Stocks and the U.S. Dollar Face More Trouble Ahead on U.S. CPI and Sentiment Data: Macro Week Ahead

Stocks and the U.S. Dollar Face More Trouble Ahead on U.S. CPI and Sentiment Data: Macro Week Ahead

By:Ilya Spivak

Stocks face deeper losses as recession fears continue to preoccupy the markets.

- U.S. CPI data is unlikely to cheer the markets despite cooling inflation.

- The Canadian dollar may rise if the BOC holds back on dovish signaling.

- Stock markets face deeper losses if U.S. consumer confidence unravels.

Stock markets continued to bleed out last week as recession fears kept swirling. Treasury yields managed a meager uptick but the broader trend lower since the beginning of the year remained firmly intact. Crude oil prices fell amid cooling demand expectations while gold idled in familiar territory.

The U.S. dollar traded broadly lower against its major counterparts. The euro saw outsized support, adding a meaty 4.6% against the greenback as Eurozone bond yields surged amid speculation about a large-scale military buildout ahead. That sharply shifted interest rate spreads in favor of the single currency.

Against this backdrop, here are the key macro waypoints to consider in the days ahead.

U.S. consumer price index (CPI) data

Inflation is expected to have cooled in the U.S. last month. The headline rate is seen ticking down to 2.9% year-on-year, returning to December’s setting after edging up to 3.0% in January. Similarly, the core rate excluding volatile food and energy prices is seen coming back to 3.2% from 3.3%.

Citigroup analytics warn that U.S. economic news-flow has increasingly disappointed relative to baseline forecasts recently, which may tilt surprise risk in favor of another miss. That is unlikely to be encouraging for markets consumed with recession fears. They might see a soft result as reinforcing growth fears, which may hurt stocks further.

A lack of urgency on interest rate cuts at the Federal Reserve might mean that downbeat CPI results dial up speculation about harder-hitting stimulus further ahead. This could push Treasury bonds higher as yields come down. The U.S. dollar may weaken as interest rate differentials turn further against the currency.

.png?format=pjpg&auto=webp&quality=50&width=762&disable=upscale)

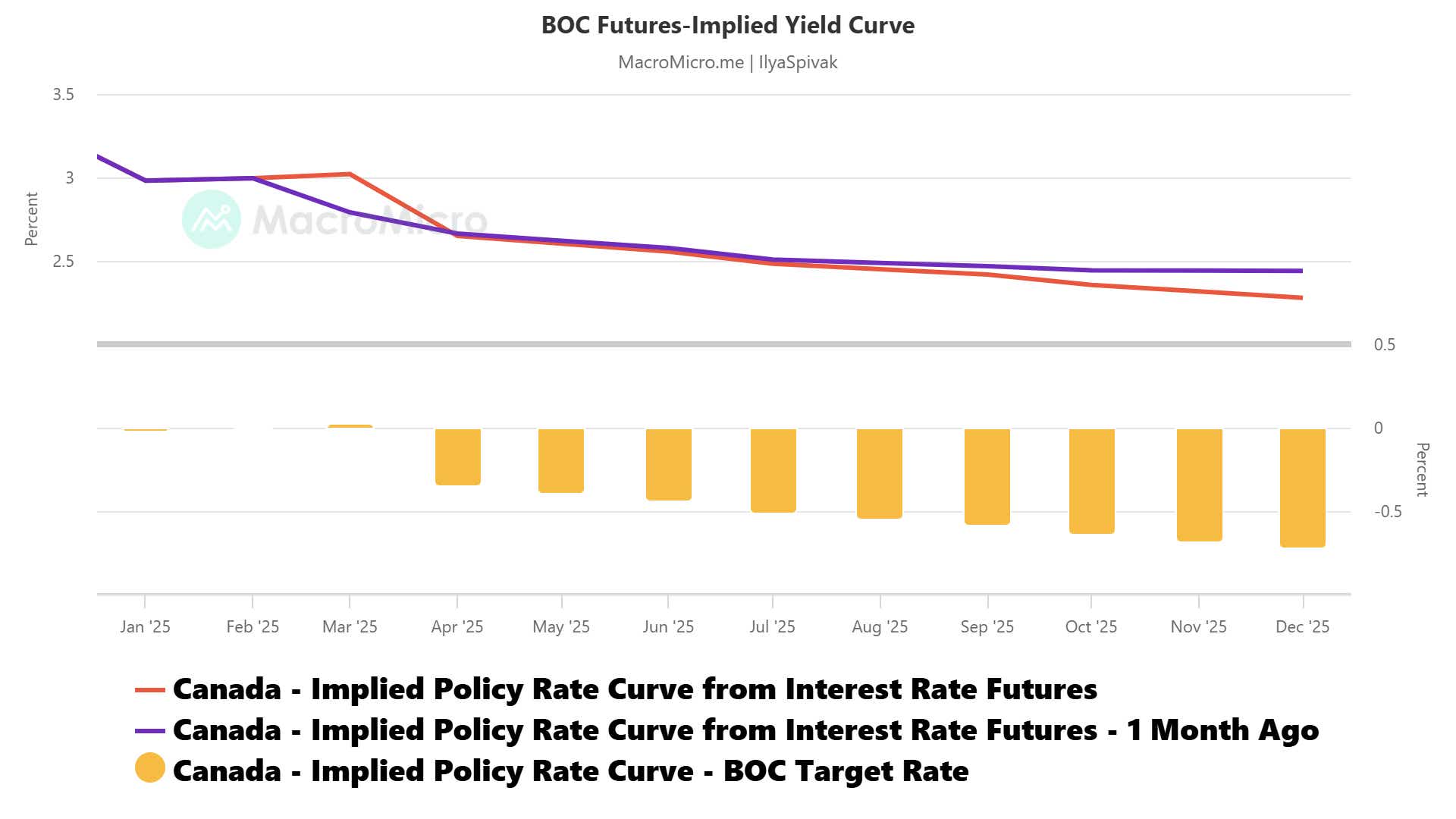

Bank of Canada (BOC) monetary policy meeting

Canada’s central bank is widely expected to lower its target interest rate by another 25 basis points (bps), arriving at 2.75%. The larger question for the markets will be whether officials are prepared to dial up stimulus expectations further as the economy remains in the doldrums. As it stands, the markets have priced 72bps in cuts for this year.

Inflation has settled near the 2% year-on-year mark. Leading purchasing managers index (PMI) data still points to contracting economic activity, but the pace of deterioration may be anchoring. Citigroup data suggests Canadian economic news has improved relative to median forecasts over recent weeks.

This might mean that the BOC resists more dovish posturing for now. The proximity of a general election now that Mark Carney has taken over as Prime Minister may be another reason to move slowly. Carney will face Pierre Poilievre to defend his new job in the coming months. On balance, this may help lift the Canadian dollar.

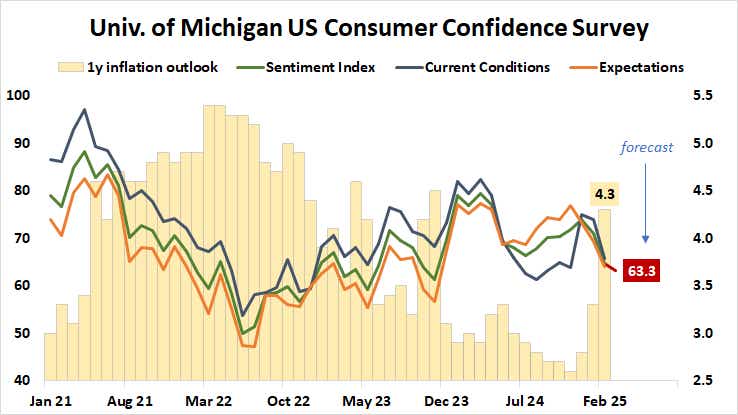

University of Michigan (UofM) consumer confidence data

February brought a sharp decline in U.S. consumer sentiment as uncertainty about tariffs and other elements of fiscal policy pushed one-year inflation expectations sharply higher. Survey respondents polled by the University of Michigan (UofM) were the gloomiest since November 2023 as the one-year price growth outlook jumped to 4.3%.

More of the same is expected as preliminary figures for this month cross the wires. Economists are penciling in a move down to 63.3 on the headline sentiment index, a new 16-month low. Household consumption accounts for close to 70% of overall U.S. gross domestic product (GDP) growth. If the mood darkens, recession fears are likely to build.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.