Learn the Basics of Gamma Scalping Options Strategies

Learn the Basics of Gamma Scalping Options Strategies

In a recent blog post we discussed some P/L ramifications of trading delta neutral. Today, we are expanding on this concept through an introduction to gamma scalping.

Volatility trading strategies that embrace a "delta neutral" philosophy seek to remove directional bias from the portfolio in favor of isolating the volatility component of theoretical edge.

In practical terms, this equates to removing a portion of the directional risk stemming from options positions. For example, if a trader buys a call because he/she thinks premium is cheap, he/she would then hedge off some of the directional risk by selling stock short against the calls.

Now, take a step back and consider a large portfolio that has philosophically incorporated a delta neutral approach. As stock prices in the portfolio fluctuate over time, positions will occasionally require adjustments in order to remain "delta neutral."

A systematic approach to these adjustments is exactly what volatility traders are referring to when they talk about "gamma scalping" or "gamma hedging." In this regard, gamma scalping/hedging is not a standalone strategy - rather, it is layered upon a volatility strategy.

To be clear, there are traders that employ "scalping" as a standalone strategy in the market - those that attempt to make small profits on fluctuations in market prices. However, scalping gamma is different, and is anchored around delta adjustments to an existing options portfolio.

“Scalping" and "hedging" are both terms that accurately describe the gamma adjustment strategy due to the dual mandate that exists when deploying this approach - profit and risk.

Gamma Scalping/Hedging Framework

Imagine a large volatility portfolio composed of both long and short premium positions. Long premium positions generally want the underlying to move quite a bit, while short premium positions generally want the underlying to sit still.

Said in a different way, the risk of a long premium position is that it doesn’t move, while the risk of a short premium position is that it makes a big move in the wrong direction. The gamma adjustment strategy works to help reduce these risks.

For example, by scalping movement out of a long premium position, the gamma scalping can help provide income that covers theta expenses related to the position. Along those lines, gamma hedging related to short premium positions can help reduce directional exposure if the underlying security moves against you.

Both of these ends are met through the continuous maintenance of delta-neutrality.

The main reason this type of system is known as “gamma scalping” is because the gamma dimension of the options position dictates the nature of the delta adjustment.

Positive Gamma

When purchasing options, the gamma of the overall position will be positive. Consequently, as the underlying stock rises, positive gamma positions get longer delta. As the underlying stock drops, positive gamma positions get shorter delta.

Negative Gamma

The opposite is true of negative gamma (aka “short gamma”) positions. As the underlying stock rises, short gamma positions get shorter delta. As the underlying stock drops, short gamma positions get longer delta.

Gamma Adjustment

The following points help summarize how a scalping overlay works, based on the gamma of the position, the direction of the underlying, and the associated adjustment.

Short Gamma Position

When you are looking to get short gamma, then you would consider making the following gamma adjustments to your portfolio:

Underlying stock rises: position gets shorter delta (adjustment: buy stock)

Underlying stock drops: position gets longer delta (adjustment: sell stock)

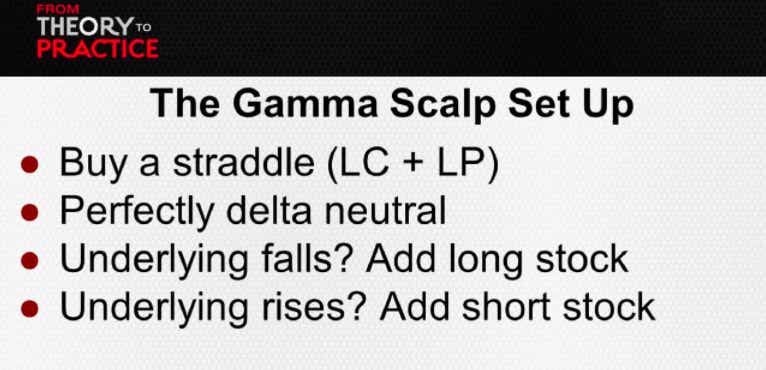

Long Gamma Position

When you are looking to get long gamma, then you would consider making the following gamma adjustments to your portfolio:

Underlying stock rises: position gets longer delta (adjustment: sell stock)

Underlying stock drops: position gets shorter delta (adjustment: buy stock)

Long premium adjustments are often referred to as "long gamma scalps,” while short premium adjustments are often called "short gamma scalps” (or “reverse gamma scalps). In all cases the purpose of the adjustment is to get closer to delta neutral.

Gamma Scalping Example

Looking more closely at the detailed mechanics of scalping requires a brief review of “the Greeks.”

As a reminder, the Greeks are parameters that measure the sensitivity of an option’s price to changes in external factors like: underlying stock price, implied volatility, time, and interest rates.

As it relates to gamma scalping, we are mostly interested in two Greeks - delta and gamma. These parameters provide first and second-level insight into how an option’s value will change based on movement in the underlying stock.

Delta tells us how much an option’s value will change given a $1 move in the underlying. Gamma, on the other hand, provides insight into how much an option’s delta will change given a $1 move in the underlying.

To reinforce these concepts, let’s move on to a practical gamma scalping example.

Consider stock XYZ which is trading $20/share and has listed options. Additionally, the front-month $22 strike call of XYZ has a mid-market price of $0.50.

For the purposes of this example, let’s say the delta of that $22 strike call is 0.25. That means that for every dollar move in the underlying, the value of the $22 strike call will change by $0.25.

If you purchase the $22 strike call for $0.50 and stock XYZ opens trading $21.00/share the next day (up a dollar), that means your $22 strike call is now worth $0.75 ($0.50 + $0.25 = $0.75). If XYZ were to open $19.00/share (down a dollar), then your $22.00 strike call would only be worth $0.25 ($0.50 - $0.25 = $0.25).

The next step is to visualize how the gamma of the option affects the delta as the underlying stock moves.

Like delta, gamma is expressed as a numeric value between 0 and 1.0. So in the earlier example, XYZ stock is trading $20/share, the $22 strike call is worth $0.50, with a delta of 0.25. Now imagine that the gamma of that option is 0.15.

As outlined earlier, if stock XYZ rises to $21/share (up a dollar), then the $22 strike call will be worth $0.75. But what is the new delta of that option? Gamma helps answer that question.

The new delta of the $22 strike call with stock XYZ trading $21/share is 0.40, which is calculated by adding the original delta of the $22 strike call (0.25) to the original gamma of the $22 strike call (0.15).

Remember, gamma is the amount that an option’s delta changes for every dollar move in the underlying. Stock XYZ moved up a dollar in price, so the $22 strike option’s delta increased by 0.15.

Logically, this makes sense because as an option's price gets closer to at-the-money (ATM), the delta of the option should get closer to 0.50. In this case, the $22 strike call had a delta of 0.25 with XYZ trading $20/share, and now has a delta of 0.40 with stock XYZ trading $21/share.

Tying It Back to Gamma Scalping

As stated previously, gamma scalping is anchored around trading delta neutral.

Imagine a trader purchased 100 contracts of the $22 strike calls in stock XYZ for $0.50. In order to be delta neutral against the 100 calls, the trader would sell short 2500 shares of stock. This is computed by multiplying the number of contracts times the delta of the option times the option multiplier, or 100 x 0.25 x 100 = 2500.

As outlined previously, if stock XYZ rises to $21/share (up a dollar), then the $22 strike calls now have a delta of 0.40. In order to be delta neutral against the position, the trader would now have to be short 4000 total shares (100 x 0.40 x 100 = 4000).

Because the trader shorted 2500 shares against the 100 long calls when initiating the position in XYZ, the trader now has another 1500 shares of stock to sell in order to maintain delta neutrality.

The sale of those 1500 shares for $21/share is gamma scalping in action.

This adjustment not only gets the position back to delta neutral, but also gives the trader a chance for additional profit if stock XYZ drops back to $20/share (or lower). It’s this back and forth scalping of XYZ that produces extra income to help cover the cost of theta.

Depending on the size of the portfolio and the degree to which the market is moving, a gamma scalping system could be executing very few to very many scalps on a daily basis. And while we’ve used a long gamma example in this post, it’s important to remember that gamma can be positive or negative.

Short premium positions are naturally short gamma, which mechanically-speaking means that the scalps will be “reverse adjustments.”

For example, when the underlying stock rises, short gamma positions get shorter delta, which means more stock will need to be purchased. When stock drops, short gamma positions get longer delta, which means more stock will need to be sold.

We have included a link below which can be used to access additional information on reverse scalping short gamma positions.

Gamma Scalping Parting Thoughts

The question you are likely asking yourself right now is “When should adjustments such as these be made?”

Unfortunately, the answer isn’t clear cut, and quite frankly is beyond the scope of this post. Having worked for eight years within a large volatility fund that utilizes a fairly complex scalping platform, the honest answer is "it depends."

One big reason there is no prescribed solution for delta-neutral adjustments is that each and every trading strategy is customized to some degree. Additionally, the risk profile of each trading firm/strategy is also different.

Due to these complexities, some strategies call for intraday adjustments, some call for end of day adjustments, and some call for weekly adjustments. Some approaches may even hold off on adjustments until a certain risk threshold has been breached - or a combination of the above.

What's vital to keep in mind is that at the end of the day, the gamma scalping overlay has been put in place to assist with both P/L and risk management.

From this standpoint, it's almost certain that every options trader has executed a gamma scalp/hedge at some point in his/her career. The only difference between your approach and that of a larger firm/strategy may be the consistency of application and the degree to which it is automated.

Due to the complexity of this subject, we’ll be following up with additional posts focusing on gamma scalping in the future.

In the meantime, if you want to learn more about gamma scalping, we highly recommend you review a three-part series on tastylive's From Theory to Practice, which focuses on this very subject (see links below).

It's important to keep in mind that this approach is relatively capital intensive, and may be prohibitive from a cost perspective (commissions, trading systems, etc…), which is one reason that many volatility traders choose not to adopt such a system.

If you have any questions about trading delta neutral or gamma scalping, we hope you’ll reach out at support@tastylive.com.

We look forward to hearing from you!

From Theory to Practice: Part 1 - True Gamma Scalping

From Theory to Practice: Part 2 - Reverse Gamma Scalping

From Theory to Practice: Gamma Scalping - The Scorecard

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices