A Near Perfect Diamond Has Our Resident Technician Eyeing an Imminent Trend Reversal

A Near Perfect Diamond Has Our Resident Technician Eyeing an Imminent Trend Reversal

By:Tim Knight

XLU: Utilities may be repeating history

- A diamond top formation is a technical analysis pattern that can signal the potential reversal of an uptrend.

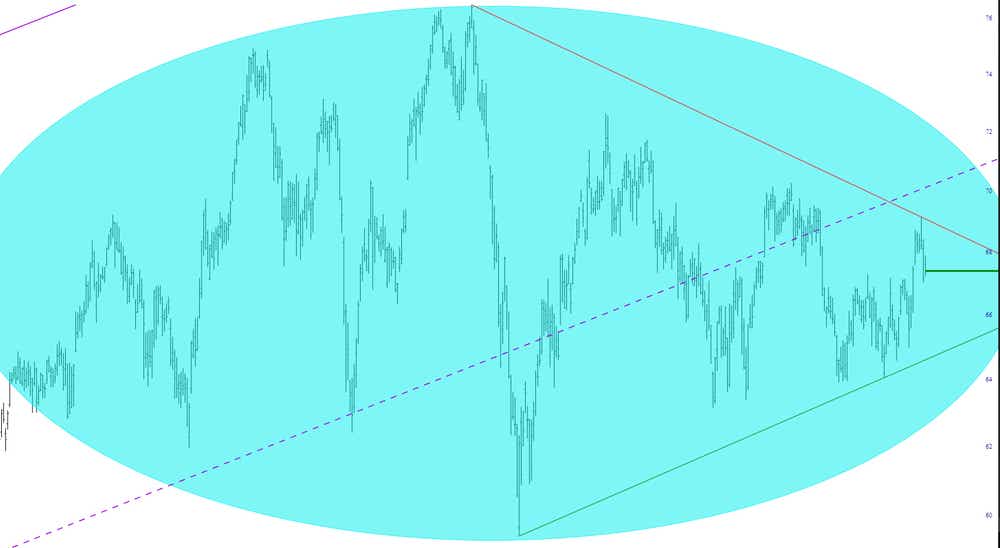

- XLU's present top is a diamond

- The upshot XLU's technical patterns were incredibly prescient about the bear market of 2008.

I have had good experiences in the past with the Utilities Select Sector SPDR Fund (XLU), and I have been taken in by its well-formed diamond pattern. Indeed, this is one of the cleanest diamond patterns I’ve ever seen. Unlike my other positions, which expire next January, February and even March, this one is relatively short-dated at September, so I certainly hope this pans out in a timely fashion!

In the chart above, I have tinted out the price zone I consider to be the diamond pattern, and I have added a supporting and resisting trendline on the right of the pattern to make plain what the key “breaks” would be.

Somewhat lacking

Now, we all know XLU doesn’t have the appeal of, let’s say, Invesco QQQ Trust Series 1 (QQQ) or VanEck Semiconductor ETF (SMH), but that’s part of the reason I’m drawn to it. As I am typing these words, for instance, the Nasdaq (/NQ) futures are up literally over 300 points, and equity futures across the board are up strongly. The Utilities Select Sector SPDR Fund (XLU) is up as well, but merely 0.16%, and it is in my estimation far more prone to a breakdown than its sexier cousins.

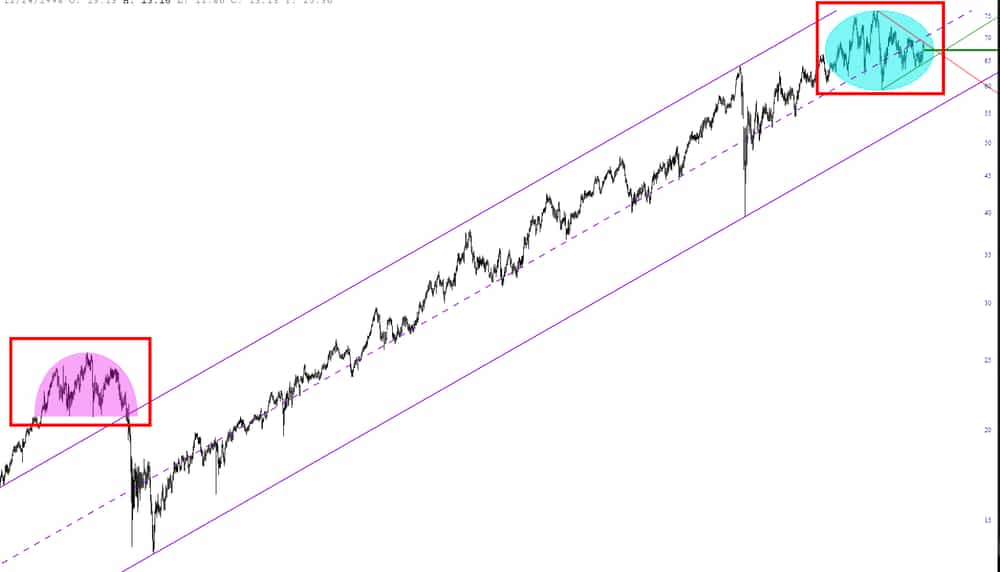

The overarching reason I find XLU so appealing is that it was incredibly prescient about the bear market of 2008. In the chart below, tinted in magenta, you can see the exquisite head and shoulders top that was hammered out before the plunge. The present top, as I’ve noted, is a diamond, but I consider these two reversal patterns to be analogous. It’s particularly intriguing since we have followed the ascending channel so steadily, for a decade and a half, ever since we entered that channel during the throes of the financial crisis.

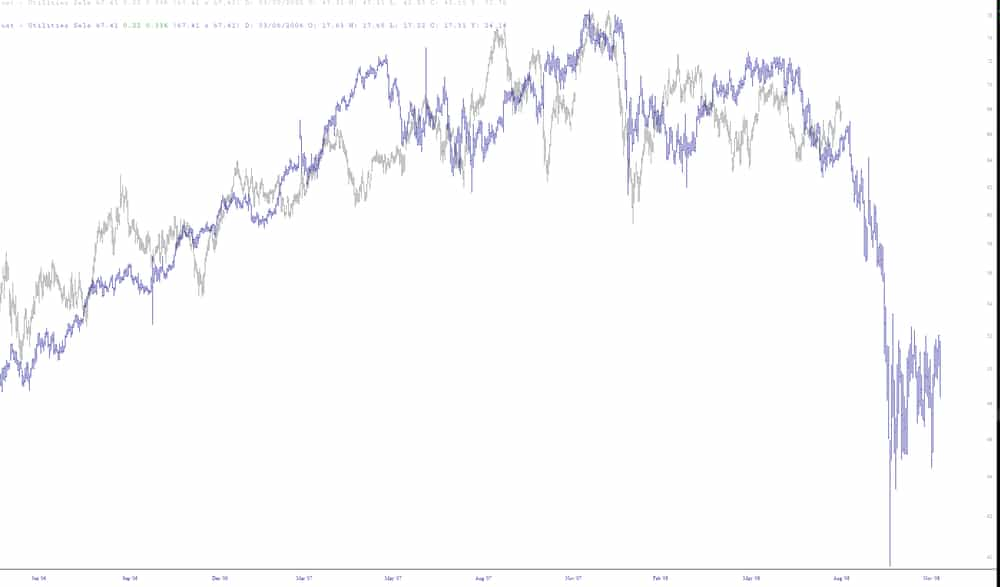

Just to drive home the “analog” point even more, I used the Layered Chart feature in the SlopeCharts tool to overlay the 2007 price action with the recent activity, and I think you can see what an alluring parallel we have here. The recent data is shown in gray, and the pre-financial crisis top is in blue (which includes part of the hard follow which transpired).

An exciting position

So, I’m pretty excited about this position, not only because it represents an opportunity but also because, if it slips lower, it could be a powerful indication of what's in store for the rest of the equity market.

Tim Knight, a charting analyst with 35 years of trading experience, hosts Trading Charts, a tastylive segment airing Monday-Friday. He founded slopeofhope.com in 2005 and uses it as the basis of his technical charting and analysis. Knight authors The Technician column for Luckbox magazine.

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.