S&P 500 Futures Drop from Record Highs After Mixed Data

S&P 500 Futures Drop from Record Highs After Mixed Data

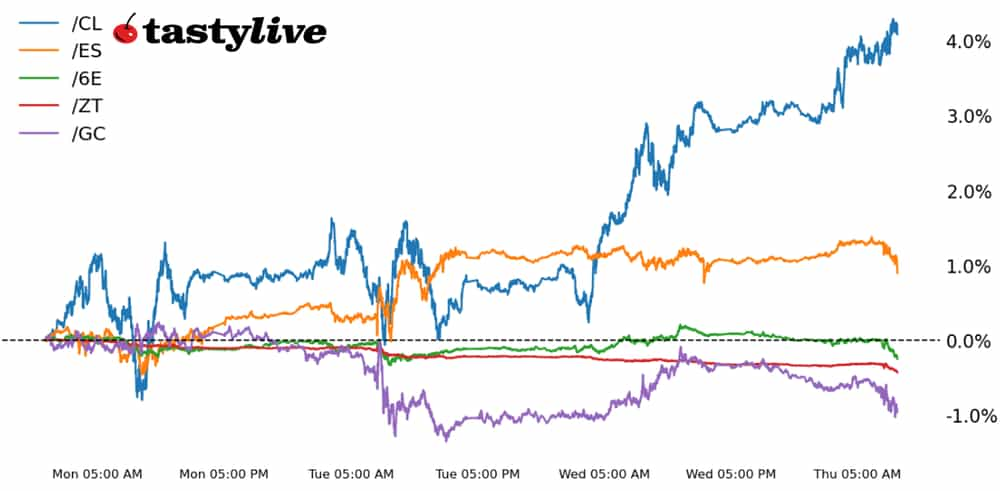

Also, two-year T-note, gold, crude oil and euro futures

S&P 500 futures (/ES): +0.16%

Two-year T-Note futures (/ZT): -0.09%

Gold futures (/GC): -0.56%

Crude Oil futures (/CL): +1.22%

Euro futures (/6E): -0.09%

Treasury yields rose after mixed U.S. economic data muddied the path for a June rate cut from the Federal Reserve, with factory-gate prices rising more than expected while retail sales came in below analysts’ expectations.

While equity traders appeared to shrug off higher yields earlier this week, it looks like traders are starting to move into a more defensive stance. And with little economic data left in the week, this mood may carry into the weekend.

Symbol: Equities | Daily Change |

/ESH4 | +0.16% |

/NQH4 | +0.20% |

/RTYH4 | -0.39% |

/YMH4 | +0.22% |

Stock investors seek direction

The S&P 500 (/ESH4) struggled for direction Thursday morning, up only 0.16%, after mixed economic data left rate cut bets in the wind.

Producer prices rose 0.6% in February from the month before, beating the expected 0.3% rise, and retail sales rose 0.6% as well, but missed the expected 0.8% increase. There isn’t much data left before next week’s Fed decision due on March 20, and equity traders will have to decide if it’s time to pump the brakes.

Strategy: (47DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5,175 p Short 5,180 p Short 5,250 c Long 5,260 c | 51% | +325 | -175 |

Short Strangle | Short 5,175 p Short 5,260c | 46% | +6,800 | x |

Short Put Vertical | Long 5,175 p Short 5,180 p | 59% | +100 | -150 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.09% |

/ZFM4 | -0.26% |

/ZNM4 | -0.35% |

/ZBM4 | -0.57% |

/UBM4 | -0.61% |

Bond traders get mixed signals

Bond markets remained under pressure as traders digested the latest economic prints that failed to give a clear picture of what the Fed will do next week.

The policy-sensitive two-year T-note futures (/ZTM4) fell for a fourth day in a row, trimming 0.09% ahead of the Wall Street opening. Today will see auctions for 4- and 8-week bills following yesterday’s surprisingly strong 30-year bond auction, which saw a high yield of 4.331% against a when-issued yield of 4.352%.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.875 p Short 102 p Short 102.5 c Long 102.625 c | 23% | +156.25 | -93.75 |

Short Strangle | Short 102 p Short 102.5 c | 41% | +718.74 | x |

Short Put Vertical | Long 101.875 p Short 102 p | 86% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCJ4 | -0.55% |

/SIK4 | +0.27% |

/HGK4 | -0.38% |

Gold down slightly

Gold traders, who pushed prices to a record high just last week, appear concerned that the Fed might not cut as soon as recently expected following this morning's PPI data.

Gold futures (/GCJ4) are down 0.55% as higher bond yields sap the metal’s appeal. Traders might decide to wait until next week’s rate decision and updates to the economic and inflation projections before deciding on the next move for the metal. For now, a downward or sideways move might be on the cards for gold.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2,165 p Short 2,170 p Short 2,205 c Long 2,210 c | 18% | +400 | -100 |

Short Strangle | Short 2,170 p Short 2,205 c | 54% | +5,400 | x |

Short Put Vertical | Long 2,165 p Short 2,170 p | 39% | +270 | -230 |

Symbol: Energy | Daily Change |

/CLJ4 | +1.22% |

/HOJ4 | +0.74% |

/NGJ4 | +1.51% |

/RBJ4 | +0.56% |

Oil demand estimates revised

The Paris-based International Energy Agency (IEA) released its oil market report, which revised its demand estimates and trimmed non-OPEC supply projections for 2024.

Its demand-growth forecast was raised by 110,000 barrels per day (bpd) due to a brighter outlook for the United States. The Energy Information Administration also reported a surprise oil draw in yesterday’s report. Today will see the EIA report natural gas stock numbers.

Strategy (34DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 78.5 p Short 79 p Short 82 c Long 82.5 c | 20% | +390 | -110 |

Short Strangle | Short 79 p Short 82 c | 54% | +3,960 | x |

Short Put Vertical | Long 78.5 p Short 79 p | 58% | +200 | -300 |

Symbol: FX | Daily Change |

/6AH4 | -0.30% |

/6BH4 | -0.09% |

/6CH4 | -0.13% |

/6EH4 | -0.31% |

/6JH4 | -0.11% |

The euro drops

A stronger dollar is cutting the euro (/6EH4), which is down 0.32% Thursday morning.

European Central Bank (ECB) member Yannis Stournaras sounded very dovish in a speech earlier today, suggesting four rate cuts this year. That aligned with dovish sentiment from ECB member Klaas Knot, who is suggesting a June cut is on the table.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.08 p Short 1.085 p Short 1.11 c Long 1.115 c | 49% | +287.50 | -337.50 |

Short Strangle | Short 1.085 p Short 1.11 c | 62% | +950 | x |

Short Put Vertical | Long 1.08 p Short 1.085 p | 82% | +175 | -450 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices