S&P 500, Nasdaq 100 Near All-Time Highs Ahead of Inflation, FOMC

S&P 500, Nasdaq 100 Near All-Time Highs Ahead of Inflation, FOMC

Big tests ahead for the stock market include May U.S. inflation data and the June Federal Reserve interest rate decision on June 12

Both the S&P 500 and Nasdaq 100 saw fresh monthly, yearly, and all-time highs.

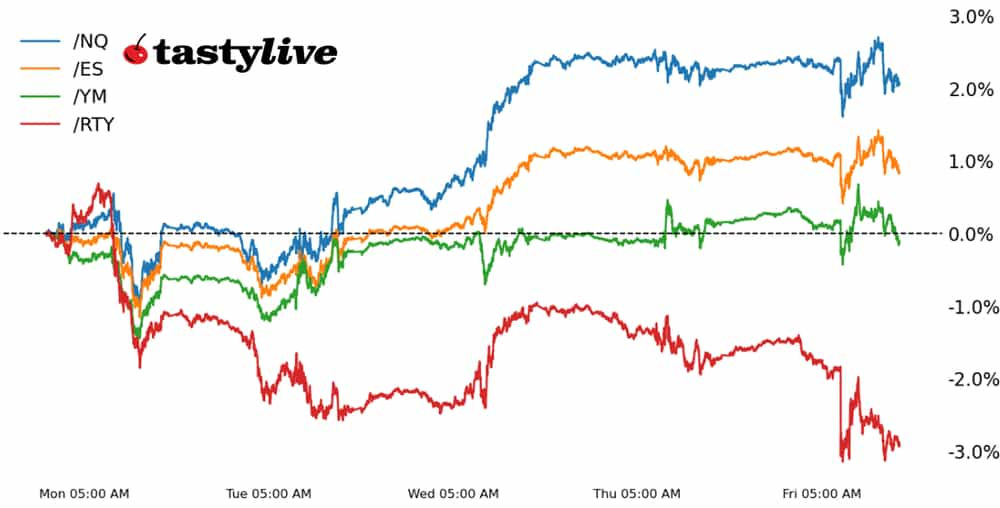

The jump in Treasury yields did no favors for the Russell 2000, however, which is on weaker technical footing heading into next week.

Now that the May U.S. jobs report is out of the way, attention turns to the May U.S. inflation report and Federal Reserve rate decision on June 12.

U.S. equity markets are off to a solid start in June, despite the sixth month of the year being a weak link in the chain of otherwise strong seasonal performance.

This week, with markets on tilt thanks to the latest episode of the GameStop (GME) rollercoaster, traders shrugged off mixed economic data that highlighted a normalizing, but still strong jobs market, with signs of wages staying firm and business activity accelerating.

The big tests are still ahead: the May U.S. inflation rate will be released on Wednesday morning, with the June Federal Reserve rate decision later that afternoon. As is often the case when the calendar stacks as such, traders tend to keep powder dry until the event risk subsides; Monday and Tuesday next week, absent another GME flareup, could very well be quiet.

If Wednesday, June 12 is a decisive day for markets, it's worth noting that equity indexes are offering diverging views. While both the S&P 500 (/ESM4) and Nasdaq 100 (/NQM4) hit fresh all-time highs earlier today, the Russell 2000 (/RTYM4) dipped into negative territory year-to-date.

Bulls and bears have setups to try and capitalize upon in the immediate future.

/ES S&P 500 price technical analysis: daily chart (October 2023 to June 2024)

The drop in the S&P 500 around the May U.S. jobs report saw prices decline into the area around 5333.50 before rebounding, former yearly highs established at the start of April.

Even though the daily candlestick is a doji, a sign of indecision, bulls remain in control after the failed attempt to drop below the former yearly low. Momentum has improved in recent days, with slow stochastics back into overbought territory and moving average convergence/divergence (MACD) issuing a bullish crossover.

For trend traders, the low volatility (IVR: 3.2) suggests that long at the money (ATM) call spreads is an appropriate way to express a bullish bias as long as the post-nonfarm payrolls report (NFP) low of 5329 holds; below, there is a case for a short-term top having been established.

/NQ Nasdaq 100 price technical analysis: daily chart (October 2023 to June 2024)

Like in S&P 500, the Nasdaq 100 has carved out a doji candle to close out the week, perhaps a sign of a breather after a solid >+2% gain to start June.

A breather makes sense contextually as well, with the pre-Federal Open Market Committee (FOMC) trading days usually producing lighter volumes. The measured move outside of the 17100-18700 range calls for a target of 20300, which could be achieved before the end of July without /NQM4 breaching the uptrend in place since the October 2023 low.

Relatively low volatility (IVR: 8.3) suggests that long ATM call spreads are an appropriate way to express a bullish bias.

/RTY Russell 2000 price technical analysis: daily chart (October 2023 to June 2024)

The Russell 2000 has been rangebound for the better part of the past six months, failing to scale above 2175 or below 1925 in any meaningful capacity.

Momentum is negative, perhaps pointing to a return to the rising trendline from the October 2023 and April 2024 lows near 2000 in the coming sessions. However, instead of taking a directional approach, trading around the range may be prudent: volatility is higher in /RTYM4 (IVR: 30.8) than in either /ESM4 or /NQM4, making short strangles or iron condors bracketed around the six-month range highs and lows an appropriate strategy in the near-term.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.