Factful forecasting, Soft-Landing Opportunities and Iron Ore

Factful forecasting, Soft-Landing Opportunities and Iron Ore

By:James Melton

A weekly look inside Luckbox magazine

The new issue includes a mashup of two of our favorite movements: Factfulness and Superforecasting.

Ground your forecasting in facts

The 93-year-old oracle of Omaha seems to find stocks a bit pricey. Warren Buffett's firm, Berkshire Hathaway (BRKA), reduced its stock holdings by $28.7 billion in the first three quarters of 2023, according to Newsweek. Does that mean a recession is coming in 2024? Your call is as good as ours. To help you make one, Luckbox is here to help with its upcoming annual forecasting issue.

The new issue includes a mashup of two of our favorite movements: Factfulness and Superforecasting. Factfulness aims to dispel commonly held misconceptions, while Superforecasters begin by making predictions based on accurate information and move on from there. Read the whole story.

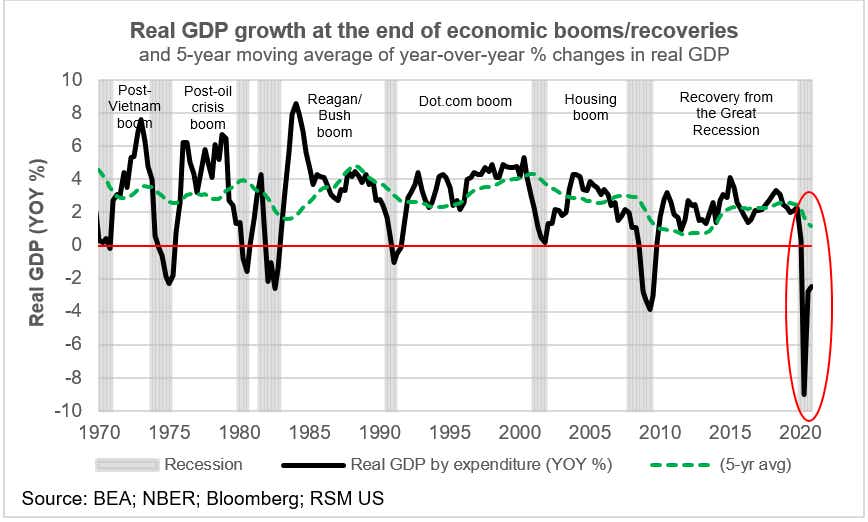

A soft landing could ignite a stock rally

In the mid-1990s, the Federal Reserve orchestrated a perfect soft landing for the U.S. economy. Back then, the stock market performed well in the wake of the Fed’s rate hike cycle and ensuing rate cuts, and the underlying economy remained resilient.

If the Fed can pull off another soft landing in 2024, the stock market will likely produce another year of positive gains. But if a hard landing materializes, the stock market could correct by 15%-20% at some point this year or early 2025. Read the whole story.

Higher prices could boost iron miners

Iron ore prices have rallied by about 30% since August and are currently trading at an 18-month high. And experts expect iron ore miners such as BHP (BHP), Rio Tinto (RIO) and Vale (VALE) to get a Q4 earnings boost from the recent upswing in prices.

Many of the major iron ore miners reported better than expected earnings in Q3 of 2023. With iron ore prices spiking by 30% in the interim, Q4 earnings should be even better.

Demand for iron ore has been historically tied with the relative strength of the global economy, indicating the first “green shoots” of a potential economic rebound may be sprouting.

During periods of robust economic growth, demand for steel and iron ore tend to increase, driving prices higher. Conversely, economic downturns can lead to reduced demand and lower prices for these two metals. Read the whole story.

James Melton is managing editor of Luckbox magazine. @JDMeltonWriter

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker,open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.