Stocks After Trump Greenland Drama: Will PMI Data Cap Gains?

Stocks After Trump Greenland Drama: Will PMI Data Cap Gains?

By:Ilya Spivak

Stock markets steadied as the drama over Greenland ebbed, but PMI data now threatens their Fed rate cut hopes.

- Wall Street turned higher after President Trump backed off owning Greenland

- US PCE inflation data dismissed by markets even as Fed rate cut bets inch down

- S&P Global PMIs are next in focus. Upbeat results may threaten risk appetite

Stock markets in the United States pushed higher after President Doland Trump walked back his demands for ownership of Greenland. Since the start of his second term last year, Trump has loudly argued that the US needs to take over the semi-autonomous Danish territory on national security grounds, as a regional military staging area.

First, the president ruled out the use of force in acquiring Greenland while speaking at the annual gathering of the World Economic Forum (WEF) in Davos, Switzerland. A post on his Truth Social platform followed, announcing that a “framework” for expanded access to Greenland – where the US already has a miliary base – was agreed following a meeting with NATO Secretary General Mark Rutte.

Mr. Trump roiled markets when he threatened to hit several European countries including the United Kingdom and France with an additional 10% tariff starting on February 1 after they beefed up their miliary presence in Greenland. That came after the president escalated public demands for the territory and pointedly did not rule out using force.

Stocks rise after Trump’s Greenland U-turn, ignore PCE data

This bombshell sent Wall Street sharply lower as markets reopened from a three-day holiday weekend marked by Martin Luther King Jr Day. The bellwether S&P 500 index gapped lower and sank, losing 2.11% by the end of the day. That was the biggest drop since October 10, when Trump threatened China with tariffs over rare earths shipments.

That dust-up ended with inaction as US and Chinese officials rushed to cool tensions. The markets cheered as Mr. Trump walked back his latest tariff menace at Davos. The S&P 500 has now recovered nearly all of its initial losses and trades down just 0.4% for the week, having lost as much 2.33% amid the worst of early selling.

Catch-up publication of US personal consumption expenditure (PCE) inflation data for October and November derailed by last year’s record-setting 43-day government shutdown passed without incident. The figures showed that headline and core price growth – which excludes volatile food and energy costs – rose to 2.8% year-on-year as expected.

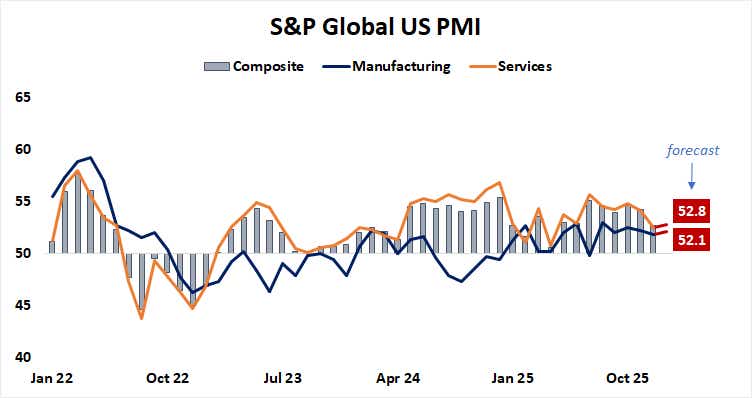

Perhaps these figures were judged to be too stale by the markets, which have already seen analog consumer price index (CPI) inflation data for December and concluded it was good enough. A timelier set of figures may generate stronger interest as traders look ahead to January’s S&P Global purchasing managers index (PMI) survey.

Fed rate cuts back in focus as key PMI data looms ahead

These are expected to show that US economic activity growth steadied in January after cooling to an eight-month low in the prior month. Improvements are penciled in for both manufacturing and the service sector. The data follows explosively strong December PMI figures from the Institute for Supply Management (ISM) and an upbeat third-quarter gross domestic product (GDP) reading.

Whether the markets embrace such results might depend more on their implications for Federal Reserve interest rate cuts than their promise of economic strength, however. Markets have begrudgingly clawed lowered expectations. They are now pricing in 42 basis points (bps) in cuts this year, making for the least dovish setting since May.

Nevertheless, that still puts traders in favor of two cuts this year, with the first one fully discounted and the probability of a second one at a commanding 68%. This clashes with the Fed’s own prognostications, which have called for a single 25bps reduction this year.

PMI data that forces markets to inch closer to the Fed’s view may disappoint traders, which are already annoyed with the US central bank’s reticence to dial up stimulus. They seem to be wanting a backstop of cheaper money amid precisely the kind of policy uncertainty on display vis-à-vis Greenland, however healthy the US economy appears to be.

Ilya Spivak, tastylive head of global macro, has over 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive.com or @tastyliveshow on YouTube

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices