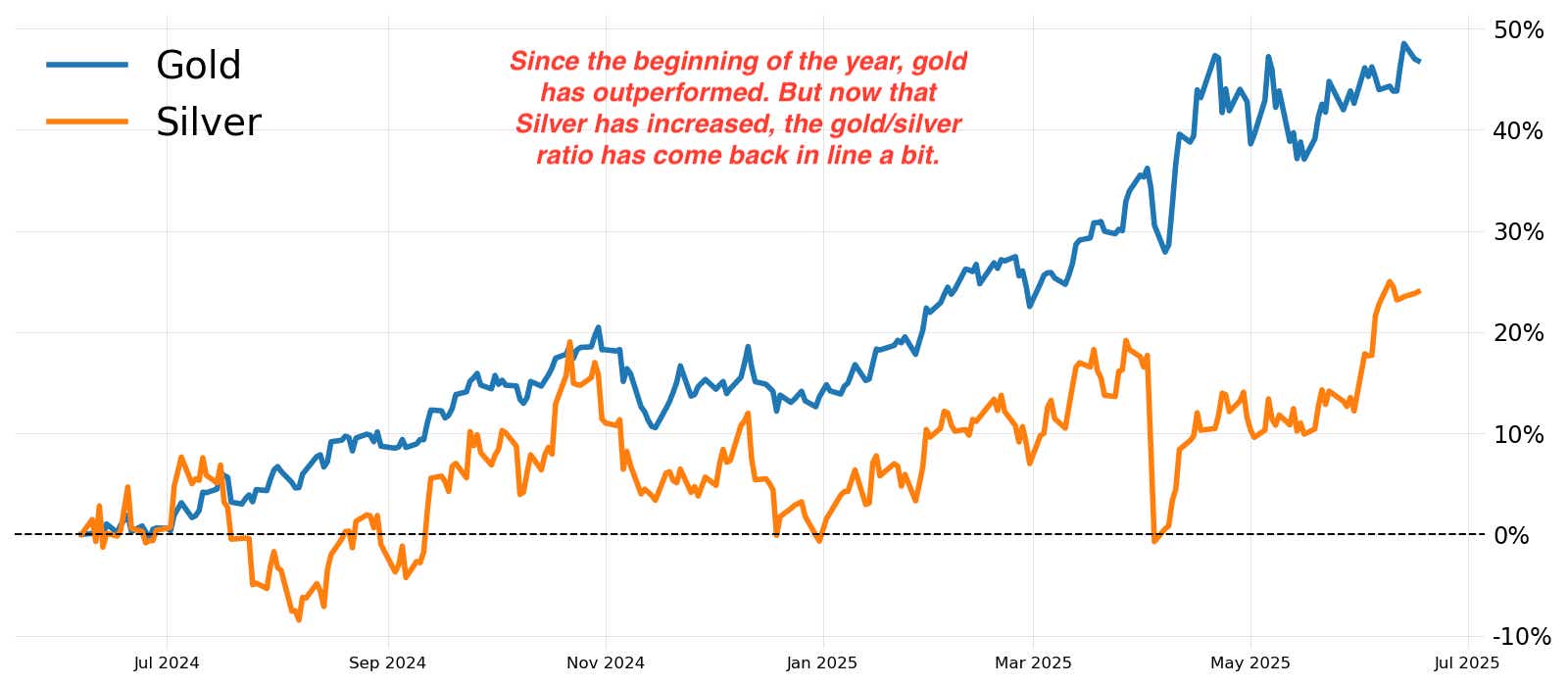

Gold/Silver Ratio Coming Back in Line

Since the beginning of 2025, gold significantly outperformed silver, pushing the gold/silver ratio to multi-year highs above 105 early this year. This spike reflected gold’s increase.

However, in recent weeks, silver has staged a notable rally, outpacing gold’s gains. As a result, the gold/silver ratio has fallen back to around 94 as of mid-June 2025.

That said, silver is still “cheap” compared to the historical gold/silver ratio — although less than it was a few weeks ago.

Trade silver with the silver ETF (SLV); and trade gold with the gold ETF (GLD).

There are new foreign exchange (FX) products available in the platform. Open a forex account with tastyfx in the tastytrade platform:

Think FX has no strategy? Last week we discussed the carry trade — it's cool stuff indeed. Trade crypto with tastytrade!

tastytrade has 20 tokens to trade on the platform. tastycrypto has a newsletter as well.

Two trade ideas

FSLR ($143.42) short put (JUL) $4.45 credit

Solar stocks have really taken a hit today. First Solar (FSLR) is down 18% today with vol expanding, and Enphase Energy (ENPH) is down 25%. If you think it might still stay above 52-week lows ($116), selling the 125 short put nets $4.45 credit at around 20 delta, with a breakeven down around $120.

/CLQ5 ($72.14) broken wing butterfly (JUL17) $0.11 credit

Crude oil volatility has absolutely exploded into the recent events in the middle east. IVR sits at 120, indicating volatility expanding above the high of the last year. "OVX:CGI" is the Cboe volatility index for /CL, hitting 66 this morning. A broken wing butterfly plays into the upside skew — buying the 80 call, selling 2x the 83 calls, and buying 1x the 88 calls for $0.11 credit ($110) is a way to play into the skew with no risk to the downside.

Our newsletter even counts as "research" when your boss walks by. Forward this email to your friends so they can subscribe to our newsletters, too! Get weekly data-driven trade ideas with Cherry Picks and daily pre-market insights and trade ideas with Cherry Bomb.

Michael Rechenthin, Ph.D., (aka “Dr. Data”), managing director of research and development, has 25 years of trading and markets experience. He’s known best for his weekly Cherry Picks newsletter. On Thursdays, he appears on Trades from the Research Team LIVE.

Nick Battista, tastylive director of market intelligence, has a decade of trading experience. He appears Monday-Friday on Options Trading Concepts Live. On Wednesdays, he co-hosts Johnny Trades. @tradernickybat

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex and macro.

Trade with a better broker. Open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices