Trading Higher for Longer

Trading Higher for Longer

The Federal Reserve held its main rate at 5.25-5.5%, as expected

- The Federal Reserve held its main rate at 5.25-5.5%, as expected.

- Is another rate hike guaranteed? Not necessarily, though the FOMC is still penciling one in.

- As anticipated, markets haven’t seen a meaningful reason to breakout one way or the other.

The Federal Reserve surprised no one today when it left its main rate on hold at 5.25% to 5.5%. As many Federal Open Market Committee (FOMC) officials have suggested in recent months, including Fed Chair Jerome Powell, any further monetary policy tightening is entirely data dependent. In other words, it is still too soon to officially announce that the rate-hike cycle is finished.

A stronger U.S. economy through the summer months, a resilient U.S. labor market, and stickier inflation provoked hawkish upgrades to the FOMC’s Summary of Economic Projections. Even though the United Auto Workers (UAW) strikes and a potential federal government shutdown could weigh on economic activity in the coming weeks, the Fed believes that a prolonged period of interest rates staying high(er) for longer is necessary. The year-end main rate was projected at 5.625% as it was in June; but the year-end 2024 main rate was revised higher to 5.125% from 4.625%, indicating that two rate cuts were eliminated for next year.

In a sense, little has changed for the Fed, and thus, little has changed in our expectations either. The Fed took a serious hit to its credibility with talk of “transitory” inflation in 2021 and early-2022, so it's likely that the Fed keeps rates higher for a sustained period. Or, as we said after the July FOMC meeting, “generals are always fighting the last war.”

Markets continue napping

Even so, these aren’t meaningful reasons for markets to wake up from their summer slumber: U.S. equity markets have traded within the expected moves as discounted by the options market ahead of the meeting, nor has the bond market moved to exit inversion territory.

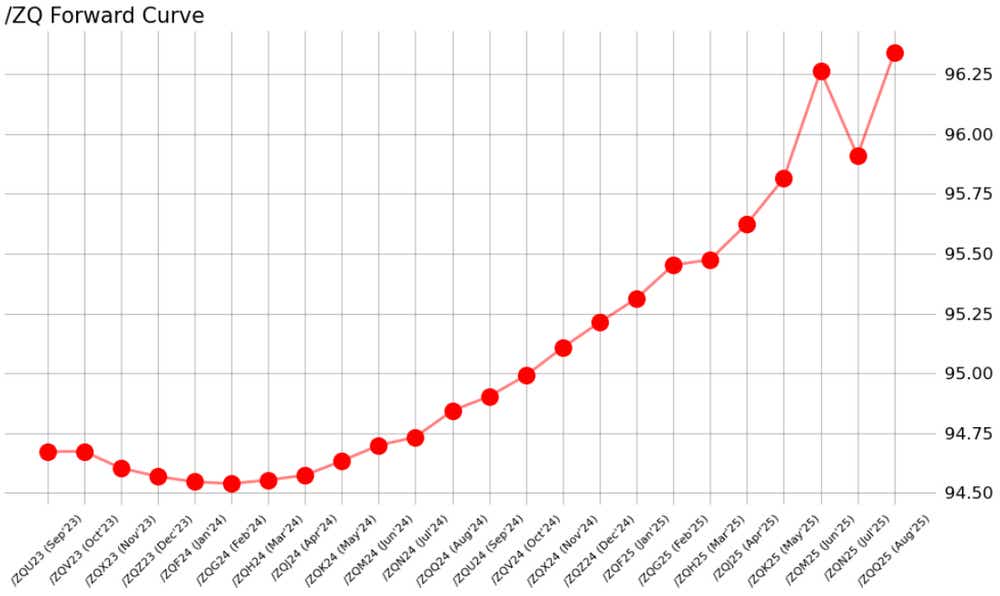

/ZQ Fed funds futures forward curve (September 2023 to August 2025)

The /ZQ (Fed funds) term structure shows an expectation that the Fed may not raise rates again this year: there is just under a 50-50 chance that another hike is delivered before the end of the year. The next FOMC meeting doesn’t arrive until November 1, so there is a lot of time for the data landscape to evolve, and thus change the minds and hearts of traders.

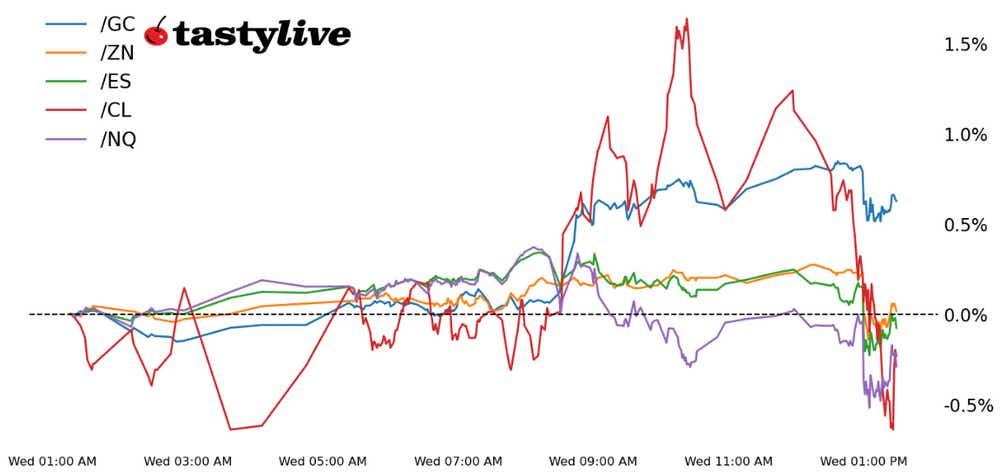

On today’s Futures Power Hour, we asked “if the Fed holds, do markets make a sound?” The answer is “no, not really,” even as U.S. equity markets and U.S. Treasury bonds weakened around the announcement.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices