Nasdaq 100 Rise Steadies and Bond Yields Drop as May OPEX Looms

Nasdaq 100 Rise Steadies and Bond Yields Drop as May OPEX Looms

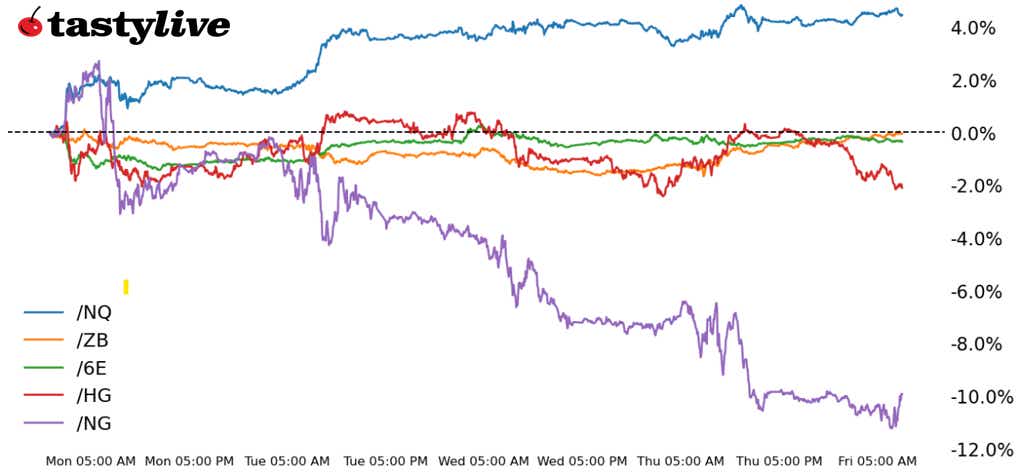

Also, 30-year T-note, copper, natural gas and euro futures

- Nasdaq 100 E-mini futures (/NQ): +0.23%

- 30-year T-note futures (/ZN): +0.8%

- Copper futures (/HG): +1.7%

- Natural gas futures (/NG): +1.61%

- Euro futures (/6E): +0.14%

A pivotal week for financial markets comes to a crescendo today with May options expiry. The torrid rally in recent weeks leaves dealers heavily long stock given the call/put imbalance for today’s expiry, which could lead to a situation where dealers unwind their long stock hedges, weighing on equities. The sharp turn in Treasuries has effectively erased the weekly losses. Elsewhere, metals remain pressured, further evidence the Liberation Day “Sell America” fear trade is finished.

Symbol: Equities | Daily Change |

/ESM5 | +0.18% |

/NQM5 | +0.23% |

/RTYM5 | +0.41% |

/YMM5 | +0.2% |

US equity markets are on pace to finish the week at their highest levels in several months: The S&P 500 (/ESM5), since the first week of March; the Nasdaq 100 (/NQM5), since the last week of February; and the Russell 2000, since the third week of March. The remarkable performance has seen VIX futures move back into contango, while the spot VIX is angling for a weekly close below 18. VVIX has likewise dropped below 110 (cut in half from its high above 220 in early-April), suggesting all of the tariff-induced angst – and relief – has been squeezed out of the markets.

Strategy: (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 19500 p Short 19750 p Short 22750 c Long 23000 c | 65% | +1315 | -3685 |

Short Strangle | Short 19750 p Short 22750 c | 71% | +5735 | x |

Short Put Vertical | Long 19500 p Short 19750 p | 86% | +440 | -4560 |

Symbol: Bonds | Daily Change |

/ZTM5 | +0.07% |

/ZFM5 | +0.23% |

/ZNM5 | +0.35% |

/ZBM5 | +0.8% |

/UBM5 | +0.94% |

The rally in Treasuries over the past two sessions might be tied to remarks made yesterday by Federal Reserve Chair Jerome Powell. Adjusting the Federal Open Market Committee’s average inflation targeting framework would suggest policymakers won’t tolerate inflation that persists above the Fed’s medium-term target of 2%. In other words, the Fed will be less likely to shift policy in a manner that proves reflationary in the future. In the near-term, Fed rate cut odds remain depressed, with traders favoring no change in rates in either June (91.7% chance of a hold) or July (60.7% chance of a hold).

Strategy (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 110 p Short 118 c Long 120 c | 63% | +500 | -1500 |

Short Strangle | Short 110 p Short 118 c | 68% | +1031.25 | x |

Short Put Vertical | Long 108 p Short 110 p | 82% | +296.88 | -1703.13 |

Symbol: Metals | Daily Change |

/GCM5 | -1.47% |

/SIN5 | -1.36% |

/HGN5 | -1.7% |

Copper prices (/HGN5) remain rangebound this week, with prices dipping about 1% following a similar gain from the previous session. The 90-day pause in tariffs between the US and China has left traders undecided on the direction of the metal, with forecasters having trouble predicting future inventory levels. Stocks in Shanghai have risen in recent weeks as trade stalled amid the initial volleys of the trade war.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4.2 p Short 4.25 p Short 5 c Long 5.05 c | 64% | +375 | -875 |

Short Strangle | Short 4.25 p Short 5 c | 71% | +2012.50 | x |

Short Put Vertical | Long 4.2 p Short 4.25 p | 82% | +200 | -1050 |

Symbol: Energy | Daily Change |

/CLM5 | -0.13% |

/HOM5 | -0.63% |

/NGM5 | +1.61% |

/RBM5 | +0.16% |

Natural gas futures (/NGM5) rose nearly 2% today following several days of losses. The weather for the United States has shifted to a mild outlook over the next several weeks and flows of liquefied natural gas leaving US ports has slowed. The commodity is trading in the middle of a range carved out between late April and May. Traders see firm support around the 3 handle, but resistance near 3.8 is also evident in the price action. Inventory levels next week are in focus nas the market decides how fast stocks are going to build given the modest weather of late.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 3 p Short 3.1 p Short 4.3 c Long 4.4 c | 61% | +350 | -650 |

Short Strangle | Short 3.1 p Short 4.3 c | 71% | +1760 | x |

Short Put Vertical | Long 3 p Short 3.1 p | 82% | +150 | -850 |

Symbol: FX | Daily Change |

/6AM5 | +0.18% |

/6BM5 | -0.02% |

/6CM5 | +0.1% |

/6EM5 | +0.14% |

/6JM5 | +0.16% |

The move lower in Treasury yields is propping up non-U.S. dollar currencies. Euro futures (/6EM5) rose about 0.14% Friday morning. U.S. consumer confidence remained suppressed in May, which may pose a problem for the dollar until the market gets the chance to digest next week’s economic data. Retail sales data and inflation caused some softening in the dollar earlier this week. The move lower in Treasury yields is propping up non-U.S. Dollar currencies.

Strategy (48DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.08 p Short 1.09 p Short 1.15 c Long 1.16 c | 62% | +312.50 | -937.50 |

Short Strangle | Short 1.09 p Short 1.15 c | 68% | +887.50 | x |

Short Put Vertical | Long 1.08 p Short 1.09 p | 91% | +87.50 | -1162.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.