S&P 500 Struggling to Stage Rally Ahead of April Expiration

S&P 500 Struggling to Stage Rally Ahead of April Expiration

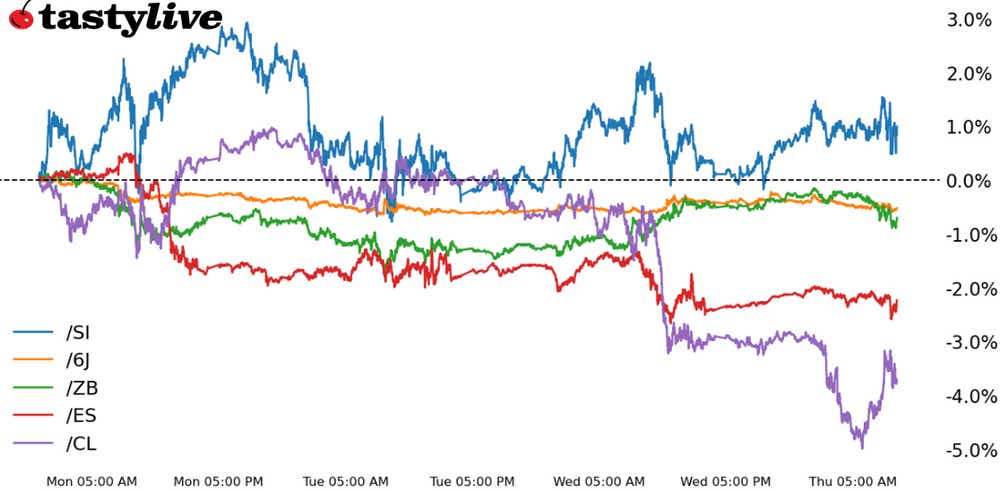

Also 30-year T-bond, silver, crude oil and Japanese yen futures

S&P 500 E-mini futures (/ES): +0.03%

30-year T-bond futures (/ZB): -0.38%

Silver futures (/SI): +0.40%

Crude oil futures (/CL): +0.12%

Japanese yen futures (/6J): -0.17%

April expiration is behind markets, but April options expiry has yet to pass. That leaves markets on soft footing today. A rebound in energy prices may be contributing to the turn lower in bonds, which had staged a rally around the 20-year bond auction yesterday.

Precious metals continue to march to their own beat, seemingly unbothered by the stronger U.S. dollar or higher yields. The calendar is packed with Federal Reserve speakers today and tomorrow as the communications blackout window ahead of the May 1 meeting begins on Saturday.

Symbol: Equities | Daily Change |

/ESM4 | +0.03% |

/NQM4 | -0.28% |

/RTYM4 | +0.26% |

/YMM4 | +0.49% |

U.S. equity markets rallied overnight but were sold at the open. Bulls are still putting up a modest defense after the S&P 500 (/ESM4) reached a critical sell-off threshold: It cut in half its year-to-date gains by falling more than 5% from its April high. Traders rallied stocks back over the course of the morning, although with options expiry looming tomorrow, any substantial “unclenching” may need to wait a few more days.

Strategy: (43DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 4750 p Short 4775 p Short 5375 c Long 5400 c | 66% | +250 | -1000 |

Short Strangle | Short 4775 p Short 5375 c | 71% | +1975 | x |

Short Put Vertical | Long 4750 p Short 4775 p | 86% | +150 | -1100 |

Symbol: Bonds | Daily Change |

/ZTM4 | -0.09% |

/ZFM4 | -0.20% |

/ZNM4 | -0.30% |

/ZBM4 | -0.38% |

/UBM4 | -0.41% |

Bonds have been sensitive to energy markets in recent weeks, selling off as crude oil prices (/CLM4) climbed to multi-year highs. But oil’s drop yesterday—eliminating all the gains this month—did not produce an unwind of the short Treasury trade (e.g. 30s (/ZBM4) and have not retraced all of their April losses.

Concern about fiscal trajectories and recent inflation data, coupled with the increasing likelihood the Federal Reserve may not cut interest rates in 2024, are proving to be a veritable albatrosses around the bond market’s proverbial neck. There are no noteworthy Treasury auctions today.

Strategy (36DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 109 p Short 110 p Short 119 c Long 120 c | 67% | +250 | -750 |

Short Strangle | Short 110 p Short 119 c | 72% | +812.50 | x |

Short Put Vertical | Long 109 p Short 110 p | 86% | +140.63 | -859.38 |

Symbol: Metals | Daily Change |

/GCM4 | +0.29% |

/SIK4 | +0.40% |

/HGK4 | +1.53% |

Bonds up, bonds down, oil up, oil down—precious metals do not care. Gold (/GCM4) and silver prices (/SIK4) are holding onto gains, pressing higher and on track to finish at fresh yearly closing highs. A reduction in geopolitical risk premia (see: oil) is not translating into a reduction in demand for metals.

More important, volatility may be high by recent standards (IVRs > 80), but a look at historical metals volatility shows there is still much more room for volatility to rise, making call selling a still-trepidatious endeavor.

Strategy (40DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 25.5 p Short 25.75 p Short 31.25 c Long 31.5 c | 65% | +300 | -950 |

Short Strangle | Short 25.75 p Short 31.25 c | 72% | +2680 | x |

Short Put Vertical | Long 25.5 p Short 25.75 p | 85% | +130 | -1120 |

Symbol: Energy | Daily Change |

/CLM4 | +0.12% |

/HOK4 | -0.92% |

/NGK4 | +3.27% |

/RBK4 | -0.55% |

Yesterday was crude oil’s (/CLM4) second worst day of 2024. Dropping 3.13%, it was outpaced only by the 3.73% loss on Jan. 8. It may be a signal traders are no longer concerned about an immediate escalation in the conflict between Israel and Iran.

Elsewhere, natural gas (/NGK4) is rallying for a second straight day; a double bottom on the daily chart may be forming. A break of the downtrend from the November 2023 and January 2024 highs would bring into focus a more significant bottoming effort for /NGK4.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 72 p Short 73 p Short 91 c Long 92 c | 63% | +270 | -730 |

Short Strangle | Short 73 p Short 91 c | 71% | +2000 | x |

Short Put Vertical | Long 72 p Short 73 p | 81% | +150 | -850 |

Symbol: FX | Daily Change |

/6AM4 | -0.08% |

/6BM4 | -0.05% |

/6CM4 | +0.05% |

/6EM4 | -0.19% |

/6JM4 | -0.17% |

The US. dollar is fighting back after yesterday’s losses, buffered by the uptick in U.S. Treasury yields. Just two days removed from its yearly high, the U.S. dollar continues to stampede over the Japanese yen (/6JM4), which is a mere 7-pips off of its 2024 (and multi-decade) low.

Otherwise, continued strength in metals may be helping insulate the Australian dollar (/6AM4) from a deeper setback today.

Strategy (50DTE, ATM) | Strikes | POP | Max Profit | Max Loss |

Iron Condor | Long 0.0063 p Short 0.00635 p Short 0.00675 c Long 0.0068 c | 63% | +150 | -475 |

Short Strangle | Short 0.00635 p Short 0.00675 c | 70% | +575 | x |

Short Put Vertical | Long 0.0063 p Short 0.00635 p | 84% | +87.50 | -537.50 |

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.