Stock Markets Are at Risk if Fed Chair Powell Dithers on Rate Cuts

Stock Markets Are at Risk if Fed Chair Powell Dithers on Rate Cuts

By:Ilya Spivak

How much pain must the US economy endure to bring the Fed in off the sidelines?

- May global PMI surveys reveal an economic slump in Europe and Japan.

- US PMI signal a pickup, but only thanks to short-term tariff frontrunning.

- All eyes on Fed Chair Powell for clues about when the Fed might step in.

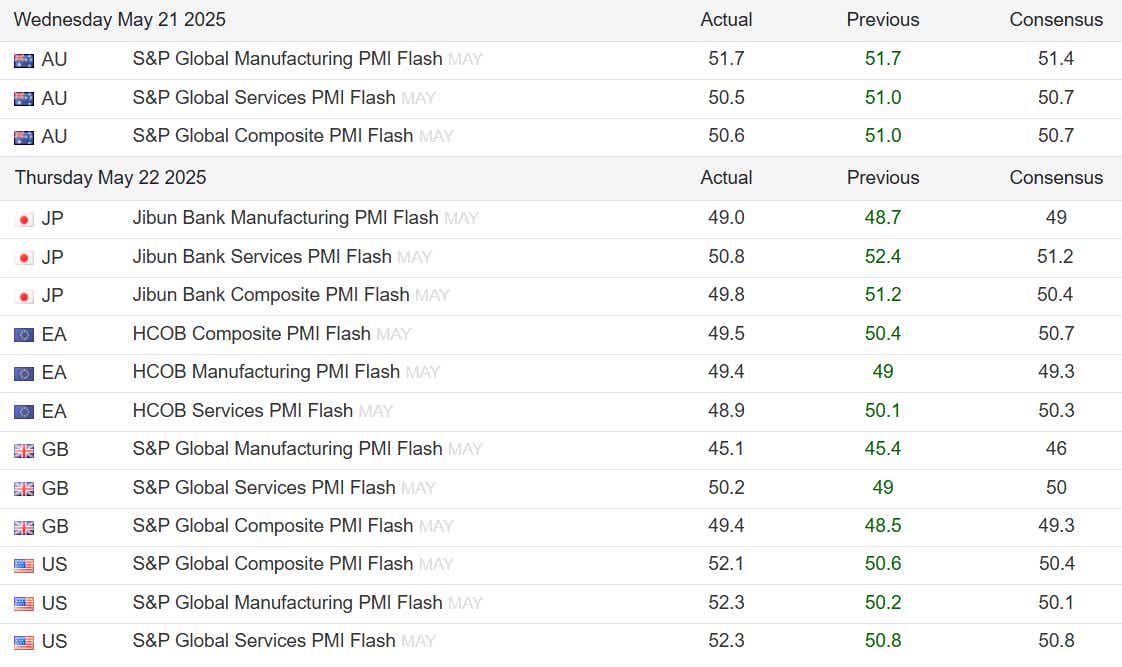

The US economy showed some welcome signs of life in May, according to the latest update of purchasing managers index (PMI) data from S&P Global. The pace of economic activity growth quickened after sinking to a 19-month low in April. Acceleration came to the manufacturing sector and services alike

This marked a sharp contrast with analog PMI results tracking performance in other major economies. Japan, the UK, and the Eurozone saw activity contract. In the single currency bloc, the service sector posted the sharpest decline since January 2024. In Australia, growth slowed to near-standstill.

Global markets seesaw as Europe, Japan, and US PMIs diverge

The data’s impact was readily on display in the markets. Stocks fell in Europe after the region’s PMI results hit the wires, then rebounded alongside Wall Street after the US survey appeared a few hours later. The euro followed a similar cadence, taking a step lower on its PMI release, then pausing to digest before slipping again on the US one.

Recent economic data has produced unwelcome early warning signs pointing to stagflation, a policymaking nightmare where price growth is accelerating while economic growth is cooling. That forces officials to reconcile conflicting objectives, which can bog down stimulus and translate into long-lasting economic weakness.

At first glance, May’s US PMI report appears to mark a welcome reprieve. Anemic conditions in Europe and China have weighed on global growth since the middle of last year. A strong US economy powered by a buoyant service sector helped keep recession fears at bay until the start of 2025. Growth has slowed sharply and almost stalled last month.

US tariff front-running has delayed “stagflation” forces

Looking past the headline figures to the underlying data is a sobering affair, however. Inventories surged by the most since data began to be collected 18 years ago, pointing to spirited front-running ahead of the new reciprocal tariff cliffhanger when a 90-day reprieve on rates above 10% expires.

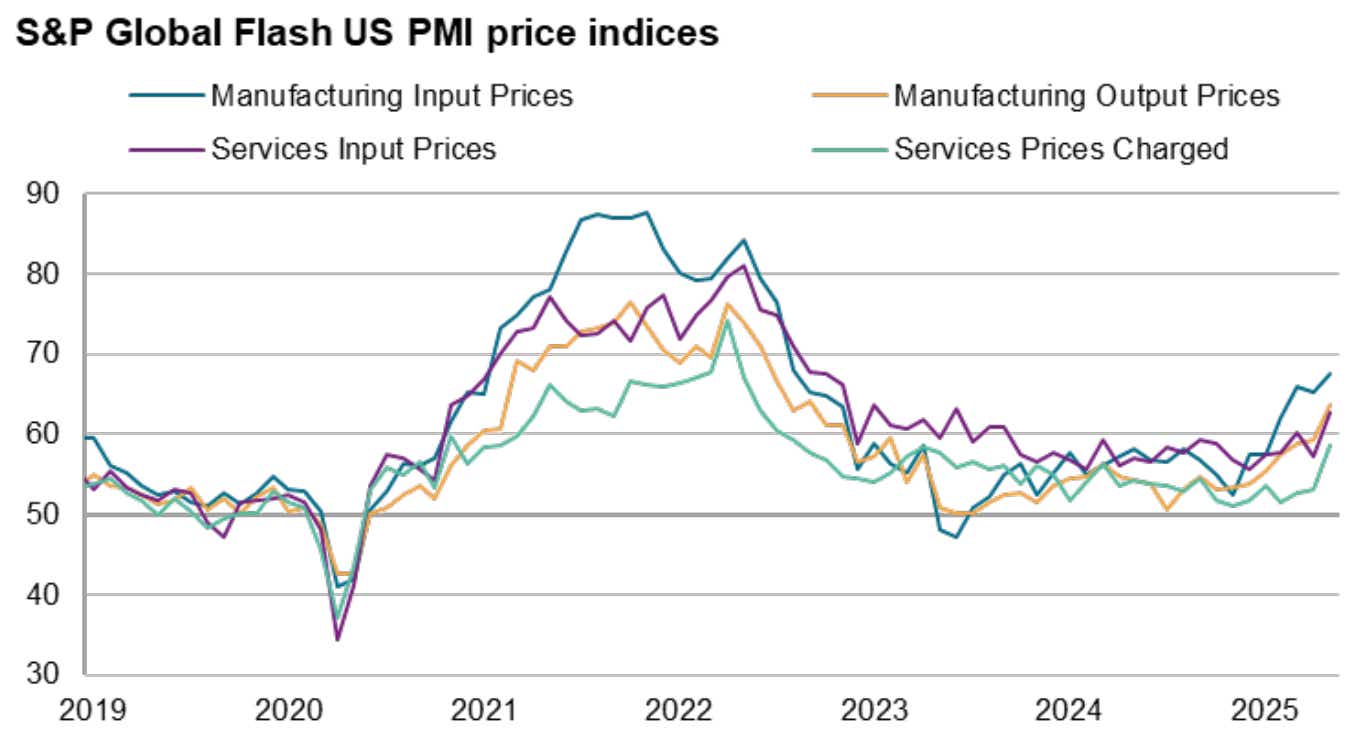

Bottlenecks became more acute along supply chains as delivery times lengthened to the greatest extent since October 2022. This alongside the stockpiling rush fueled sharply higher prices. Average costs jumped at a rate unseen since August 2022, when the inflationary spike after the COVID-19 pandemic was still near its peak.

All this amounts to a worrying backdrop. Restocking is a short-term impetus for growth. Indeed, US manufacturers and service providers both cut employment, signaling reticence about extrapolating demand into the future. Moreover, it may leave firms holding the bag if gloomy consumers are slow to draw down inventories as spending slows.

Will Fed Chair Powell offer a lifeline to the markets?

As much has already shown up in key economic statistics. The first quarter produced the weakest consumption growth in almost two years. The second quarter is on track for another poor showing. Last week’s data flow pointed to anemic retail sales and sinking sentiment even as businesses shielded consumers from tariff-related costs.

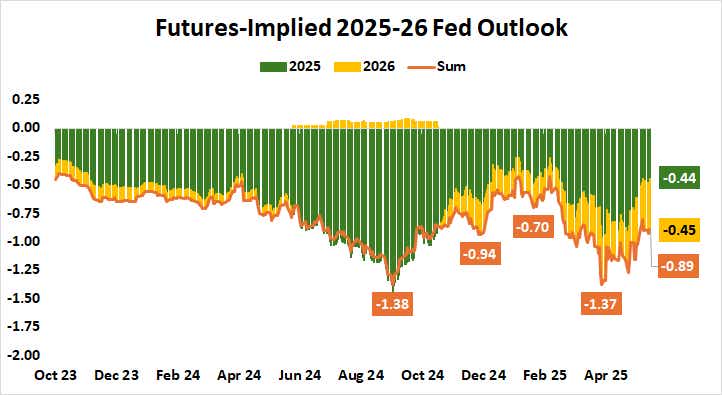

With this in mind, the spotlight turns toward a weekend speech from Federal Reserve Chair Jerome Powell. The central bank seems to have no clearer picture of which side of its mandate to prioritize than it’s had since March, when it began to highlight the tariff-induced conflict between higher prices and weaker growth as a reason to stay put.

More of the same might signal to the markets that the central bank will be slow to respond to whatever economic weakness emerges after the tariff front-run window closes, waiting for the drop in demand to appear as disinflation before acting. This may put pressure on stocks and the dollar even as it bids up longer-dated Treasury bonds.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices