S&P 500 Points Higher Today as U.S. Yields and Oil Decline

S&P 500 Points Higher Today as U.S. Yields and Oil Decline

Also, 10-year T-note, gold, crude oil and Japanese yen futures

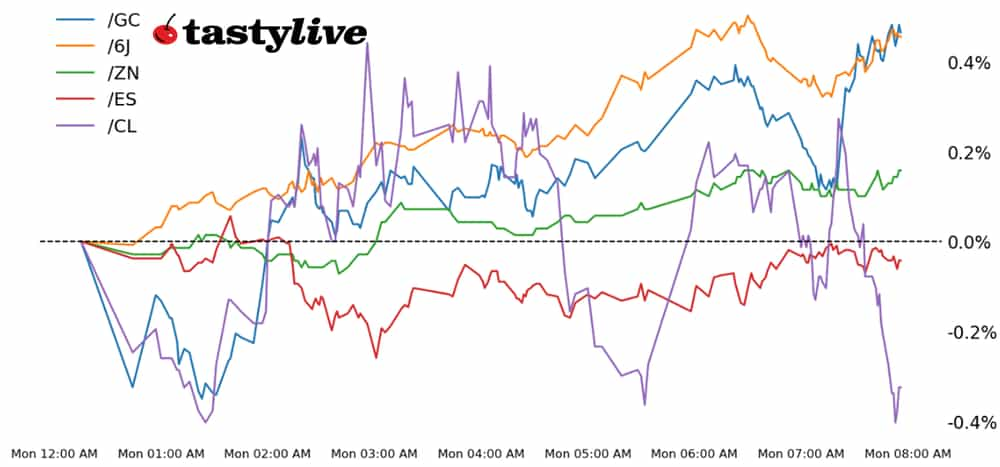

S&P 500 E-mini futures (/ES): +0.25%

10-year T-note futures (/ZN): +0.30%

Gold futures (/GC): +0.34%

Crude oil futures (/CL): -0.39%

Japanese yen futures (/6J): +0.28%

“Sell in May and go away” was once again nonsensical, but that doesn’t mean June is guaranteed to continue the resurgence in U.S. equity markets. That said, June is off to a solid start, with stocks and bonds both rallying at the beginning of a heavy macroeconomic week. Central banks in Europe and Canada will be in focus as the Federal Reserve is now in its communications blackout window. The June OPEC+ meetings this week could likewise break the recent paradigm in energy markets.

Symbol: Equities | Daily Change |

/ESM4 | +0.25% |

/NQM4 | +0.58% |

/RTYM4 | +1.22% |

/YMM4 | -0.01% |

U.S. markets are green this morning, with S&P 500 contracts (/ESM4) up 0.24% as technology shares blaze higher, led by Nvidia (NVDA). The chipmaker announced its next generation chips over the weekend and pledged to update its units every year. The move comes amid increasing competition as the race for artificial general intelligence heats up.

A Reddit (RDDT) post from Keith Gill (aka Roaring Kitty), the retail trader behind the meme stock frenzy of 2021, regarding a nine figure position in GameStop (GME), is fueling speculation across the retail investor space and helping to drive more bets on the stock—as well as many other single stocks that have a large short interest share of their outstanding float.

Strategy: (46DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5100 p Short 5125 p Short 5625 c Long 5650 c | 66% | +227.50 | -1022.50 |

Short Strangle | Short 5125 p Short 5625 c | 71% | +1587.50 | x |

Short Put Vertical | Long 5100 p Short 5125 p | 86% | +125 | -1125 |

Symbol: Bonds | Daily Change |

/ZTU4 | +0.06% |

/ZFU4 | +0.20% |

/ZNU4 | +0.30% |

/ZBU4 | +0.65% |

/UBU4 | +0.77% |

Treasuries advanced this morning following overnight gains in bond markets in the United Kingdom. The 10-year T-note futures contract (/ZNU4) advanced 0.30%, extending its gains from Thursday and Friday. This morning’s manufacturing data may influence yields if it nudges Fed interest rate cut bets. The Treasury is scheduled to auction 13- and 26-week bills today.

Strategy (53DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 106 p Short 106.5 Short 111.5 c Short 112 c | 65% | +125 | -375 |

Short Strangle | Short 106.5 Short 111.5 c | 71% | +468.75 | x |

Short Put Vertical | Long 106 p Short 106.5 | 91% | +62.50 | -437.50 |

Symbol: Metals | Daily Change |

/GCQ4 | +0.34% |

/SIN4 | +0.66% |

/HGN4 | +1.43% |

Gold futures (/GCQ4) bounced off a one-month low this morning, rising 0.34% as the Wall Street bell rang. Precious metals traders are mostly on the sideline ahead of an event-filled week that will help inform the outlook on the U.S. economy. If those data points support Fed rate cuts in 2024, we may see some upside in gold prices through the week. This morning’s manufacturing report will kick off the economic docket.

Strategy (52DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2200 p Short 2225 p Short 2475 c Long 2500 c | 68% | +570 | -1920 |

Short Strangle | Short 2225 p Short 2475 c | 73% | +2130 | x |

Short Put Vertical | Long 2200 p Short 2225 p | 88% | +250 | -2250 |

Symbol: Energy | Daily Change |

/CLN4 | -0.39% |

/HON4 | -0.25% |

/NGN4 | +6.38% |

/RBN4 | -0.24% |

Crude oil prices (/CLN4) dropped over 1% today despite a surprise extension of production cuts by OPEC+. The oil cartel decided to extend production cuts of nearly 4 million barrels per day (bpd) through 2025. The group will also extend voluntary production cuts of just over 2 million bpd by three months, through September of this year.

That wasn’t enough for oil markets, however. Global demand continues to trend below earlier targets, which has oil bulls worrying about the supply balance going forward through the second half of this year when many expect demand to drop further. GasBuddy’s Patrick De Haan said data showed Memorial Day fuel demand fell nearly 3% from a year ago at 8.867 million barrels per day (mbpd).

Strategy (44DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 68 p Short 69 p Short 83 c Long 84 c | 66% | +230 | -770 |

Short Strangle | Short 69 p Short 83 c | 72% | +1200 | x |

Short Put Vertical | Long 68 p Short 69 p | 84% | +130 | -870 |

Symbol: FX | Daily Change |

/6AU4 | +0.32% |

/6BU4 | +0.03% |

/6CU4 | +0.03% |

/6EU4 | +0.04% |

/6JU4 | +0.28% |

The multi-day decline in U.S. Treasury yields is continuing to weigh on the U.S. dollar, with the rates-sensitive Japanese yen (/6JU4) emerging as a leader this morning. The week is chock full of macro event risk, with the June Bank of Canada rate decision on Wednesday and the European Central Bank iteration on Thursday—not to mention May U.S. nonfarm payrolls on Friday.

Strategy (32DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.00635 p Short 0.00665 c Long 0.0067 c | 64% | +175 | -450 |

Short Strangle | Short 0.00635 p Short 0.00665 c | 70% | +450 | x |

Short Put Vertical | Long 0.0063 p Short 0.00635 p | 83% | +100 | -525 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.