Natural Gas Prices Pressured Amid Inventory Builds, Weather Modeling

Natural Gas Prices Pressured Amid Inventory Builds, Weather Modeling

Natural Gas Prices Resume Selloff on Monday as Warmer Weather Approaches

Natural gas futures were trading about 0.13 cents lower, or 6%, on Monday as traders digested updated weather models that see slightly warmer temperatures over the next eight to fourteen days, particularly in the Southeast United States.

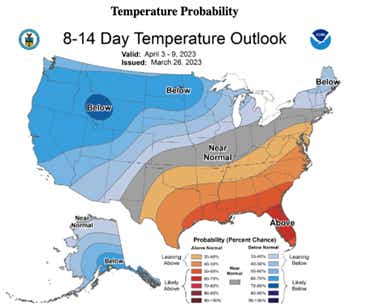

This puts U.S Henry Hub prices at a loss of nearly 25% for March, extending the selloff that preceded February’s price action when the commodity fell 35% and 40% in December and January. The chart below displays the NOAA’s 8–14-day temperature outlook.

Most of the demand will be driven by the Western U.S., where temps are expected to be cooler than average. That may keep prices from dropping much lower, but actual temperatures will dictate spot prices which heavily influence futures.

Traders Have Eyes on Upcoming EIA Report

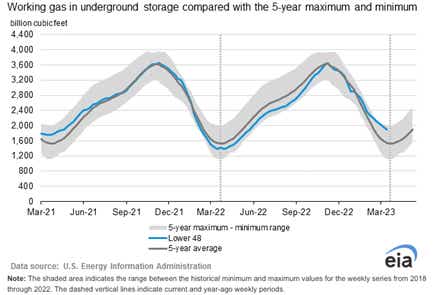

A warm winter in the U.S. allowed natural gas inventories to fall at a slower pace relative to historical averages, leading to a bearish trend in storage capacity over the winter withdrawal season. That also sets up prices for a bearish start to April, which marks the start of the 2023 injection season that runs through October. This is a period when injections outpace withdrawals, resulting in a net increase to stock levels.

According to the latest Weekly Natural Gas Storage Report from the Energy Information Administration (EIA), working gas in storage as of March 17 was 1,900 billion cubic feet (Bcf), which represents a 504 Bcf increase from the same period last year and 351 Bcf higher than the historical five-year average. The EIA’s next storage update for the week ending March 23 is due on Thursday. That report, combined with the April contract settling on Wednesday, brings the chance for additional volatility.

Chart Indicates Bears Remain in Control

The natural gas daily chart displays the bearish trading trend that has been in control since earlier this month when a rally was turned away by the falling 50-day Simple Moving Average (SMA). Now, prices are nearing the psychologically important $2 level, which may serve as a rallying point for bulls to stage another push higher.

However, given the broader weakness in prices, traders may opt to sell into strength. That said, those two levels may serve as decisive and telling points for traders to act. And with an implied volatility rank of above 50, there are also opportunities for premium sellers in the market.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices