Precious Metals Pump: Gold Prices and Silver Prices Jump in July

Precious Metals Pump: Gold Prices and Silver Prices Jump in July

Market Update: Gold prices up 2.74% month-to-date

- With Fed rate hike odds pulling back, U.S. Treasury yields have dropped, paving the way higher for precious metals.

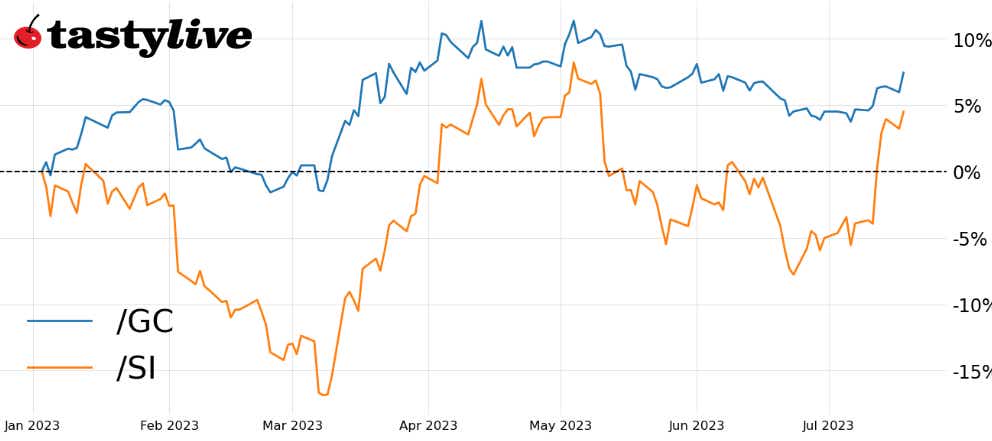

- Gold prices are up by 2.74% in July, while silver prices have gained 10.17% this month.

- Technical indicators now indicate near-term momentum has improved, suggesting further gains in the immediate future.

It’s been an interesting few weeks for precious metals.

In late-June, we discussed the potential for gold prices to continue to struggle and for a brief period, they did, bottoming out at 1900.60 in the first week of July. Something changed, however, after the release of the June U.S. nonfarm payrolls report, a feeling that was reassured by the June U.S. inflation reports—both the consumer price index and the producer price index.

What changed? The odds of a Fed rate hike took a meaningful step backward, and with U.S. Treasuries having a considerable net-short positioning bias in the futures market, a powder keg was lit for yields to come down across the board. Recently, we haven’t been shy on our optimism towards the bond market, at least from the technical perspective, which inherently means that the outlook for gold and silver–damned in June, darlings in July–must change as well.

For recent viewers and listeners of Futures Power Hour (Monday-Friday, 1 p.m. ET/12 p.m. CT) or Overtime (Monday-Thursday 4:30 p.m. ET/3:30. p.m. CT), these views will sound familiar, if not a verbatim repetition of what has been said over the past week–particularly since I abandoned my short gold position at 1950.

/GC Gold price technical analysis: daily chart (July 2022 to July 2023)

In the late-June update, it was noted that “the uptrend from the November 2022 and March 2023 lows has been broken, while the 1950-2000 range in /GCQ3 has broken to the downside. A return to the March lows below 1900 can’t be ruled out in the near-term.” Having hit a low of 1900.60, the measured move was completed, allowing for a period of consolidation or reversal.

The latter path was taken. gold prices have since traded through 1950, which constitutes a return into a former well-defined range. As a heuristic, I treat this kind of price action–false breakouts—as an indication that prices may soon revert to the other side of the range. It makes sense, then, that gold prices may be striving for another attempt at the level of 2000 soon.

Reinforcing the near-term bullish interpretation has been a shift in the momentum profile as well. The moving average convergence/divergence (MACD) is trending higher and nearing a cross above its signal line, while slow stochastics have returned to overbought territory for the first time since April. While I have fundamental reasons for why gold prices will not do well in either a higher for longer or soft-landing world, there’s no sense in trying to be short gold (in my opinion) when the technicals indicate that more upside may be in store; at 2000, bears may regain interest.

/SI Silver price technical analysis: daily chart (July 2022 to July 2023)

Silver prices have been outperforming their golden counterpart in recent weeks, outpacing gold by nearly four to one in July. The multi-month uptrend from the October 2022 and March 2023 swing lows remains valid, and it has been buttressed by the bullish falling wedge that formed between April and July.

In achieving a bullish breakout from this pattern, silver prices, as seen in /SIU3, may now be on track to return to the base of the wedge, the yearly high at 26.630. Technical indicators suggest momentum is firmly bullish, with silver prices above their daily 5-, 8-, and 13-EMAs, MACD trending higher through its signal line, and Slow Stochastics staying nestled in overbought territory.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multi-national firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.