Stocks in Trouble if PMI Data Hints Fed Rate Cuts Are Too Late

Stocks in Trouble if PMI Data Hints Fed Rate Cuts Are Too Late

By:Ilya Spivak

Officials at the Fed have reiterated that bringing inflation back down to 2% will demand a slowdown

Fear of recession was at the heart of market turmoil in July and early August.

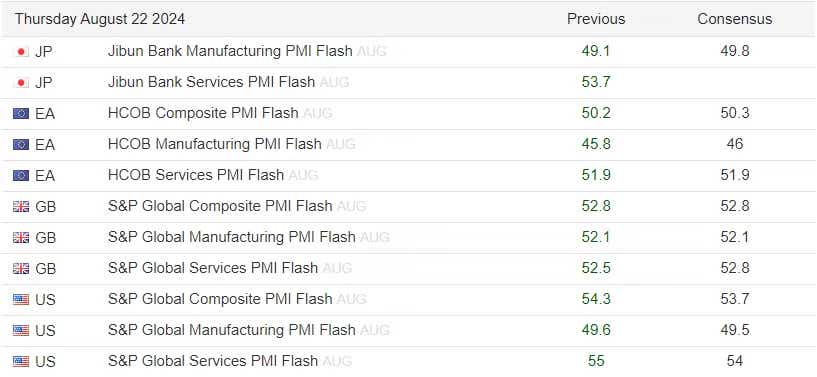

Incoming PMI data may signal global growth will slow for a third month.

Stocks may fall if Fed rate cuts seem to come too late to avoid a deep downturn.

Recession worries gripped financial markets in the second half of July and the first week of August. Much ink has been spilled blaming Japan and the now almost mythical-sounding “unwind of the carry trade,” but this is misleading. Yen-funded carry traders are typically unwound when risk appetite fizzles. It is a symptom, not a cause.

The real culprit is the Federal Reserve, and the real fear comes from the implications of what it seems to be saying. Since mid-2021, the U.S. central bank has firmly asserted a single-minded focus on battling inflation. Fed Chair Jerome Powell changed the tune in July, signaling that too-high unemployment is now a risk on par with sticky prices.

Put simply, this means a rapid rate hike cycle and the waning influence of fiscal largesse from the fight against COVID-19 have combined to put the brakes on the economy. That much was always in the cards: For nearly three years, Fed officials have tirelessly reiterated that bringing inflation back down to 2% will demand a slowdown.

Markets are saying the Fed is late on rate cuts

That this would be a benign affair—a gradual “letting the air out” of an economy bloated by the pandemic’s many aftershocks, the proverbial “soft landing”—has underpinned risk-taking by investors for almost a year. In this scenario, the Fed would only cut rates as a form of maintenance to keep credit costs steady as inflation expectations ease.

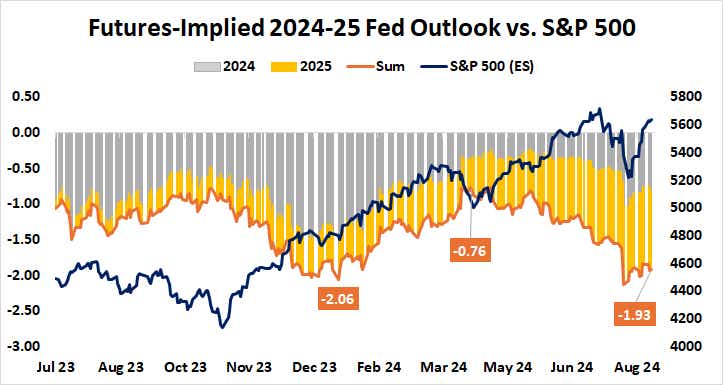

The central bank might still pull off this trick, but traders have grown suspicious. As Fed officials bemoaned the slow pace of disinflation in the first half of the year, the markets seemingly reckoned that their reticence to cut has already put them behind the curve. Seeing rates “higher for longer” in 2024 triggered repricing for sharp catch-up cuts in 2025.

Against this backdrop, last month’s pivot in Fed guidance was understandably interpreted to mean even the inflation-fearing U.S. central bank has perceived something worrying about growth trends, developing a sense of urgency about reducing interest rates. Recession fears rapidly swelled with every soft data point that followed.

In large part, this is because the U.S. economy has been a pillar of resilience amid an otherwise troubled backdrop for the other major engines of global demand. Eurozone economic activity growth has regressed to near-standstill after a shallow rebound from an almost-recessionary slowdown late last year. China has been moribund for over a year.

Stocks at risk if PMI data shows third month of global slowdown

That makes the incoming set of August purchasing managers’ index (PMI) data an important input, especially while markets await the next key update from the Fed when Powell speaks at the Jackson Hole Symposium this week. This will help traders get a sense of global growth trends, calibrating how urgent the need for stimulus appears.

July marked the second consecutive month of slowdown for growth in the global manufacturing and service sectors. Analytics from Citigroup warn that worldwide economic data outcomes have increasingly disappointed relative to baseline forecasts since mid-April, suggesting August may mark another step in the wrong direction.

This might turn up the volume on calls for Fed support as worries about a global downturn spread anew. Minutes from July’s meeting of the rate-setting Federal Open Market Committee (FOMC) suggest officials are inclined to oblige in September. However, stock markets may swoon if the PMIs hint that this might be too little and too late.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.