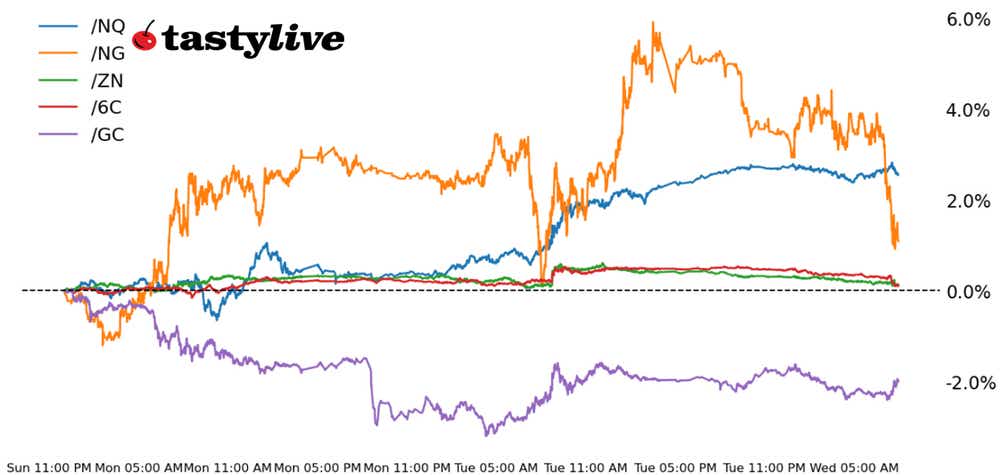

Nasdaq 100 Leads Rebound as Tesla Rallies After Earnings

Nasdaq 100 Leads Rebound as Tesla Rallies After Earnings

Also 10-year T-bond, silver, crude oil and Japanese yen futures

Nasdaq 100 E-mini futures (/NQ): +0.54%

10-year T-note futures (/ZN): -0.27%

Gold futures (/GC): -0.18%

Natural gas futures (/NG): -3.37%

Canadian dollar futures (/6C): -0.43%

Tesla (TSLA) earnings may have been disappointing, but the announcement of a new mass-produced low-cost vehicle is the center of attention and enough of a reason for a better tone in markets this morning.

Even with Meta Platforms (META) earnings looming after hours, the Nasdaq 100 is the clear leader out of the gate. A better than expected March U.S. durable goods orders report may be helping to keep bond yields elevated and the U.S. dollar pointed higher against its counterparts.

Symbol: Equities | Daily Change |

/ESM4 | +0.09% |

/NQM4 | +0.54% |

/RTYM4 | -0.37% |

/YMM4 | -0.16% |

U.S. equity markets are holding onto gains from earlier in the week as markets prepare for more earnings. As mentioned earlier, Meta is scheduled to report after the closing bell. Boeing (BA) rose in pre-market trading after the embattled airplane maker reported a lower cash burn than expected. AT&T (T) was also higher after strong earnings driven by 5G growth impressed investors. Tesla (TSLA) jumped after CEO Elon Musk said cheaper cars would roll out later this year.

Strategy: (57DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 16250 p Short 16500 p Short 19000 c Long 19250 c | 64% | +1350 | -3650 |

Short Strangle | Short 16500 p Short 19000 c | 70% | +4975 | x |

Short Put Vertical | Long 16250 p Short 16500 p | 83% | +715 | -4285 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.07% |

/ZFM4 | -0.16% |

/ZNM4 | -0.27% |

/ZBM4 | -0.52% |

/UBM4 | -0.70% |

Treasuries moved higher this morning following yesterday’s strong two-year auction when the Treasury auctioned $69 billion worth of the notes—a record. Today, traders will have their eyes on the $70 billion five-year auction, which is expected to yield good results because yields aren’t seen rising much even if interest rate cut expectations get pushed back again. 30-year T-Bond futures (/ZBM4) were the biggest loser this morning, trimming -0.52%.

Strategy (30DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 105.5 p Short 106 p Short 110 c Long 110.5 c | 64% | +140.63 | -359.38 |

Short Strangle | Short 106 p Short 110 c | 71% | +468.75 | x |

Short Put Vertical | Long 105.5 p Short 106 p | 85% | +78.13 | -421.88 |

Symbol: Metals | Daily Change |

/GCM4 | -0.18% |

/SIK4 | +0.03% |

/HGK4 | +0.53% |

Higher yields and a stronger dollar weighed on precious metals this morning, with gold prices (/GCM4) falling 0.25% ahead of the opening bell. U.S. inflation data due later this week could push bets on interest rate cut back if the data comes across as expected, which would pose trouble for precious metals because of higher-for-longer rates. Meanwhile, the tension in the Middle East between Israel and Iran has cooled for now, further weighing on bullion.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2200 p Short 2225 p Short 2425 c Long 2450 c | 63% | +720 | -1780 |

Short Strangle | Short 2225 p Short 2425 c | 70% | +2440 | x |

Short Put Vertical | Short 2225 p Short 2425 c | 85% | +310 | -2190 |

Symbol: Energy | Daily Change |

/CLM4 | -0.29% |

/HOK4 | -0.91% |

/NGK4 | -3.37% |

/RBK4 | -0.29% |

Natural gas futures (/NGM4) fell today, trimming yesterday’s gains but leaving prices positive for the week. Freeport LNG, a Texas export terminal for natural gas, resumed exports on yesterday following an unexpected outage at the facility. The outage created some upward pressure for European prices, which likely also created increased demand competition from importers in Asia. The resumption of U.S. export flows and cooling tension in the Middle East may see prices head back toward April lows around the 1.9 level.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.7 p Short 1.75 p Short 2.35 c Long 2.4 c | 61% | +170 | -330 |

Short Strangle | Short 1.75 p Short 2.35 c | 70% | +830 | x |

Short Put Vertical | Long 1.7 p Short 1.75 p | 79% | +100 | -400 |

Symbol: FX | Daily Change |

/6AM4 | +0.15% |

/6BM4 | -0.06% |

/6CM4 | -0.43% |

/6EM4 | -0.15% |

/6JM4 | -0.11% |

The uptick in U.S. Treasury yields is helping to prop up the U.S. dollar today. With energy markets facing difficulties, the Canadian dollar (/6CM4) is leading to the downside. But U.S.-Canada two-year yield spreads have moved in a favorable manner in recent days, and are now at 68 basis points (bps), up from 80bps a week ago. The pullback in /6CM4, coupled with the elevated volatility environment, may be producing an opportunity—thanks to the divergence from yield spreads.

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.71 p Short 0.715 p Short 0.745 c Long 0.75 c | 70% | +90 | -410 |

Short Strangle | Short 0.715 p Short 0.745 c | 73% | +190 | x |

Short Put Vertical | Long 0.71 p Short 0.715 p | 93% | +50 | -450 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.