Natural Gas Bears Feel the Heat as Prices Rise

.png?format=pjpg&quality=50&width=387&disable=upscale&auto=webp)

Natural Gas Bears Feel the Heat as Prices Rise

Prices on pace for more gains

- Natural gas price (/NG) pace higher amid continued heat.

- Europe faces supply disruptions as it faces similar weather.

- Speculators added to long positions, according to COT data.

Traders are pushing U.S. natural gas prices (/NG) up about 17 cents on Thursday afternoon to $2.751 per million British thermal units (mmBtu) as they contemplate the uncertainty caused by higher-than-average temperatures across the United States, as well as a volatile supply situation in Europe where hotter temperatures are also increasing demand.

Extreme temperatures remain the primary tailwind to gas prices

The summer has been hot not only in the United States but also around the globe. According to NASA's global temperature analysis, June recorded the highest temperatures on record. The demand for natural gas increases during the summer due to above-average mercury readings as people use air conditioning.

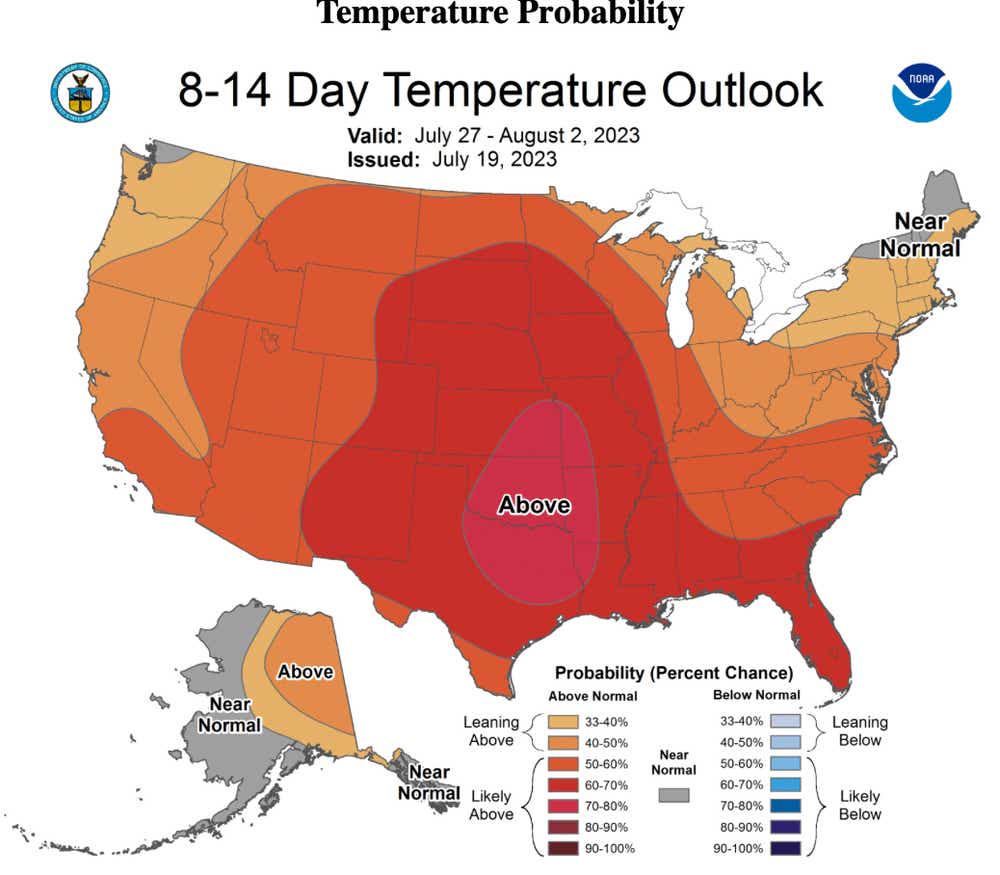

The National Oceanic and Atmospheric Administration's 8-14 Day Temperature Outlook predicts that these hot temperatures will persist until early August. The forecast, shown in the chart below, covers almost the entire U.S. with "likely above" and "leaning above" probabilities for above-normal temperatures during the 8-14-day period. This forecast should support bullish sentiment for the commodity.

Supply Concerns in Europe Add Fuel to Bull Case

While Moscow's incursion into Ukraine and the resulting consequences, including severely limited gas supply from Russia, have likely spared Europe from a catastrophic energy situation, the situation remains delicate. Europe continues to face intense heat similar to that across the Atlantic, leading to increased cooling demand at a particularly bad time. However, this has been partially countered by a decline in industrial activity due to the European Central Bank's rate-tightening cycle.

The importation of liquified natural gas (LNG), primarily from the U.S., has contributed to a moderation in Dutch natural gas prices, which have fallen over 50% since January 1st, although they remain high compared to pre-war levels. Norway's oil fields, the primary domestic source of European gas, have also aided in lowering prices.

Even so, several Norwegian gas fields are scheduled for maintenance in the upcoming weeks, which could limit further selling as Europe's reliance on U.S. LNG flows supports demand during this already unusually high period in the states. Traders should anticipate continued volatility in the sector.

Money Managers Add to Net Long Position

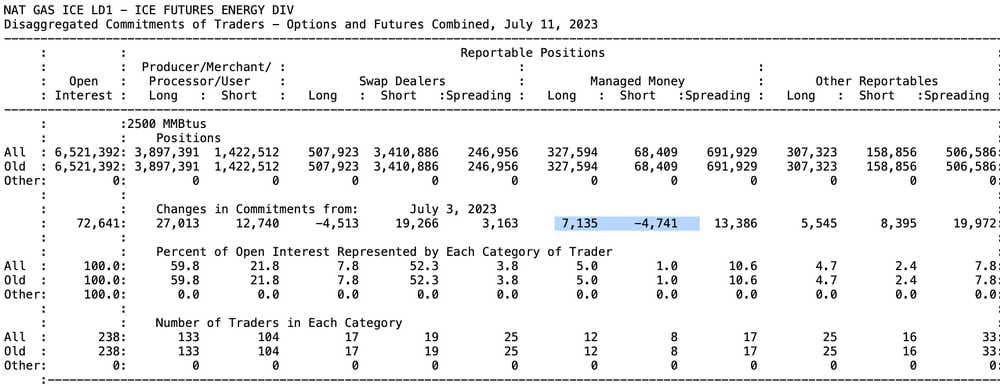

The latest Commitments of Traders report (COT) from the Commodities Futures Trading Commission (CFTC) shows that money managers, who are naturally speculative in nature, added to their long positions for the week ending July 11. The net long position rose 7,135 contracts to a total of 327,594. That compares to a net short position of 68,409 after those funds trimmed 4,741 contracts.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.