S&P 500 Rebounds as Israel-Iran Tensions Stabilize

S&P 500 Rebounds as Israel-Iran Tensions Stabilize

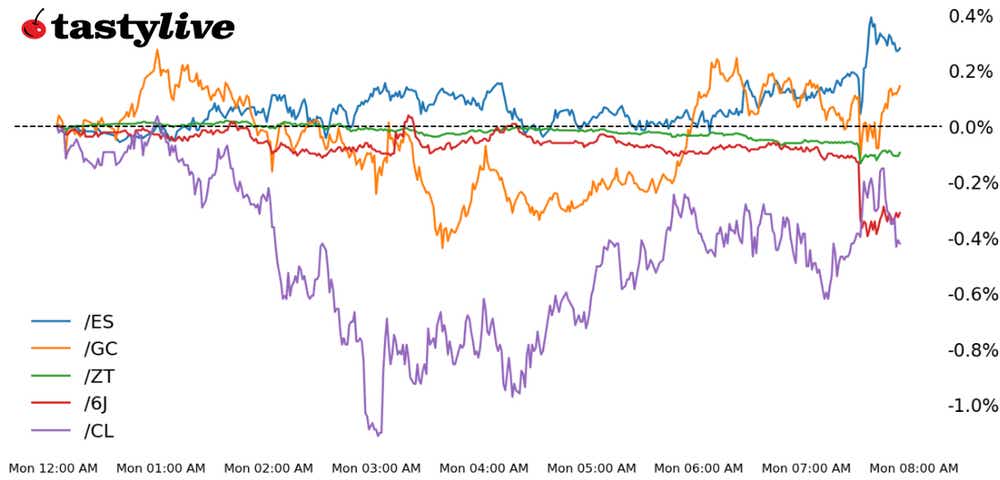

Also, two-year T-note, gold, crude oil, and Japanese yen futures

S&P 500 e-mini futures (/ES): +0.79%

Two-year T-note futures (/ZT): -0.17%

Gold futures (/GC): +0.01%

Crude oil futures (/CL): -0.93%

Japanese yen futures (/6J): -0.64%

A robust but rebuffed Iranian attack against Israel over the weekend has not led to fears that a broader regional war may transpire.

Energy futures are lower, giving breathing room for a rebound in stocks, which are turning their attention back to earnings season. The lack of demand for safe havens, coupled with a hot March U.S. retail sales report, has pushed bonds to their lows of the year.

Symbol: Equities | Daily Change |

/ESM4 | +0.79% |

/NQM4 | +0.85% |

/RTYM4 | +0.34% |

/YMM4 | +0.77% |

Stock volatility is modest

U.S. equity markets have shrugged off the weekend geopolitical risk, with volatility coming in modestly across the board. Vixpiration is this Wednesday, however, and volatility typically stays elevated into the event.

Earnings are increasingly in focus now that the big banks are in the rearview mirror. 84% of companies are beating their revenue estimates, according to FactSet.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4900 p Short 4925 p Short 5475 c Long 5500 c | 63% | +292.50 | -957.50 |

Short Strangle | Short 4925 p Short 5475 c | 69% | +2150 | x |

Short Put Vertical | Long 4900 p Short 4925 p | 85% | +137.50 | -1112.50 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.17% |

/ZFM4 | -0.44% |

/ZNM4 | -0.68% |

/ZBM4 | -1.26% |

/UBM4 | -1.52% |

Treasuries drop

The drop in demand for safe-haven assets is nowhere more apparent than in the bond market, where Treasuries are down across the curve. The March U.S. retail sales report offered more evidence that the Federal Reserve should be in no rush to start its rate cutting cycle.

Rate-cut odds for June have dropped below 20%, and the first cut isn’t discounted until September. In terms of Treasury auctions this week, there is a 20-year bond on Wednesday and a five-year TIPS on Thursday.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 100.5 p Short 100.75 p Short 102.5 c Long 102.75 c | 62% | +93.75 | -406.25 |

Short Strangle | Short 100.75 p Short 102.5 c | 67% | +281.25 | x |

Short Put Vertical | Long 100.5 p Short 100.75 p | 94% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCM4 | +0.01% |

/SIK4 | +1.78% |

/HGK4 | +2.07% |

Precious metals hang on to gains

Despite the geopolitical unclenching at the start of the week, precious metals have held onto their recently robust gains.

Gold prices (/GCM4) are hovering in positive territory while silver prices (/SIK4) continue to race towards the 2021 high near 30. Elsewhere, in what may be a sign that the recent run-up in commodities is not just geopolitically driven, copper prices (/HGK4) tested their highest level since June 2022 earlier today.

Strategy (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2200 p Short 2225 p Short 2500 c Long 2525 c | 65% | +620 | -1880 |

Short Strangle | Short 2225 p Short 2500 c | 72% | +2820 | x |

Short Put Vertical | Long 2200 p Short 2225 p | 86% | +270 | -2230 |

Symbol: Energy | Daily Change |

/CLM4 | -0.93% |

/HOK4 | -1.21% |

/NGK4 | -3.28% |

/RBK4 | -0.77% |

Crude oil drops

The reduction in perceived geopolitical risk is making itself apparent in energy markets, where crude oil prices (/CLM4) are off nearly 1% at the start of the week. Yet /CLM4 has not yet been able to pierce the swing lows from the past week near 84, suggesting that traders aren’t ready to fully remove their geopolitical hedges just yet; an Israeli response to Iran appears within the realm of possibility.

Strategy (31DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 77 p Short 78 p Short 91 c Long 92 c | 61% | +270 | -730 |

Short Strangle | Short 78 p Short 91 c | 70% | +1530 | x |

Short Put Vertical | Long 77 p Short 78 p | 81% | +140 | -860 |

Symbol: FX | Daily Change |

/6AM4 | +0.36% |

/6BM4 | +0.28% |

/6CM4 | +0.34% |

/6EM4 | +0.08% |

/6JM4 | -0.64% |

The dollar shows weakness

The U.S. dollar is mostly on its backfoot today as traders drop the world’s reserve currency and shift back into riskier fiat.

There is one exception however: the Japanese yen (/6JM4), which is at fresh yearly and multi-decade lows, perhaps in part due to the sharp uptick in U.S. Treasury yields today. Nevertheless, the bond market reigns supreme; if U.S. yields keep escalating, U.S. dollar weakness may not persist for long.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.00635 p Short 0.00675 c Long 0.0068 c | 60% | +175 | -450 |

Short Strangle | Short 0.00635 p Short 0.00675 c | 69% | +675 | x |

Short Put Vertical | Long 0.0063 p Short 0.00635 p | 84% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.