S&P 500 Trades to New All-Time Highs; Gold, Oil Retrace Gains

S&P 500 Trades to New All-Time Highs; Gold, Oil Retrace Gains

Also 10-year T-Note, Gold, Crude Oil, and Japanese Yen Futures

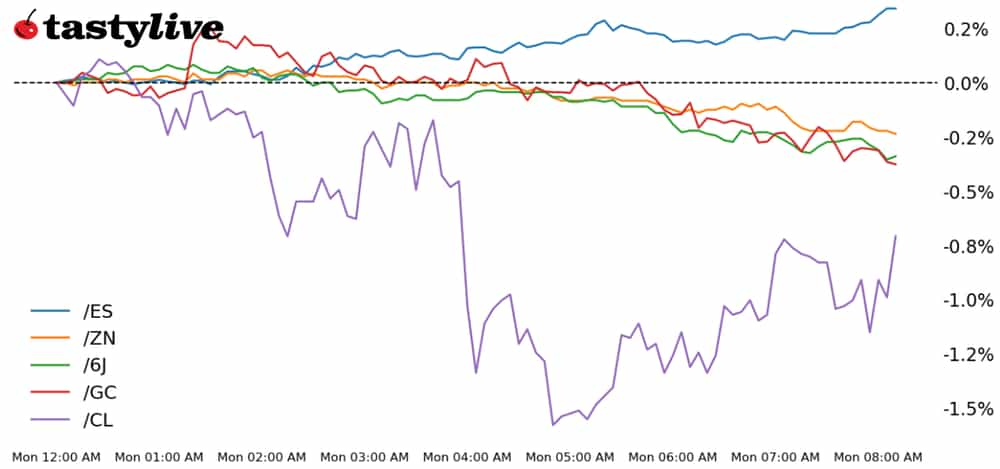

- S&P 500 E-mini futures (/ES): +0.28%

- 10-year Treasury futures (/ZN): -0.4%

- Gold futures (/GC): -0.41%

- Crude oil futures (/CL): -2.02%

- Japanese yen futures (/6J): -0.47%

U.S. equity markets are marking Columbus Day/Indigenous People’s Day (dealer’s choice) and the closure of the bond market by trading to fresh monthly highs—and in the case of the S&P 500, a climb to new all-time highs. Bond futures are still open, however, and are trading softer across the curve. Higher yields are helping the U.S. dollar, which in turn may be weighing on metals. There are two macro stories as well. First, Israel-Iran tensions continue to simmer, allowing volatility to come off and oil prices to retrace. Second, the fiscal stimulus announcement by China is being perceived as too light.

Symbol: Equities | Daily Change |

/ESZ4 | +0.28% |

/NQZ4 | +0.52% |

/RTYZ4 | +0.11% |

/YMZ4 | -0.11% |

U.S. equity markets rallied overnight and have started the U.S. trading session on a positive footing. The S&P 500 (/ESZ4) has traded to a fresh record high, peaking above 5900 in the process. The leader on the day is the Nasdaq 100 (/NQZ4), where the Magnificent Seven companies are leading the pack. Volatility is coming down in both spot and the futures market.

Strategy: (35DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5500 p Short 5600 p Short 6200 c Long 6300 c | 60% | +837.50 | -4162.50 |

Short Strangle | Short 5600 p Short 6200 c | 65% | +2612.50 | X |

Short Put Vertical | Long 5500 p Short 5600 p | 80% | +575 | -4425 |

Symbol: Bonds | Daily Change |

/ZTZ4 | -0.11% |

/ZFZ4 | -0.27% |

/ZNZ4 | -0.4% |

/ZBZ4 | -0.67% |

/UBZ4 | -0.88% |

The bond market may be closed but futures are open, and they’re not looking pretty today. A week devoid of meaningful economic data or significant Treasury auctions leaves U.S. yields at the whim of macro influences (e.g. Israel-Iran and China). Ongoing weakness in Treasuries suggests and decoupling from November Federal Reserve interest rate cut odds suggest something else may be in play: As was noted in late-June and early-July, rising odds of a GOP trifecta may be having some sway.

Strategy (39DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 110 p Short 114 c Long 115 c | 56% | +328.13 | -671.88 |

Short Strangle | Short 110 p Short 114 c | 64% | +796.88 | x |

Short Put Vertical | Long 109 p Short 110 p | 80% | +187.50 | -812.50 |

Symbol: Metals | Daily Change |

/GCZ4 | -0.41% |

/SIZ4 | -1.31% |

/HGZ4 | -2.25% |

A stronger U.S. dollar and higher U.S. Treasury yields, against the backdrop of no escalation between Israel and Iran over the weekend, may be why precious metals are lower today. Traders unloading their safe haven assets (bonds, precious metals and the Japanese Yen) are likewise selling their China-sensitive assets like copper (/HGZ4), which is the worst-performing metals future on the day.

Strategy (42DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2535 p Short 2550 p Short 2810 c Long 2835 c | 63% | +470 | -1030 |

Short Strangle | Short 2550 p Short 2810 c | 71% | +2960 | x |

Short Put Vertical | Long 2535 p Short 2550 p | 82% | +250 | -1250 |

Symbol: Energy | Daily Change |

/CLZ4 | -2.02% |

/HOZ4 | -2.18% |

/NGZ4 | -3.15% |

/RBZ4 | -2.06% |

No war, war trades removed. Another violent session is unfolding in energy markets as traders remain locked on the Middle East. Volatility is staying at exceptionally elevated levels, closing last week and starting this one with an IVR >100. Short-term coiling in crude oil (/CLZ4) suggests a breakout may soon transpire; although price remains near the exact midpoint of the 52-week trading range. Inventory data from API and the EIA over the coming days will give traders a better idea of how Hurricanes Helene and Milton impacted Gulf of Mexico flows.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 61 p Short 62 p Short 88 c Long 89 c | 63% | +260 | -740 |

Short Strangle | Short 62 p Short 88 c | 72% | +2670 | x |

Short Put Vertical | Long 61 p Short 62 p | 79% | +160 | -840 |

Symbol: FX | Daily Change |

/6AZ4 | -0.78% |

/6BZ4 | -0.3% |

/6CZ4 | -0.25% |

/6EZ4 | -0.28% |

/6JZ4 | -0.47% |

The Japanese yen (/6JZ4) is down across the board today as traders abandon their low-yielding safe haven plays put on ahead of a weekend fraught with geopolitical risk. Rising yields are doing /6JZ4 no favors, which has seen a consistent, steady decline in volatility over the past three weeks. For all intents and purposes, the market is behaving like the carry trade is coming back in vogue.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0064 p Short 0.0065 p Short 0.007 c Long 0.0071 c | 64% | +350 | -900 |

Short Strangle | Short 0.0065 p Short 0.007 c | 70% | +800 | x |

Short Put Vertical | Long 0.0064 p Short 0.0065 p | 83% | +187.50 | -1062.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.