S&P 500 Inches Higher as Bonds Eclipsed by Commodities

S&P 500 Inches Higher as Bonds Eclipsed by Commodities

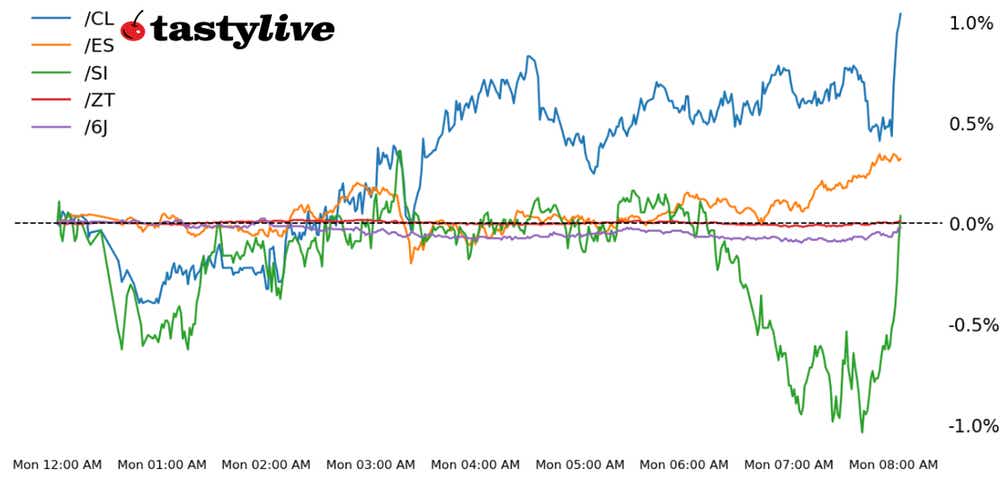

Also 2-year T-note, silver, crude oil, and Japanese yen futures

S&P 500 E-mini futures (/ES): +0.20%

Tw0-year T-note futures (/ZT): -0.09%

Silver futures (/SI): +1.01%

Crude oil futures (/CL): +0.03%

Japanese yen futures (/6J): -0.22%

A busy week for markets beckons. 1Q’24 earnings season kicks off at the end of this week, but before then, there is a substantial macro calendar with which to contend.

The March U.S. inflation report is due out tomorrow, the March Federal Open Market Committee (FOMC) meeting minutes will come out on Wednesday. The April European Central Bank rate decision will happen on Thursday. Treasury auctions are substantial, with three-year notes on Tuesday, 10-year notes on Wednesday, and 30-year bonds on Thursday. All eyes are still on commodity markets, where energy and metals prices are pushing fresh yearly highs–a big problem for the bond market.

Symbol: Equities | Daily Change |

/ESM4 | +0.20% |

/NQM4 | +0.29% |

/RTYM4 | +0.55% |

/YMM4 | +0.14% |

S&P 500 futures move up

S&P 500 futures (/ESM4) moved higher to start the week on Monday morning despite higher Treasury yields. Traders have an event-heavy week ahead, which may induce some volatility. On Wednesday, U.S. inflation numbers will cross the wires. Rate cut odds are still in focus as markets mull the possibility of fewer cuts amid a strong economic backdrop. Tesla (TSLA) was up nearly 4% this morning after CEO Elon Musk, on Friday, tweeted about the company’s robotic taxi, which is set to premier in August.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4975 p Short 5000 p Short 5525 c Long 5550 c | 62% | +297.50 | -952.50 |

Short Strangle | Short 5000 p Short 5525 c | 69% | +2250 | x |

Short Put Vertical | Long 4975 p Short 5000 p | 84% | +150 | -1100 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.09% |

/ZFM4 | -0.29% |

/ZNM4 | -0.44% |

/ZBM4 | -0.69% |

/UBM4 | -0.75% |

T-note futures dip

Traders continue to price in a less aggressive rate cutting path by the Federal Reserve, which is pressuring bonds and pushing yields higher. Policy-sensitive two-year T-note futures (ZTM4) are down 0.08%. This week’s inflation data may change the calculus but for now waning rate cut odds will likely drive the narrative in bonds markets. The Treasury is set to auction 13- and 26-week bills today.

Strategy (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 100.875 p Short 101 p Short 102.75 c Long 102.875 c | 54% | +46.88 | -203.13 |

Short Strangle | Short 101 p Short 102.75 c | 58% | +187.50 | x |

Short Put Vertical | Long 100.875 p Short 101 p | 98% | +15.63 | -234.38 |

Symbol: Metals | Daily Change |

/GCM4 | +0.03% |

/SIK4 | +1.01% |

/HGK4 | +1.29% |

Silver prices move up

Silver prices (/SIK4) are extending last week’s rally, which ended the week with a 10.38% gain—the best weekly percentage gain for the metal since August 2020. Metals traders are focused on U.S. inflation numbers along with monetary policy abroad. The European Central Bank (ECB) is expected to leave rates unchanged this week and New Zealand’s central bank will also report a rate decision this week. The gold/silver ratio is extending last week’s drop and trading at the lowest since December.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 24.75 p Short 25 p Short 31.25 c Long 31.5 c | 64% | +320 | -930 |

Short Strangle | Short 25 p Short 31.25 c | 72% | +3295 | x |

Short Put Vertical | Long 24.75 p Short 25 p | 83% | +165 | -1085 |

Symbol: Energy | Daily Change |

/CLK4 | -0.29% |

/HOK4 | -1.07% |

/NGK4 | +1.23% |

/RBK4 | -0.48% |

Middle East violence and oil prices

Crude oil prices (/CLK4) fell Monday morning as traders considered how recent moves in the Middle East could affect oil markets.

The Israeli military withdrew some of its forces from Southern Gaza over the weekend, which could make for smoother negotiations towards a cease fire agreement. Elsewhere, oil’s demand outlook is still strong, supported by last week’s U.S. jobs report and a recent move by Saudi Arabia to raise selling prices to Asia, which suggests strong demand from China. That is unlikely to be enough to support crude prices at the $90 per barrel level, especially as crack spreads glide lower.

Strategy (38DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 77 p Short 78 p Short 94 c Long 95 c | 66% | +240 | -760 |

Short Strangle | Short 78 p Short 94 c | 73% | +1510 | x |

Short Put Vertical | Long 77 p Short 78 p | 84% | +120 | -880 |

Symbol: FX | Daily Change |

/6AM4 | +0.24% |

/6BM4 | -0.02% |

/6CM4 | +0.09% |

/6EM4 | +0.02% |

/6JM4 | -0.22% |

Yen futures fall

Japanese yen futures (/6JM4) fell 0.22% Monday morning and despite the threat of intervention around these levels by Japanese authorities, traders appear unphased.

The Japanese currency is trading near 34-year lows and is down sharply this year despite earlier high hopes for the currency. Over the weekend, Takehiko Nakao, former vice finance minister for international affairs, said that intervention could happen “at any time,” according to a Reuters report.

Strategy (60DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0064 p Short 0.00645 p Short 0.00685 c Long 0.0069 c | 62% | +162.50 | -462.50 |

Short Strangle | Short 0.00645 p Short 0.00685 c | 69% | +587.50 | x |

Short Put Vertical | Long 0.0064 p Short 0.00645 p | 88% | +75 | -550 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.