S&P 500 E-mini, Two-Year T-Notes, Silver, Natural Gas and Euro Futures

S&P 500 E-mini, Two-Year T-Notes, Silver, Natural Gas and Euro Futures

Five futures in focus. Right here, every weekday morning.

This Morning’s Five Futures in Focus:

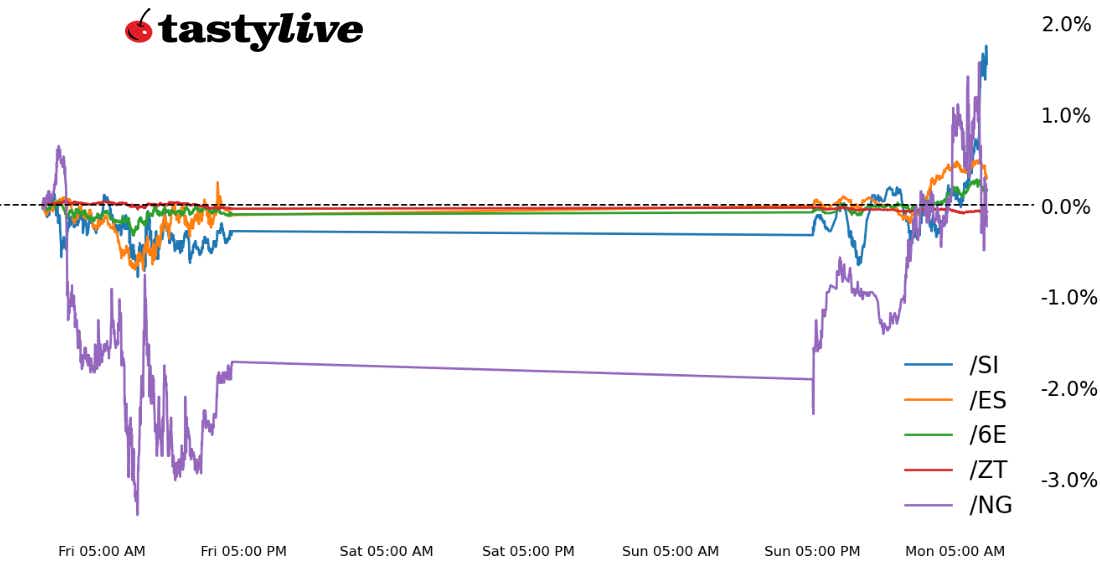

- S&P 500 E-mini Futures (/ES): +0.91%

- Two-Year T-Note Futures (/ZT): +0.37%

- Silver Futures (/SI): +0.22%

- Natural Gas Futures (/NG): -0.85%

- Euro Futures (/6E): -0.20%

While the week ahead doesn’t offer a supersaturated docket, traders will be watching intently as three stories develop: Chinese property sector woes; Nvidia's (NVDA) earnings for clues about the viability of the AI-driven tech rally; and the Federal Reserve Jackson Hole Economic Policy Symposium.

Symbol: Equities | Daily Change |

/ESU3 | +0.35% |

/NQU3 | +0.58% |

/RTYU3 | +0.13% |

/YMU3 | +0.19% |

A lack of negative news from China over the weekend is giving some breathing room to equity markets globally at the start of the week. Modest gains have accumulated ahead of the U.S. cash equity open in New York, with /ESU3 posting a +0.35% bump higher. /NQU3 is the top performer, however, up by +0.58%, with NVDA’s earnings report coming into focus on Wednesday after hours.

Strategy (4DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4390 p Short 4395 p Short 4405 c Long 4410 c | 8% | +232.50 | -17.50 |

Long Strangle | Long 4395 p Long 4405 c | 45% | x | -3175 |

Short Put Vertical | Long 4390 p Short 4395 p | 53% | +107.50 | -142.50 |

Symbol: Bonds | Daily Change |

/ZTU3 | -0.05% |

/ZFU3 | -0.14% |

/ZNU3 | -0.27% |

/ZBU3 | -0.73% |

/UBU3 | -0.85% |

Global bond markets saw further erosion at the start of the week after Chinese lenders did not cut the one-year and five-year prime loan rates as much as anticipated. But the Fed’s policy conference later in the week also appears to be a significant source of binary risk in the coming days, with Fed Chair Jerome Powell likely to beat the drum of “higher for longer” when he speaks on Friday.

Strategy (1DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 101.125 p Short 101.25 p Short 101.5 c Long 101.625 c | 49% | +125 | -125 |

Long Strangle | Long 101.25 p Long 101.5 c | 42% | x | -203.13 |

Short Put Vertical | Long 101.125 p Short 101.25 p | 75% | +78.13 | -171.88 |

Symbol: Metals | Daily Change |

/GCU3 | +0.44% |

/SIU3 | +2.19% |

/HGU3 | +0.34% |

/GCU3 and /SIU3 prices are jumping higher even as traders sell bonds. A weakening dollar is likely supporting the move in precious metals as rate traders await comments from Fed Chair Powell later this week in Jackson Hole. Some short-term Treasury auctions are scheduled for today, which may influence dollar strength, but the calendar is otherwise empty, leaving gold and silver at the mercy of broader market sentiment.

Strategy (7DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1890 p Short 1895 p Short 1905 c Long 1910 c | 46% | 300 | -200 |

Long Strangle | Long 1900 p Long 1890 c | 40% | x | -670 |

Short Put Vertical | Short 1900 p Long 1890 p | 83% | 60 | -940 |

Symbol: Energy | Daily Change |

/CLU3 | +0.86% |

/NGU3 | +2.00% |

/CLU3 was trading up about 1.00 per gallon, or 1.29%, to trade at 81.71 before Wall Street’s Monday opening bell. The bullish price action follows a move by China’s central bank that saw its one-year loan prime rate (LPR) cut by 10 basis point. While traders expected more easing via the five-year LPR, the move seemed enough to energize oil bulls. /CLU3 is coming off its first weekly loss in over eight weeks.

Meanwhile, /NGU3 is back higher as potential labor strikes in Australia threatens to upend the global supply of liquified natural gas (LNG). Another spike in global LNG prices, akin to what happened in August 2022, could ultimately prove problematic for a swath of currencies, especially /6B and /6E.

Strategy (7DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 82 p Short 82.25 p Long 83 c Short 82.75 c | 24% | 200 | -50 |

Long Strangle | Long 82.5 c Long 82 p | 46% | x | -640 |

Short Put Vertical | Short 82 p Long 81.75 p | 32% | 160 | -90 |

Symbol: FX | Daily Change |

/6AU3 | +0.11% |

/6BU3 | +0.13% |

/6CU3 | +0.32% |

/6EU3 | +0.21% |

/6JU3 | -0.51% |

The U.S. dollar wrecking ball is swinging a little bit lighter today as most major currencies advance vs. the greenback. The bump in U.S. Treasury yields may be weighing down /6J, but most components, including /6E, are trading higher. /6B and /6E traders should keep their eye on LNG prices in the coming days to see if fears of an energy supply issue are rekindled.

Strategy (18DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 1.085 p Short 1.0875 p Short 1.0925 c Long 1.095 c | 21% | +262.50 | -50 |

Long Strangle | Long 1.0875 p Long 1.0925 c | 45% | x | -1325 |

Short Put Vertical | Long 1.085 p Short 1.0875 p | 67% | +112.50 | -200 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.