Nasdaq 100 Leads Rebound as Oil Steadies Near 52-Week Low

Nasdaq 100 Leads Rebound as Oil Steadies Near 52-Week Low

Also, 10-year T-note, silver, crude oil and Japanese yen futures

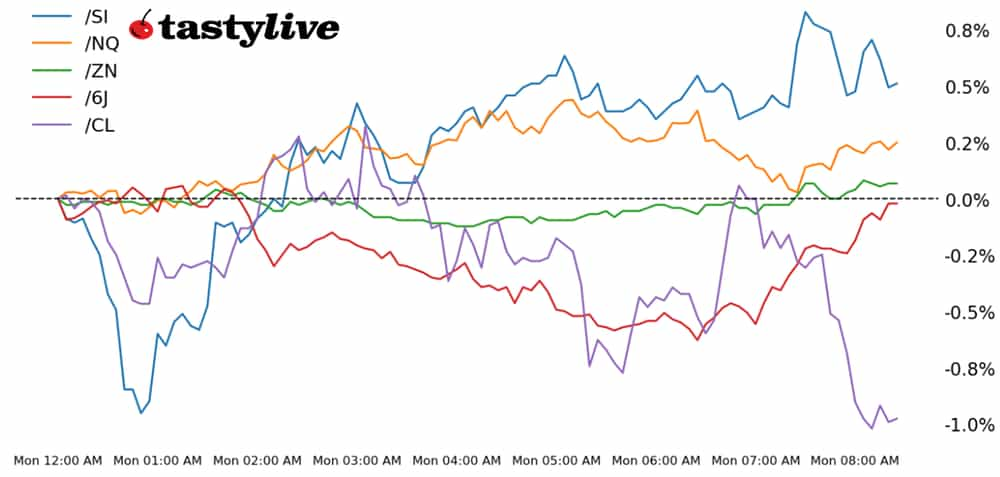

Nasdaq 100 E-mini futures (/NQ): +1.07%

10-year T-note futures (/ZN): -0.38%

Silver futures (/SI): -0.19%

Crude oil futures (/CL): +1.28%

Japanese yen futures (/6J): -0.54%

An early August redux did not happen. Disappointing U.S. jobs data on Friday had little spillover impact on Asian markets overnight, and the deja-vu disappointment is giving risk assets breathing room at the start of the week. The Nasdaq 100 is leading the rebound, with all four equity markets trading higher. Bonds yields are higher as traders hone on a 25-basis-point (bps) interest rate cut next week. Energy prices remain pressured, with crude oil barely holding above its 52-week low established Friday. Elsewhere, the U.S. dollar is the top performer among the major currencies.

Symbol: Equities | Daily Change |

/ESU4 | +0.85% |

/NQU4 | +1.07% |

/RTYU4 | +0.28% |

/YMU4 | +0.5% |

No major collapse in Japanese stocks or worries about the carry trade on the other side of the August U.S. jobs report has led to a relief rally on the other side of the weekend. Measures of volatility are coming down, with the VIX off by more than two points; the Nasdaq 100 (/NQU4) has seen its IVR drop from 43 to 34 today alone. The AI theme will see a significant test today with the Apple (AAPL) “Glowtime” event that could unveil the iPhone 16, Apple Watch 10 and next generation AirPods.

Strategy: (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 17000 p Short 17250 p Short 20500 c Long 20750 c | 64% | +1170 | -3830 |

Short Strangle | Short 17250 p Short 20500 c | 69% | +5350 | x |

Short Put Vertical | Long 17000 p Short 17250 p | 84% | +600 | -4400 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.09% |

/ZFZ4 | -0.14% |

/ZNZ4 | -0.19% |

/ZBZ4 | -0.3% |

/UBZ4 | -0.39% |

Bonds are priced for the equivalent of nine 25bps rate cuts through the end of next September, a pace of easing that suggests the Federal Reserve will be taking a measured approach when they get started next week. Indeed, the odds of a 50-bps rate cut next week have dropped from a high of 54% last week to a more modest 27% today; a further reduction in cut odds going into the September Federal Open Market Committee (FOMC) meeting would likely prove a headwind for bonds. Treasury auctions are back on the calendar this week, with three-year notes (tomorrow), 10-year notes (Wednesday) and 30-year bonds (Thursday) on tap.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 111 p Short 112 p Short 117 c Long 118 c | 63% | +234.38 | -765.63 |

Short Strangle | Short 112 p Short 117 c | 68% | +531.25 | x |

Short Put Vertical | Long 111 p Short 112 p | 91% | +78.13 | -921.88 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.29% |

/SIZ4 | +1.28% |

/HGZ4 | +1.23% |

Metals are displaying surprising resiliency at the start of the week, given the headwinds of a stronger U.S. Dollar and higher Treasury yields. Nevertheless, volatility measures remain elevated, and in the cases of gold (/GCZ4) and silver (/SIZ4), recent trading ranges are holding firm.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 25 p Short 26 p Short 31 c Long 32 c | 60% | +1395 | -3605 |

Short Strangle | Short 26 p Short 31 c | 68% | +3670 | x |

Short Put Vertical | Long 25 p Short 26 p | 80% | +705 | -4295 |

Symbol: Energy | Daily Change |

/CLZ4 | +0.31% |

/HOZ4 | +0.66% |

/NGZ4 | -2.81% |

/RBZ4 | +0.93% |

Energy markets are trying to establish some signs of recovery in the wake of the OPEC+ announcement last week, but little traction has been made. At the time of writing, crude oil prices (/CLZ4) were fading their gains, having established a fresh 52-week low at the end of last week. Markets are reading through the OPEC+ production hike delay as a sign that global demand is weak; indeed, China is experiencing its longest streak of deflation since the late-1990s.

Strategy (67DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 57 p Short 58.5 p Short 78.5 c Long 80 c | 60% | +380 | -1120 |

Short Strangle | Short 58.5 p Short 78.5 c | 72% | +1840 | x |

Short Put Vertical | Long 57 p Short 58.5 p | 79% | +270 | -1230 |

Symbol: FX | Daily Change |

/6AU4 | -0.17% |

/6BU4 | -0.3% |

/6CU4 | -0.03% |

/6EU4 | -0.38% |

/6JU4 | -0.54% |

If it was believed that the July U.S. jobs report sparked capitulation in the carry trade, the lack of reaction in Japanese stocks and the Japanese yen (/6JU4) to the August U.S. jobs report underscores how that catalyst has been exhausted in the short-term. Instead, the yen is trading in a more typical rates-sensitive, safe haven fashion. It’s rallying when stocks fall and bonds rally and falling when stocks rise and bonds fall.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0066 p Short 0.0068 p Short 0.0073 c Long 0.0075 c | 56% | +737.50 | -1762.50 |

Short Strangle | Short 0.0068 p Short 0.0073 c | 63% | +1337.50 | x |

Short Put Vertical | Long 0.0066 p Short 0.0068 p | 83% | +200 | -1050 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.