S&P 500 Stalls at All-Time Highs Ahead of NFP

S&P 500 Stalls at All-Time Highs Ahead of NFP

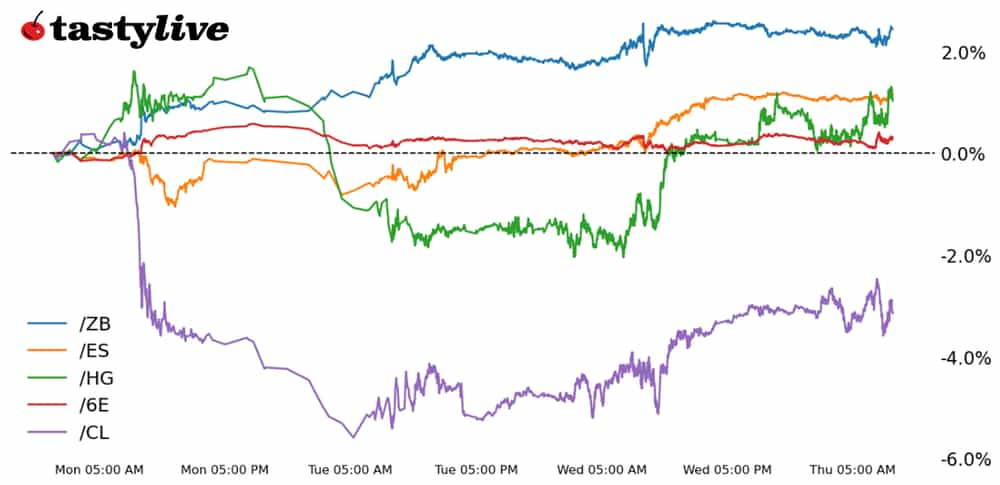

Also 30-year T-bond, copper, crude oil, and Japanese yen futures

S&P 500 E-mini futures (/ES): -0.02%

30-year T-bond futures (/ZB): -0.18%

Copper futures (/HG): +0.96%

Crude oil futures (/CL): +055%

Euro futures (/6J): -0.16%

U.S. traders appear cautious ahead of tomorrow’s non-farm payrolls report, which could make or break the case for a September rate cut.

This morning’s jobless claims data was encouraging but yields rose for the first time in days. The U.S. dollar softened slightly following the European Central Bank’s rate cut—the first since 2019. Energy prices rose, and precious metals climbed for a second day.

Chip stocks are under pressure after CNBC reported that the Federal Trade Commission (FTC) and Department of Justice (DOJ0) are set to open antitrust actions against OpenAI, Nvidia (NVDA) and Microsoft (MSFT) over their combined influence on artificial intelligence.

How you can profit from the Nvidia stock split.

Symbol: Equities | Daily Change |

/ESM4 | -0.02% |

/NQM4 | +0.10% |

/RTYM4 | -0.52% |

/YMM4 | -0.06% |

Lululemon pops

U.S. stock futures are steady this morning, with S&P 500 contracts (/ESM4) down by only 0.02% ahead of the New York open. Nvidia fell 2% at the open after rising above the $3 trillion market cap—the first chip stock to pass the milestone. Lululemon Athletica (LULU) rose more than 9% in pre-market trading after the company increased its profit outlook for the year.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5200 p Short 5225 p Short 5675 c Long 5700 c | 64% | +255 | -955 |

Short Strangle | Short 5225 p Short 5675 c | 70% | +1737.50 | x |

Short Put Vertical | Long 5200 p Short 5225 p | 84% | +157.50 | -1092.50 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.02% |

/ZFM4 | -0.05% |

/ZNM4 | -0.10% |

/ZBM4 | -0.18% |

/UBM4 | -0.30% |

Bond yields go higher

U.S. bond yields ticked higher Thursday morning following an overnight move in Europe where yields there remained higher through the European Central Bank’s rate announcement.

The two-year T-note futures (/ZTM4) fell 0.02%, breaking a five-day win streak. Still, the underlying yield is holding above the May swing low of 4.704%.

Eyes shift to tomorrow’s jobs report, which should provide the next directional cue for U.S. yields. The Treasury auctions off four- and eight-week bills today.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 114 p Short 115 p Short 124 c Long 125 c | 61% | +312.50 | -687.50 |

Short Strangle | Short 115 p Short 124 c | 69% | +1187.50 | x |

Short Put Vertical | Long 114 p Short 115 p | 83% | +187.50 | -812.50 |

Symbol: Metals | Daily Change |

/GCQ4 | +0.04% |

/SIN4 | +1.19% |

/HGN4 | +0.96% |

Copper keeps rising

Copper prices (/HGN4) rose for a second day on Thursday despite rising inventories in China.

The metal is coming off its lowest levels since early May after selling off from a multi-year high. With the likelihood that recent profit taking from those highs will moderate, we could see a period of consolidation form amid the swelling supply.

China’s copper levels held in the Shanghai Futures Exchange rose above 300k tons for the end of May. We might have to see some acceleration in the Chinese economy for copper to challenge its recent highs.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4 p Short 4.05 p Short 4.95 c Long 5 c | 62% | +350 | -900 |

Short Strangle | Short 4.05 p Short 4.95 c | 71% | +2800 | x |

Short Put Vertical | Long 4 p Short 4.05 p | 89% | +100 | -1150 |

Symbol: Energy | Daily Change |

/CLN4 | +0.55% |

/HON4 | +0.63% |

/NGN4 | +3.34% |

/RBN4 | +0.65% |

Crude oil moves up

Crude oil (/CLN4) is climbing toward the 75 level, with prices up for a second day.

The chances for a September rate cut have increased, which has halted oil’s drop, which was driven on fears that OPEC would phase out its output cuts. The commodity remains sharply lower from its highs traded in April and the current rebound may be more from bearish exhaustion rather than a turnaround in the overall narrative for oil.

Strategy (41DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 66 p Short 67 p Short 81 c Long 82 c | 66% | +230 | -770 |

Short Strangle | Short 67 p Short 81 c | 71% | +1010 | x |

Short Put Vertical | Long 66 p Short 67 p | 84% | +120 | -880 |

Symbol: FX | Daily Change |

/6AM4 | -0.21% |

/6BM4 | -0.17% |

/6CM4 | -0.11% |

/6EM4 | +0.02% |

/6JM4 | -0.16% |

The euro rises

Euro contracts (/6EM4) gained after the European Central Bank (ECB) raised its inflation forecast alongside its rate cut overnight.

The ECB now expects inflation to average 2.2% in 2025, a 0.2% increase from the prior forecast. That leaves the expected rate path higher than expected even with the bank kicking off its cutting cycle.

Wage gains and services sector demand remain a concern for European policymakers, and data over the past month has complicated the outlook to get back to a “normal” rate environment.

Strategy (29DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.075 p Short 1.08 p Short 1.11 c Long 1.115 c | 64% | +175 | -450 |

Short Strangle | Short 1.08 p Short 1.11 c | 70% | +437.50 | x |

Short Put Vertical | Long 1.075 p Short 1.08 p | 87% | +100 | -525 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.