S&P 500 Rallies and Yields Drop After November Jobs Beat Forecasts

S&P 500 Rallies and Yields Drop After November Jobs Beat Forecasts

Also, 10-year T-note, gold, crude oil and Australian dollar futures

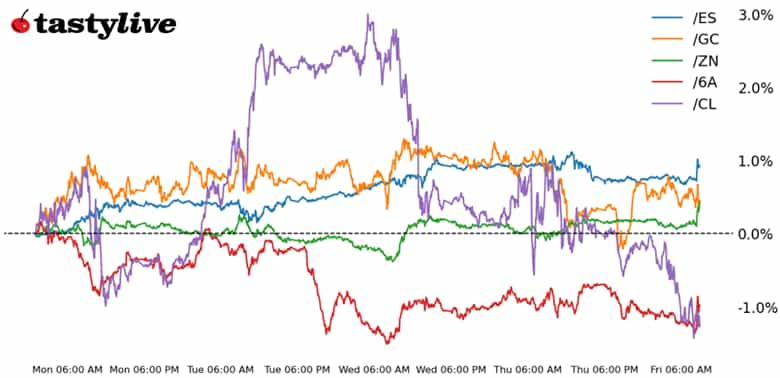

- S&P 500 E-mini futures (/ES): +0.12%

- 10-year T-note futures (/ZN): +0.31%

- Gold futures (/GC): +0.12%

- Crude oil futures (/CL): -1.02%

- Australian dollar futures (/6A): -0.5%

The November U.S. non-farm payrolls showed the economy added 227,000 jobs last month, comfortably above the 200,000 consensus forecast. But this report was always supposed to produce a strong headline number: the end of the Boeing strikes and recovery from Hurricanes Helene and Milton would give back jobs absent in October.

Noise within the headline jobs growth figure aside, the internals of the jobs report this morning offers a picture of a resilient if not moderating U.S. labor market. As expected, the U3 unemployment rose to 4.2% from 4.1%, and the household employment survey showed 355,000 fewer jobs. Wages surprised and came in at an increase of 0.4% month over month (m/m) and an increase of 4% year over year (y/y) vs. the expected increase of 0.3% m/m and 3.9% y/y. Notably, the Sahm Rule indicator, which suggests a recession has started once the unemployment rate rises by more than 0.5% relative to the minimum of the three-month averages from the previous 12 months, held steady at 0.43%; the recession condition triggered over the summer has now been untriggered the past two months.

Overall, data releases pertaining to 4Q ’24 offer a still-optimistic view of the U.S. economy, with Federal Reserve gross domestic product (GDP) trackers ranging from 1.81% (New York Fed Nowcast) to 3.3% (Atlanta Fed GDPNow). Accordingly, rates markets are pricing an 85% chance of a 25-basis-point (bps) cut in interest rates when the Fed meets Dec. 18.

Symbol: Equities | Daily Change |

/ESZ4 | +0.12% |

/NQZ4 | +0.11% |

/RTYZ4 | +0.77% |

/YMZ4 | +0.1% |

Good jobs data isn’t a reason for traders to stop the bull run in stocks. Both the S&P 500 (/ESZ4) and Nasdaq 100 (/NQZ4) are trading back near all-time highs amid sustained low trading volume and low volatility. A relatively light earnings calendar lies ahead next week, although Oracle (ORCL), Adobe (ADBE) and Broadcom (AVGO) releases next week will have the AI narrative squarely in focus.

Strategy: (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 5775 p Short 5825 p Short 6400 c Long 6450 c | 66% | +332.50 | -2167.50 |

Short Strangle | Short 5825 p Short 6400 c | 69% | +1425 | x |

Short Put Vertical | Long 5775 p Short 5825 p | 90% | +137.50 | -2362.50 |

Symbol: Bonds | Daily Change |

/ZTH5 | +0.11% |

/ZFH5 | +0.23% |

/ZNH5 | +0.31% |

/ZBH5 | +0.39% |

/UBH5 | +0.32% |

The internals of the jobs report were soft enough to convince traders the Federal Reserve will cut rates at its Dec. 18 meeting; odds of a 25bps rate cut have increased from 71% yesterday to 90.5% today. Treasuries are up across the curve, led higher by the long-end; volatility measures in both notes (/ZNH5) and bonds (/ZBH5) continue to plummet, with IVRs below 10 in each.

Strategy (49DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 108 p Short 109 p Short 114 c Long 115 c | 68% | +203.13 | -796.88 |

Short Strangle | Short 109 p Short 114 c | 72% | +421.88 | x |

Short Put Vertical | Long 108 p Short 109 p | 90% | +93.75 | -906.25 |

Symbol: Metals | Daily Change |

/GCG5 | +0.12% |

/SIH5 | +0.31% |

/HGH5 | +0.76% |

Lower yields and the increasing odds of a Fed rate cut in less than two weeks are helping the metals recover some ground—although gains have been fading since the release of the November jobs report. A week of choppy price action has changed little for any of gold (/GCG5), silver (/SIH5), or copper prices (/HGH5); technically, the outlooks remain unchanged.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 2525 p Short 2550 p Short 2750 c Long 2775 c | 61% | +820 | -1680 |

Short Strangle | Short 2550 p Short 2750 c | 70% | +3090 | x |

Short Put Vertical | Long 2525 p Short 2550 p | 83% | +410 | -2090 |

Symbol: Energy | Daily Change |

/CLF5 | -1.02% |

/HOF5 | -0.64% |

/NGF5 | -1.07% |

/RBF5 | -0.89% |

OPEC+ has announced it will delay production hikes until April 2025, and the UAE will delay its production hike by an additional three-months. When production increases resume, they’ill be spread over 18 months instead of 12. Superficially, these are bullish developments for crude oil prices (/CLF4). Realistically, OPEC+ sees the threat of increased supply from the U.S. under a second Trump term coupled with weak global demand for energy. The short-term technical trend in /CLF5 is beginning to turn more negative, with support in the recent seven-week trading range nearing.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 61 p Short 62 p Short 74 c Long 75 c | 62% | +270 | -730 |

Short Strangle | Short 62 p Short 74 c | 69% | +1310 | x |

Short Put Vertical | Long 61 p Short 62 p | 78% | +160 | -840 |

Symbol: FX | Daily Change |

/6AZ4 | -0.5% |

/6BZ4 | +0.11% |

/6CZ4 | -0.52% |

/6EZ4 | -0.03% |

/6JZ4 | +0.2% |

A mixed day for the U.S. dollar is overshadowing the significant underperformance in the commodity currencies in recent sessions. Both the Australian dollar (/6AZ4) and the Canadian dollar (/6CZ4) are down by more than 0.5% today, and both are holding near their lowest levels of the year; for both /6AZ4 and /6CZ4, these would be the lowest closes of 2024.

Strategy (63DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.61 p Short 0.62 p Short 0.66 c Long 0.67 c | 59% | +340 | -660 |

Short Strangle | Short 0.62 p Short 0.66 c | 66% | +680 | x |

Short Put Vertical | Long 0.61 p Short 0.62 p | 85% | +150 | -850 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive Inc. and tastytrade Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.