Nasdaq 100 Holding Gains After Alphabet and Microsoft Earnings Reports

Nasdaq 100 Holding Gains After Alphabet and Microsoft Earnings Reports

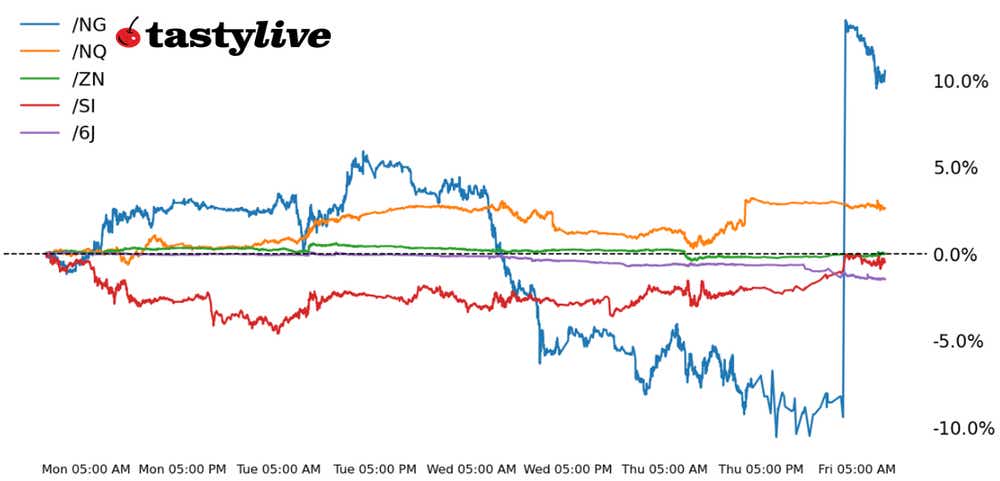

Also 10-year T-bond, silver, crude oil and Japanese yen futures

Nasdaq 100 E-mini futures (/NQ): +0.91%

10-year T-Note futures (/ZN): +0.23%

Silver futures (/SI): +0.87%

Natural Gas futures (/NG): -2.97%

Japanese Yen futures (/6J): -0.80%

U.S. markets moved higher this morning after the personal consumption expenditures index (PCE) cooled fears that inflation would continue to push back Federal Reserve interest rate cut bets.

A so-far-so-good earnings season is also helping to prop up market sentiment and the tech-heavy nasdaq-100 futures (/NQM4) are on track to record its first weekly gain since March. The Fed decision and the rest of the earnings season is in focus for traders next week.

A longer runway until the first Fed cut gives the central bank and markets more time to assess inflation and economic data, and with equities seemingly already repriced for that later cut, bulls may decide to press higher until the data poses additional risk to the rate cut outlook.

Symbol: Equities | Daily Change |

/ESM4 | +0.73% |

/NQM4 | +0.91% |

/RTYM4 | +0.37% |

/YMM4 | +0.13% |

Traders took on some risk this morning after the Fed’s preferred inflation gauge showed a print in line with estimates, providing some relief from yesterday’s gross domestic product (GDP) report. An exceptional earnings report from Microsoft (MSFT) is also helping to open up market sentiment going into the weekend. Traders still have several big tech earnings to look forward to next week, including Amazon (AMZN).

Strategy: (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16500 p Short 16750 p Short 18750 c Long 19000 c | 67% | +1225 | -3775 |

Short Strangle | Short 16750 p Short 18750 c | 72% | +3580 | x |

Short Put Vertical | Long 16500 p Short 16750 p | 85% | +650 | -4350 |

Symbol: Bonds | Daily Change |

/ZTM4 | +0.03% |

/ZFM4 | +0.13% |

/ZNM4 | +0.23% |

/ZBM4 | +0.47% |

/UBM4 | +0.68% |

Bond yields dropped on this morning’s inflation report, which is helping to provide some relief to risk assets. Yesterday’s seven-year note auction saw a modest response, with a bid-to-cover ratio of 2.48. With economic data and earnings out of the way for the week, the prevailing move pressure yields across the curve may continue into the weekend.

Next week is a light week for auctions, which leaves the market looking at how the U.S. earnings season wraps up along with the Fed’s May interest rate decision.

Strategy (28DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105 p Short 105.5 p Short 109.5 c Long 110 c | 64% | +140.63 | -359.38 |

Short Strangle | Short 105.5 p Short 109.5 c | 70% | +421.88 | x |

Short Put Vertical | Long 105 p Short 105.5 p | 88% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCM4 | +0.67% |

/SIN4 | +0.87% |

/HGN4 | +1.27% |

Falling yields and a weaker dollar opened some upside for precious metals, with silver prices (/SIN4) gaining 0.87% ahead of the opening bell. A report out of China from the Gold Association showed China’s gold consumption rose nearly 6% in the January to March quarter from a year earlier.

Precious metals should continue to perform well over the short term amid geopolitical tensions, but acute repricing's to Fed rate cut bets, should it happen again, could drag on prices. Investors might take these moments as buying opportunities instead of a signal to go short, however.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 24.25 p Short 24.5 p Short 30.75 c Long 31 c | 67% | +315 | -935 |

Short Strangle | Short 24.5 p Short 30.75 c | 74% | +2795 | x |

Short Put Vertical | Long 24.25 p Short 24.5 p | 86% | +140 | -1110 |

Symbol: Energy | Daily Change |

/CLM4 | +0.75% |

/HOK4 | +0.95% |

/NGK4 | -2.97% |

/RBK4 | +0.40% |

Natural gas prices (/NGK4) fell today as the end of the trading week approaches. Mild temperature outlooks across much of the United States is depressing bullish activity. European storage is above trend for this time of year, which is keeping the level of agreed-upon gas contracts to refill the coffers at modest levels.

Concerns over a cold winter in Europe, however, are reflected in the Dutch price curve. That said, the deep contango structure in Europe could lead to a mid-term bullish backdrop if long-term weather forecasts turn decidedly colder than average.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.6 p Short 1.65 p Short 2.25 c Long 2.3 c | 65% | +150 | -350 |

Short Strangle | Short 1.65 p Short 2.25 c | 72% | +650 | x |

Short Put Vertical | Long 1.6 p Short 1.65 p | 81% | +80 | -420 |

Symbol: FX | Daily Change |

/6AM4 | +0.49% |

/6BM4 | +0.05% |

/6CM4 | +0.09% |

/6EM4 | -0.06% |

/6JM4 | -0.80% |

Japanese yen futures are sharply lower as they drop into fresh 30-year lows despite this morning’s broader dollar weakness and a drop in U.S. Treasury yields. Japan’s policy makers from the Ministry of Finance (MOF) and the Bank of Japan (BOJ) have warned markets that there is a chance of intervention.

But so far, those warnings have come and gone without consideration. While there is a chance a currency intervention could come soon, Japan may wait for better-suited market conditions before pulling the trigger. Meanwhile, there is a record short position on the yen, which leaves a risk for a pain trade for shorts developing if Japan does pull the trigger.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0061 p Short 0.00615 p Short 0.00665 c Long 0.0067 c | 69% | +125 | -500 |

Short Strangle | Short 0.00615 p Short 0.00665 c | 74% | +500 | x |

Short Put Vertical | Long 0.0061 p Short 0.00615 p | 90% | +43.75 | -581.25 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.