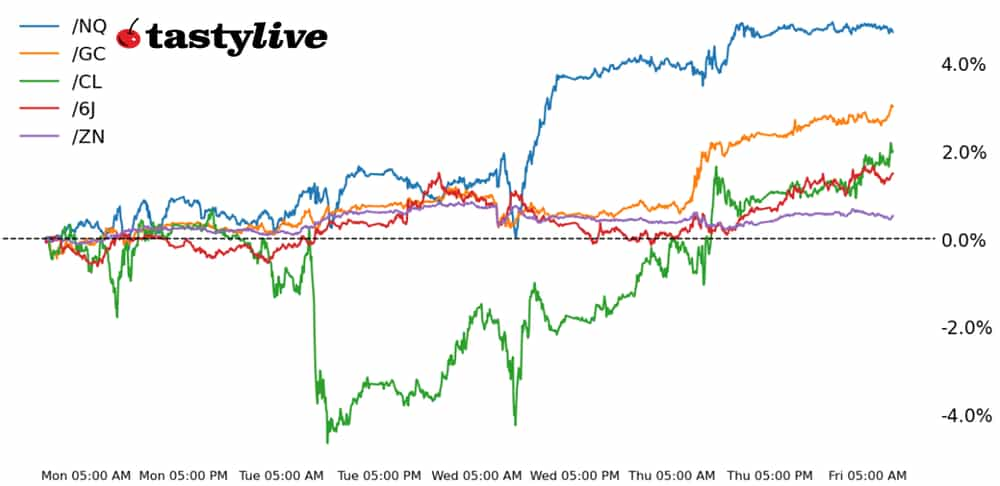

Nasdaq 100 Keeps Climbing; Crude Rebounds with Gold at All-Time High

Nasdaq 100 Keeps Climbing; Crude Rebounds with Gold at All-Time High

Also, 10-year T-Note, Gold, Crude Oil, and Japanese Yen Futures

Nasdaq 100 E-mini futures (/NQ): +0.21%

10-year T-note futures (/ZN): +0.09%

Gold futures (/GC): +0.8%

Crude oil futures (/CL): +1.51%

Japanese yen futures (/6J): +0.93%

An unexpected article from The Wall Street Journal’s Federal Reserve whisperer Nick Timiraos late yesterday has shaped price action across asset classes this morning. The report suggested Fed officials are decidedly mixed on starting their cut cycle with either 25 or 50 basis points (bps), which traders have interpreted as meaning 50bps rate cut odds were too low. The odds closed yesterday at 13% and opened today at 43%. A U.S. economy that by all means is slowing but still growing, coupled with expansive fiscal policy and the prospect of lower rates, may prove inflationary. After all, traders are bidding up commodities and putting the U.S. dollar on offer to end the week.

Symbol: Equities | Daily Change |

/ESU4 | +0.21% |

/NQU4 | +0.02% |

/RTYU4 | +0.83% |

/YMU4 | +0.21% |

U.S. equity futures were mostly steady ahead of the New York open. Nasdaq contracts (/NQU4) were down slightly, as traders digested earnings from Adobe (ADBE). The company traded over 8% lower in pre-market hours after reporting a soft sales outlook. Upwork (UPWK) rose over 3% after activist investors Engine Capital’s move to shake up the board excited investors. Boeing (BA) fell over 2% after the company’s union factory workers voted to strike. University of Michigan consumer sentiment data due this morning may shift the tone in the early hours of trading as we head into the weekend.

Strategy: (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 18000 p Short 18250 p Short 20750 c Long 21000 c | 62% | +!445 | -3555 |

Short Strangle | Short 18250 p Short 20750 c | 69% | +5550 | x |

Short Put Vertical | Long 18000 p Short 18250 p | 85% | +620 | -4380 |

Symbol: Bonds | Daily Change |

/ZTZ4 | +0.08% |

/ZFZ4 | +0.08% |

/ZNZ4 | +0.09% |

/ZBZ4 | +0.12% |

/UBZ4 | +0.09% |

Bond yields are down across the curve as traders grow more confident in the Fed’s outlook to cut rates. Yesterday’s 30-year bond auction was met with tepid demand, sending yields higher following the auction. Next week’s rate decision is in focus as traders continue to grapple with how fast the Fed will cut.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 112 p Short 113 p Short 118 c Long 119 c | 68% | +203.13 | -796.88 |

Short Strangle | Short 113 p Short 118 c | 72% | +437.50 | x |

Short Put Vertical | Long 112 p Short 113 p | 90% | +93.75 | -906.25 |

Symbol: Metals | Daily Change |

/GCZ4 | +0.8% |

/SIZ4 | +1.47% |

/HGZ4 | +0.19% |

Gold (/GCZ4) is making its break higher into fresh record territory as yields and the dollar clear a path higher for the precious metal. The optimistic outlook on rate cuts is helping to underpin strength in the commodity. There is also rising pressure on China to provide more stimulus to its economy, which could offer another tailwind for gold.

Strategy (45DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2475 p Short 2490 p Short 2735 c Long 2750 c | 62% | +510 | -990 |

Short Strangle | Short 2490 p Short 2735 c | 71% | +3210 | x |

Short Put Vertical | Long 2475 p Short 2490 p | 83% | +270 | -1230 |

Symbol: Energy | Daily Change |

/CLX4 | +1.51% |

/HOZ4 | +0.57% |

/NGZ4 | +1.48% |

/RBZ4 | +1.39% |

The landfall of Hurricane Francine has helped spark a rebound in crude oil prices (/CLX4) this week as Gulf Coast production—accounting for 14% of total U.S. production—was ground to a halt. Positioning in oil futures is thin, having reached a z score of -1.37 (measured from 2014 to present) for the most recent reporting period. Since 2014, when oil positioning has been this low, oil futures have seen an average return of 4.9% and a median return of 3.6% over the next month.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 59 p Short 60.5 p Short 77.5 c Long 79 c | 62% | +420 | -1080 |

Short Strangle | Short 60.5 p Short 77.5 c | 70% | +1840 | x |

Short Put Vertical | Long 59 p Short 60.5 p | 79% | +250 | -1250 |

Symbol: FX | Daily Change |

/6AZ4 | -0.17% |

/6BZ4 | +0.27% |

/6CZ4 | +0.09% |

/6EZ4 | +0.28% |

/6JZ4 | +0.93% |

A recalibration in Fed rate cut expectations is having a ripple effect through the rates-sensitive FX market. The Japanese yen (/6JZ4), arguably the major currency most sensitive to interest rate differentials, is leading the way higher the tune of a nearly 1% increaseas traders bet the rate differential between the Federal Reserve and theBank of Japan is going to close faster than presumed.

Elsewhere, the Canadian dollar (/6CZ4) is stabilizing amid the sharp rebound in energy markets.

Strategy (56DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.00675 p Short 0.0069 p Short 0.00755 c Long 0.0077 c | 65% | +475 | -1400 |

Short Strangle | Short 0.0069 p Short 0.00755 c | 70% | +987.50 | x |

Short Put Vertical | Long 0.00675 p Short 0.0069 p | 84% | +250 | -1625 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.