S&P 500 Futures Nudge Higher Ahead of Key Bond Auctions

S&P 500 Futures Nudge Higher Ahead of Key Bond Auctions

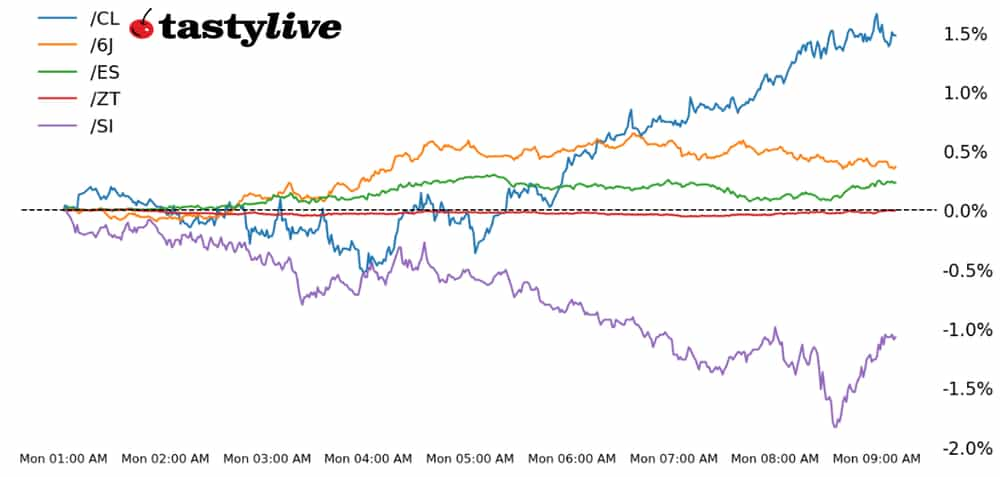

Also two-year T-note, silver, crude oil and Japanese yen futures

- S&P 500 E-mini futures (/ES): +0.09%

- 2-year T-note futures (/ZT): +0.02%

- Silver futures (/SI): -1.69%

- Crude oil futures (/CL): +2.22%

- Japanese yen futures (/6J): +0.70%

The holiday trading week beckons, which means thinner liquidity conditions and more limited trading opportunities. Nonetheless, before Thanksgiving arrives, several noteworthy events could still spur volatility. Treasury issuances (a 20-year auction today and two-year FRN and 10-year TIPS auctions tomorrow) could spark the bond market. Nvidia (NVDA), Lowe’s (LOWE) and John Deere (DE) have earnings releases between tomorrow and Wednesday may stir equity market volatility. The November Federal Open Market Committee (FOMC) meeting minutes will be released tomorrow afternoon as well, which could affect assets across the board.

Symbol: Equities | Daily Change |

/ESZ3 | +0.09% |

/NQZ3 | +0.09% |

/RTYZ3 | +0.25% |

/YMZ3 | +0.06% |

U.S. equity index futures are moving cautiously higher this morning to start a short trading week for U.S. markets with stock and bond markets closed Thursday. That may reduce liquidity and make for some volatile moves if there is a sharp shift in sentiment. For now, however, traders are focused on Federal Reserve rate hike bets, which show a growing potential for the first cut to come in March. The S&P 500 (/ESZ3) is trading about 2.75 higher, or 0.06%, this morning at the open bell. Tomorrow’s FOMC minutes are in focus as traders look to get a better grip on where policymakers are headed.

Strategy: (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4530 p Short 4540 p Short 4630 c Long 4640 c | 19% | +362.50 | -137.50 |

Long Strangle | Long 4530 p Long 4640 c | 50% | x | -4375 |

Short Put Vertical | Long 4530 p Short 4540 p | 62% | +162.50 | -337.50 |

Symbol: Bonds | Daily Change |

/ZTZ3 | +0.02% |

/ZFZ3 | -0.02% |

/ZNZ3 | -0.10% |

/ZBZ3 | -0.27% |

/UBZ3 | -0.29% |

Two-year T-note futures (/ZTZ3) are inching higher this morning. The dovish narrative about cooling inflation after last week’s data is driving yields and the dollar lower, which should help underpin broader market sentiment. TheFOMC’s minutes from its last meeting are due tomorrow, which may reinforce the market’s view of potential rate cuts, which are being priced in as soon as March, according to Fed Funds futures.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.5 p Short 101.625 p Short 102.375 c Long 102.5 c | 37% | +125 | -125 |

Long Strangle | Long 101.5 p Long 102.5 c | 44% | x | -390.63 |

Short Put Vertical | Long 101.5 p Short 101.625 p | 86% | +62.50 | -187.50 |

Symbol: Metals | Daily Change |

/GCZ3 | -0.78% |

/SIZ3 | -1.69% |

/HGZ3 | +0.32% |

A slightly weaker dollar isn’t enough to help silver prices (/SIZ3), which are down about 1.5% this morning. The advance in Treasuries is slowing as rhetoric around potential rate cuts next year cools off. Data prints that may affect precious metals are light on today’s calendar, but tomorrow brings the FOMC minutes and several Treasury auctions, both of which have the potential to affect prices.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 23.55 p Short 23.6 p Short 24.1 c Long 24.15 c | 12% | +220 | -30 |

Long Strangle | Long 23.55 p Long 24.15 c | 45% | x | -5795 |

Short Put Vertical | Long 23.55 p Short 23.6 p | 57% | +115 | -135 |

Symbol: Energy | Daily Change |

/CLF4 | +2.22% |

/HOZ3 | +1.26% |

/NGZ3 | -1.96% |

/RBZ3 | +2.44% |

Crude oil (/CLF4) rose about $1.84 per barrel, or 2.42%, this morning as traders mulled over the prospect of further output cuts from OPEC+, which followed weeks of declining price action. Sources familiar with the matter told Reuters on Friday that OPEC would consider the additional supply cuts during its Nov. 26 meeting. Last week, the futures market fell into contango, which means futures contract prices rose above spot prices and indicates a better-supplied market. However, traders are also watching how demand for gasoline plays out this holiday season as travelers hit the road and take to the sky for Thanksgiving.

Strategy (24DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 75 p Short 75.5 p Short 80.5 c Long 81 c | 27% | +340 | -160 |

Long Strangle | Long 75 p Long 81 c | 44% | x | -3440 |

Short Put Vertical | Long 75 p Short 75.5 p | 61% | +170 | -330 |

Symbol: FX | Daily Change |

/6AZ3 | +0.51% |

/6BZ3 | +0.14% |

/6CZ3 | -0.03% |

/6EZ3 | +0.19% |

/6JZ3 | +0.70% |

Japanese yen futures (/6JZ3) are trading near a seven-week high amid broader dollar weakness. The yen has been on the rise after hitting levels that sparked concern over another potential intervention by Japanese authorities. That speculation caused a flurry of options trades over the last few weeks that dissuaded further declines in the currency. Now, with many thinking the dollar has topped, bets are moving back into the yen. Japan’s inflation data for October is due this week, although trading liquidity may be thin with the U.S. holiday.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0065 p Short 0.0066 p Short 0.0071 c Long 0.0072 c | 75% | +162.50 | -1087.50 |

Long Strangle | Long 0.0065 p Long 0.0072 c | 11% | x | -200 |

Short Put Vertical | Long 0.0065 p Short 0.0066 p | 93% | +62.50 | -1187.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.