Nasdaq 100 Steadies, Russell 2000 Extends Gains After CPI & PPI

Nasdaq 100 Steadies, Russell 2000 Extends Gains After CPI & PPI

Also, 10-year T-note, silver, crude oil and Japanese yen futures

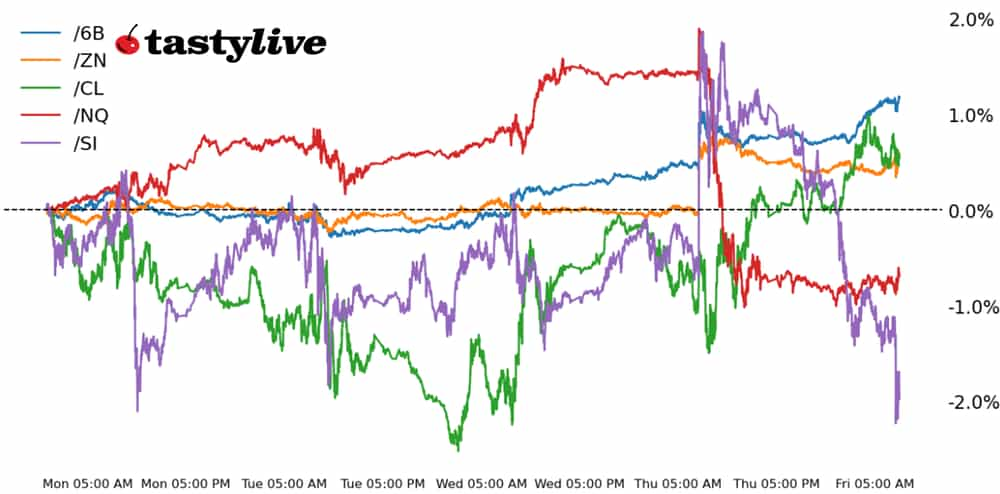

Nasdaq E-mini futures (/NQ): +0.08%

10-year T-note futures (/ZN): -0.07%

Silver futures (/SI): -2.59%

Crude oil futures (/CL): +0.84%

British pound futures (/6B): +0.42%

On the other side of the June U.S. inflation reports—both the consumer price index (CPI) and the producer price index (PPI)— the bigger winner remains the Russell 2000. Unlike yesterday, however, the S&P 500 and Nasdaq 100, are in positive territory. Elsewhere, U.S. bond yields are ticking higher in the wake of President Joe Biden’s NATO press conference as it appears less likely he will step aside as Democratic nominee. The U.S. dollar remains on its back foot, while reports from Japan last night indicated the Bank of Japan was asking banks for yen quotes, which historically has been the step before an intervention; yen strength yesterday morning may have been aided by Japanese policymakers.

Symbol: Equities | Daily Change |

/ESU4 | +0.08% |

/NQU4 | +0.01% |

/RTYU4 | +1.24% |

/YMU4 | +0.21% |

An aggressive short covering rally in small cap stocks may have been the sharp move higher in the Russell 2000 (/RTYU4) yesterday and today, while weakness in the S&P 500 (/ESU4) and Nasdaq 100 (/NQU4)—traders forced to sell down mega cap winners to cover losses in small cap losers. Volatility has ticked up marginally, although without key technical levels breaking, /ESU4 and /NQU4 may be entering another period of consolidation.

Strategy: (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19000 p Short 19250 p Short 21750 c Long 22000 c | 64% | +1220 | -3780 |

Short Strangle | Short 19250 p Short 21750 c | 70% | +4695 | x |

Short Put Vertical | Long 19000 p Short 19250 p | 83% | +680 | -4320 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.03% |

/ZFU4 | 0% |

/ZNU4 | -0.07% |

/ZBU4 | -0.13% |

/UBU4 | -0.25% |

Ever since the first presidential debate, bond yields have acted sensitively to Biden’s election odds: if he remains at the top of the ticket, down-ballot drag is likely, which increases the odds of a Republican trifecta. Gridlock is OK, but singular party control of Congress and the White House likely means increased deficits and debts. With two full rate cuts now discounted for 2024, it stands to reason that domestic politics may be a more potent catalyst in the short-term.

Strategy (70DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 107.5 p Short 108 p Short 114 c Long 114.5 c | 64% | +125 | -375 |

Short Strangle | Short 108 p Short 114 c | 70% | +515.63 | x |

Short Put Vertical | Long 107.5 p Short 108 p | 93% | +46.88 | -453.13 |

Symbol: Metals | Daily Change |

/GCQ4 | -0.79% |

/SIU4 | -2.59% |

/HGU4 | +1.25% |

The backup in U.S. yields may be spilling over to precious metals, which are unwinding the gains from yesterday. But for both gold (/GCQ4) and silver (/SIU4), breaching the June 7 high—when China announced it ceased adding gold to its reserves for the first time in 18-months—represents an important psychological milestone. With multi-month consolidations in place following aggressive rallies, familiar tenets remain: directional bears should remain cautious until /GCQ4 drops below 2300 and /SIU4 drops below 29.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 27.5 p Short 28 p Short 34 c Long 34.5 c | 65% | +660 | -1840 |

Short Strangle | Short 28 p Short 34 c | 72% | +3145 | x |

Short Put Vertical | Long 27.5 p Short 28 p | 83% | +315 | -2185 |

Symbol: Energy | Daily Change |

/CLQ4 | +0.84% |

/HOQ4 | +0.52% |

/NGQ4 | +0.13% |

/RBQ4 | +0.25% |

Energy prices are up across the board to close the week, with crude oil prices (/CLQ4) staging a meaningful rally off of its one-month moving average (daily 21-EMA) in recent sessions. Despite headlines suggesting a truce between Israel and Hamas is increasingly likely, /CLQ4 continues to ignore geopolitics; volatility remains non-existent.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 76 p Short 77 p Short 87 c Long 88 c | 63% | +260 | -740 |

Short Strangle | Short 77 p Short 87 c | 70% | +1050 | x |

Short Put Vertical | Long 76 p Short 77 p | 82% | +150 | -850 |

Symbol: FX | Daily Change |

/6AU4 | +0.21% |

/6BU4 | +0.42% |

/6CU4 | -0.01% |

/6EU4 | +0.21% |

/6JU4 | -0.05% |

The British pound (/6BU4) has emerged at the top of the heap today as the top-performing major currency. In recent sessions, volatility was slowly contracting across the asset class in the wake of the British and French elections. But the quotes check yesterday by the Bank of Japan, one of the ways with which they intervene, reintroduced uncertainty into the space. That said, strong technical trends in non-USD FX coupled with still-elevated volatility means opportunities persist.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.265 p Short 1.27 p Short 1.325 c Long 1.33 c | 62% | +100 | -212.50 |

Short Strangle | Short 1.27 p Short 1.325 c | 69% | +381.25 | x |

Short Put Vertical | Long 1.265 p Short 1.27 p | 89% | +50 | -262.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices