Weekly Market Observations: Jobs Report, Volatility, and Energy

Weekly Market Observations: Jobs Report, Volatility, and Energy

By:Ryan Grace

When taking a look at recent top performers in the energy sector, we see Devon Energy (DVN), Baker Hughes (BKR), and Marathon Petroleum (MPC) all leading the pack with gains over 10% in the past month.

Maybe Inflation Doesn’t Matter…

Jerome Powell threaded the needle during his opening remarks at the Fed’s Jackson Hole economic summit last week, reiterating the central bank’s view that inflation is mostly transitory, while providing no clear timeline for when the Fed will taper its $120 billion of monthly bond purchases. (It could be by the end of this year.) Instead, the Fed has emphasized its focus on the on-going labor market recovery. Which in my view, has always been the real barometer for when we might see a policy shift.

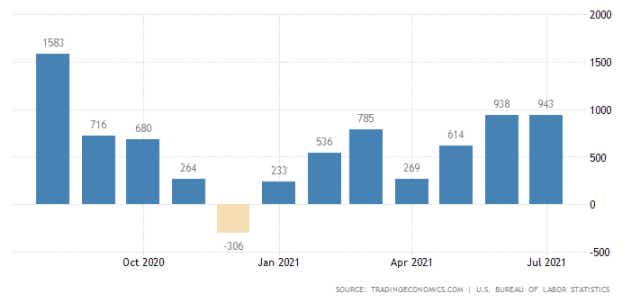

So again, all eyes are now on this week's jobs report. A better than expected number Friday (9-3), could shift the dovish narrative and lead to a bout of volatility across assets. As we wait with bated breath, the consensus view is for the U.S. to have added around 650K jobs in the month of August, against 943K jobs added in July.

The labor market is recovering, albeit slower than expected, as we’ve seen the pace of jobs added increase m/m from 278K in April 21 to 943K as of most recently. Additionally, with jobs coming in better than expected over the past two months, even in the face of resurgent COVID cases, there’s the potential for a print above the elusive 1 million level. Should this happen, Jerome and company might start thinking differently.

U.S. Non-Farm Payrolls

Speaking of Volatility…

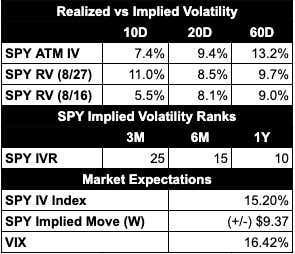

Realized vol in the S&P 500 has started to pick itself up off the mat after collapsing throughout most of August.

Don’t let the lack of both real and implied volatility fool you into thinking there’s no risk in this market, as we’re starting to come off of realized volatility levels that have historically been cycle lows. Check out the table below for a bit more context around these volatility levels and market expectations for the week.

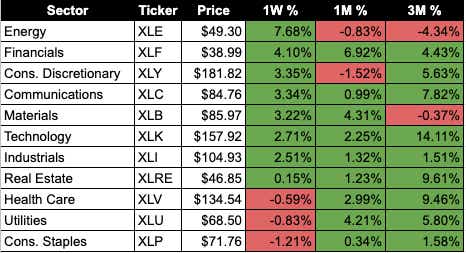

Sector Performance: Can energy catch up?

Finally, will energy stocks catch up to this week’s 5% rip in RUT and new all-time highs in SPX and NDX?

We ended the week with an almost 1% drop in the dollar index, while oil bounced 11% and natural gas jumped by 14%. Should the energy market look past this recent COVID related growth scare, there could be opportunities within the energy sector, which has significantly lagged the rest of the market on both a 1-month and 3-month basis. Below we’ve included a sector performance update as well as where we're seeing bullish momentum among some of the top performing companies in the XLE ETF.

Energy Sector ETF Top Bullish Momentum

When taking a look at recent top performers in the energy sector, we see Devon Energy (DVN), Baker Hughes (BKR), and Marathon Petroleum (MPC) all leading the pack with gains over 10% in the past month.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices