The Difference Between Options and Futures

The Difference Between Options and Futures

While the great spectrum of products in the financial industry provides a broad landscape for diversification, it also represents a somewhat daunting challenge for new traders/investors in the field.

tastylive provides background and context on many of these products to help new traders successfully navigate the often complex world of commodities, equities, options, futures, and much more.

Today we are providing an overview of two broader categories - futures and options - to help clarify how they are different and what that means for market participants.

The Crux

If one looks only at textbook definitions, the difference between futures and options may appear rather subtle. Consequently, before defining futures and options, we want to point out one critical difference in these dynamic financial contracts:

- futures obligate the buyer to own a specific asset at a particular price on a particular date.

- owners of options have the right, but not the obligation, to buy or sell an asset at a particular price and prior to a particular date.

But wait, there’s more!

Futures

As we said, a future is a financial contract that obligates the buyer to purchase an asset at a predetermined price and date. The underlying asset in this type of trade may be a commodity or a financial security/instrument. The seller agrees to the exact same terms on the opposite side of the transaction.

Futures contracts can be written to include physical delivery of the underlying asset or merely an exchange of cash based on the difference between the predetermined price and the market price on the final day of the contract’s life.

The various market participants in futures can range from producers and suppliers to traders and speculators. For example, a farmer of soybeans may sell a futures contract to lock in a price for the upcoming harvest. A speculator might buy or sell futures contracts based on his/her outlook on price.

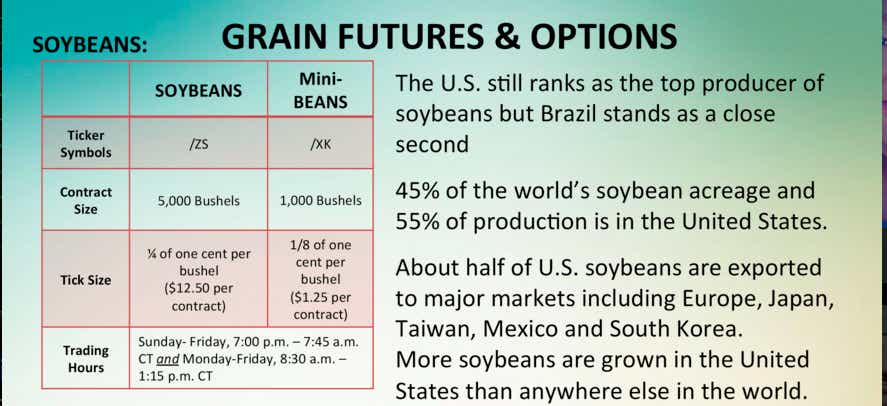

Now let's take a deeper look at futures by analyzing a specific example on soybean futures contracts:

As you can see, a standard soybean futures contract (/ZS) represents 5,000 bushels. Trading one contract of soybeans therefore represents a notional value of $49,250, if we assume a price of $9.85/bushel (5,000 x $9.85 = $49,250).

Now consider a farmer that is expecting a harvest of 50,000 bushels (equivalent to 10 contracts).

If this farmer considers $9.85 a good price, he/she may decide to sell 10 futures contracts on soybeans now instead of waiting to see what the price is when his product is ready for delivery. The farmer has consequently locked in a price of $9.85 x 50,000 bushels, or $492,500 for this year's harvest.

While the price of soybeans may fluctuate between the trade date and ultimate delivery, the farmer has removed some degree of price uncertainty from the equation, especially on the downside. However, the farmer is now at risk that the price of soybeans futures increases (potentially substantially) before the delivery date.

Looking at this same example from another perspective, consider a speculator that purchased the 10 soybeans futures contracts from the farmer.

Using historical statistics or weather forecasts, the speculator is likely anticipating an increase in the price of soybeans prior to the contract’s completion. By purchasing 10 futures contracts, the speculator has agreed to take delivery on 50,000 bushels of soybeans for a trade price of $492,500.

If the speculator is wrong, and the market price of soybeans drops below $9.85 by the delivery date, then the speculator has lost the difference between the initial transaction price and the spot price multiplied by the number of bushels. If soybeans dropped to $9.00/bushel, the speculator would lose $42,500 ($9.85-$9.00 x 50,000) on the trade.

The recent drop in crude oil prices is an excellent example of the power held in futures trading.

Producers that leveraged futures to lock in higher prices before the steep sell-off in the price of oil are positioned substantially better than producers that did not hedge their risk.

Options

While futures obligate market participants to buy or sell an underlying asset, option contracts allow for relatively more flexibility.

Market participants that purchase options have the right, but not the obligation, to buy or sell an asset at a set price on or before a certain date. The set price is “the strike price” and the certain date is “the expiration date.”

Like futures and stocks, options trade on exchanges and have defined contract terms. The underlying of an option is another asset or security, which is what makes this financial instrument so versatile.

Options are also called derivatives, because their price is “derived” from the value of another asset. In the case of stocks, an option derives its value from the underlying stock. Appropriately, another term for stock options is therefore “equity derivatives.”

Given the complexity of an option contract at first glance, consider this real-world example:

Imagine the owner of a ranch in Texas wants to sell you an option to buy his property five years from now for $300,000. How much would that right (but not obligation) be worth?

That would depend on how much the property is worth right now, and how much one anticipates it to be worth five years in the future.

Imagine that you purchase the option and immediately after you sign the contract, oil is discovered underneath the property next to the ranch. It seems plausible that all the land in that area (including the ranch you have a right to buy) would increase substantially in value.

Consequently, the option you own to buy the ranch for a set price would also increase in value. The value of your option therefore “derives” its price from the value of the underlying land.

This same trade structure can be applied to almost any asset or security (assuming you can find someone to trade the other side). A wide range of stocks, indexes, and commodities do offer options.

For example, Apple (AAPL) stock is currently trading about $95. How much would you pay for the right to buy Apple stock for $150 in January of 2017?

Well, the answer depends on one’s forecast for Apple stock through that date.

If you think Apple is going to skyrocket in the next year, that option might have considerable value in your opinion. But if you believe that Apple stock will remain stagnant, or even decrease by January of next year, you might assign a value of zero to the contract.

In this example, we can actually observe the current market price for the right (but not the obligation) to purchase Apple stock for $150 by the third Friday of January in 2017.

With Apple stock (AAPL) currently trading about $95 as of February of 2016, the current price for the $150 strike option contract in January 2017 is $0.45.

In equity options, one contract is equal to 100 shares of stock. This is known as the multiplier.

Let’s say you wanted to own the right (but not the obligation) to purchase 100 shares of Apple stock through January of 2017.

Because one contract is equal to 100 shares, you would pay the price of the option ($0.45) times the number of contracts times the multiplier for this right. In this case, that would be a total cost of $0.45 x 1 x 100 = $45.

If you wanted the right to own 1,000 shares of Apple stock through January of 2017, you could then buy 10 contracts for a total cost of $0.45 x 10 x 100 = $450.

If Apple stock appreciates to above $150 per share prior to the expiration of your option then you can either sell your options for a profit or exercise your right to purchase the Apple stock at a price of $150. Keep in mind that exercising the option (right) and buying the stock will require considerable capital.

One hundred shares of Apple stock at $150/share will cost you $15,000 in capital. One thousand shares would cost you $150,000.

Takeaways

- Futures and options are extremely dynamic contracts that help market participants take and hedge risk.

- Additional information on both futures and options is available through the tastylive website.

If you have any questions or comments we encourage you to contact us at support@tastylive.com.

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices