Nasdaq 100 Challenges Record High as Retail Sales and Jobless Claims Surprise

Nasdaq 100 Challenges Record High as Retail Sales and Jobless Claims Surprise

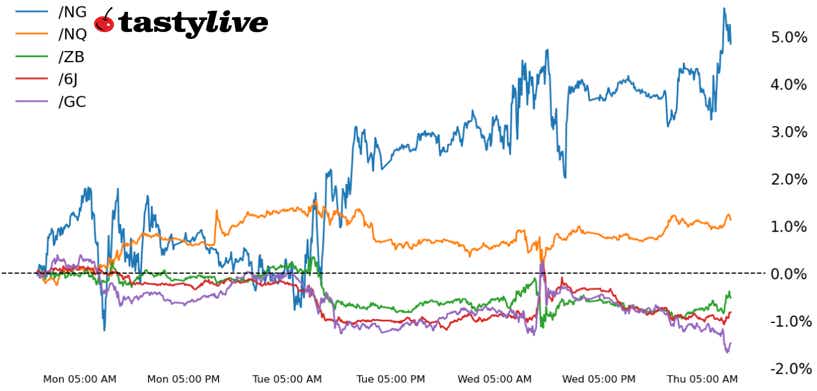

Also, 30-year T-bond, gold, natural gas and Japanese yen futures

- Nasdaq 100 E-mini futures (/NQ): +0.18%

- 30-year T-bond futures (/ZB): +0.28%

- Gold futures (/GC): -1.15%

- Natural gas futures (/NG): +1.04%

- Japanese yen futures (/6J): -0.44%

Traders are taking this morning’s US economic data releases as good news for risk appetite. Softer initial and continuing weekly jobless claims alongside better than expected retail sales for June (even adjusted for inflation) are lending credibility to the idea that the US economy will avoid recession. Strong breadth in equities, led by small- and mid-cap stocks, underscores the optimism. The US dollar is bouncing back while long-end US yields drop, all while precious metals dip. In sum, it’s a “buy America” kind of day.

| Symbol: Equities | Daily Change |

| /ESU5 | +0.14% |

| /NQU5 | +0.18% |

| /RTYU5 | +0.32% |

| /YMU5 | +0.16% |

Nasdaq futures (/NQU5) rose in early trading, supported by positive earnings headlines and labor market data. United Airlines (UAL) rose over 4% after reporting a beat, and PepsiCo (PEP) gained 6% on its own set of positive results. Archer-Daniels-Midland (ADM) fell after President Donald Trump said Coca-Cola (KO) will use cane sugar in their drinks instead of high fructose corn syrup. Taiwan Semiconductor Manufacturing (TSM) rose over 2% after it beat second-quarter estimates.

| Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 21500 p Short 21750 p Short 24500 c Long 24750 c | 60% | +1170 | -3790 |

| Short Strangle | Short 21750 p Short 24500 c | 67% | +5595 | x |

| Short Put Vertical | Long 21500 p Short 21750 p | 82% | +630 | -4370 |

| Symbol: Bonds | Daily Change |

| /ZTU5 | -0.02% |

| /ZFU5 | +0.01% |

| /ZNU5 | +0.09% |

| /ZBU5 | +0.28% |

| /UBU5 | +0.3% |

After a day of volatility in the bond market, prices on the longer end of the curve are pacing higher, with 30-year T-bond futures (/ZBU5) rising about 0.31% in early trading. This morning’s labor market data pushed yields a bit lower. The 30-year yield is trading below the 5% mark that it crossed earlier this week for the first time since early June. While the Federal Reserve’s independence seems safe for now, strong economic data has pushed back on dovish calls for rate cut bets later this year.

| Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 106 p Short 108 p Short 116 c Long 118 c | 62% | +453.13 | -1546.88 |

| Short Strangle | Short 108 p Short 116 c | 67% | +912.88 | x |

| Short Put Vertical | Long 106 p Short 108 p | 86% | +203.13 | -1796.88 |

| Symbol: Metals | Daily Change |

| /GCQ5 | -1.15% |

| /SIU5 | -0.64% |

| /HGU5 | -0.77% |

Gold prices (/GCQ5) are moving lower after this morning’s data cast doubt on the possibility of rate cuts sooner rather than later. The metal is trading around the 3,330 level and below its 21-day exponential moving average (EMA). We’re heading toward the bottom of the June range, and a test of the 3,300 level could provide some clues on how firm bulls want to stand in this market. Some strength in the dollar is also weighing on bullion prices.

| Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 3150 p Short 3175 p Short 3475 c Long 3500 c | 63% | +820 | -1680 |

| Short Strangle | Short 3175 p Short 3475 c | 72% | +3920 | x |

| Short Put Vertical | Long 3150 p Short 3175 p | 83% | +300 | -2200 |

| Symbol: Energy | Daily Change |

| /CLQ5 | +0.51% |

| /HOQ5 | +1.04% |

| /NGQ5 | +1.04% |

| /RBQ5 | +0.48% |

Natural gas (NGQ5) rose over 1% to the highest level since June 30, extending a rally that came from a multi-month bottom that occurred earlier this month. The 15% rally since the lows from last week has brought prices near a trendline that was broken from the April lows. The Energy Information Administration (EIA) will report inventory data for gas storage later today. Last year for this period, the EIA reported an 18 billion cubic feet (bcf) build, but analysts are looking for a number nearer to 50 bcf.

A storm system is affecting the Gulf Coast currently, but so far there have been few reported disruptions to export facilities. However, it’s possible the operators may have front-loaded some export capacity ahead of the storm to hedge against the possibility of a stronger system impeding operations, although if so, it's likely to only have a small impact on today’s EIA figures.

Natural gas bulls are also getting some support from weather modeling, with forecast models seeing improving chances for hotter-than-average temperatures across much of the United States over the next two weeks.

| Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 2.9 p Short 3 p Short 4.2 c Long 4.3 c | 63% | +310 | -690 |

| Short Strangle | Short 3 p Short 4.2 c | 72% | +1480 | x |

| Short Put Vertical | Long 2.9 p Short 3 p | 81% | +150 | -850 |

| Symbol: FX | Daily Change |

| /6AU5 | -0.8% |

| /6BU5 | -0.06% |

| /6CU5 | -0.4% |

| /6EU5 | -0.35% |

| /6JU5 | -0.44% |

Relaxed concerns around Fed Chair Jerome Powell’s job security, coupled with strong US economic data, are proving beneficial for the US dollar. It’s gaining strength because Fed rate cut odds for July have been zeroed out, while odds of a September cut are now at their lowest point of the cycle. With elections looming over the weekend in Japan, the yen (/6JU5) remains weak. Expectations are for the voting to weaken LDP rule, which could ultimately lead to tax reform that erodes the country’s already-shaky fiscal standing. Whenever developed economy currencies weaken when interest rates rise, it’s typically the market that sends a warning sign about policy in such fashion.

| Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

| Iron Condor | Long 0.0064 p Short 0.0065 p Short 0.007 c Long 0.0071 c | 64% | +300 | -950 |

| Short Strangle | Short 0.0065 p Short 0.007 c | 70% | +700 | x |

| Short Put Vertical | Long 0.0064 p Short 0.0065 p | 87% | +125 | -1125 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.