US Dollar, S&P 500 Putting Recession Risk at Center Stage: PCE Inflation Preview

US Dollar, S&P 500 Putting Recession Risk at Center Stage: PCE Inflation Preview

By:Ilya Spivak

Markets would have celebrated disinflation as recently as two months ago. Now, price action in US stocks and the Dollar hints that the calculus has changed as recession fears dominate the spotlight.

- March US PCE inflation data in focus, climb-down to one-year low expected

- Fed policy speculation seems to have ceded the spotlight to recession fears

- Stocks may fall as the US Dollar gains if price growth undershoots forecasts

US inflation remains on a declining path

The markets are bracing for a key stage-setting exercise as the March edition of US PCE inflation data – the Fed’s favored price growth measure – gets set to cross the wires. It is expected to show that the headline rate dipped to 4.1 percent, climbing down from 5 percent in the prior month and marking a one-year low.

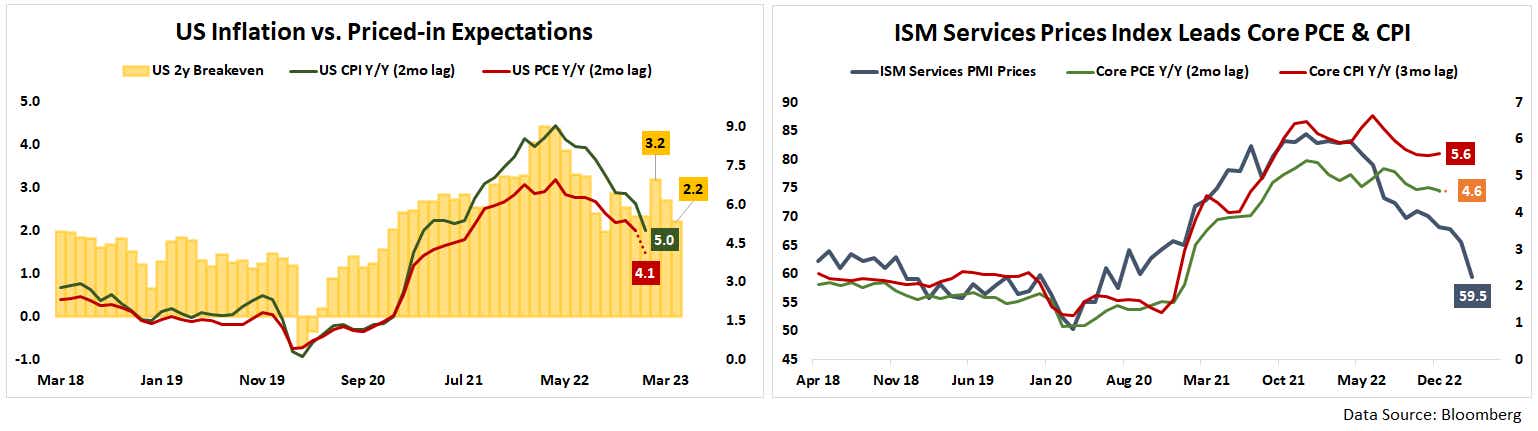

The case for continued disinflation seems compelling. The 2-year “breakeven rate” – a measure of the inflation path priced into bond markets and revealed by taking difference between nominal and real Treasury yields – has been leading PCE and CPI by about two months. There is a similar relationship with the price-tracking subindex of the service-sector ISM survey. Both measures suggest lower readings ahead.

Fed policy speculation may be giving way to recession fears

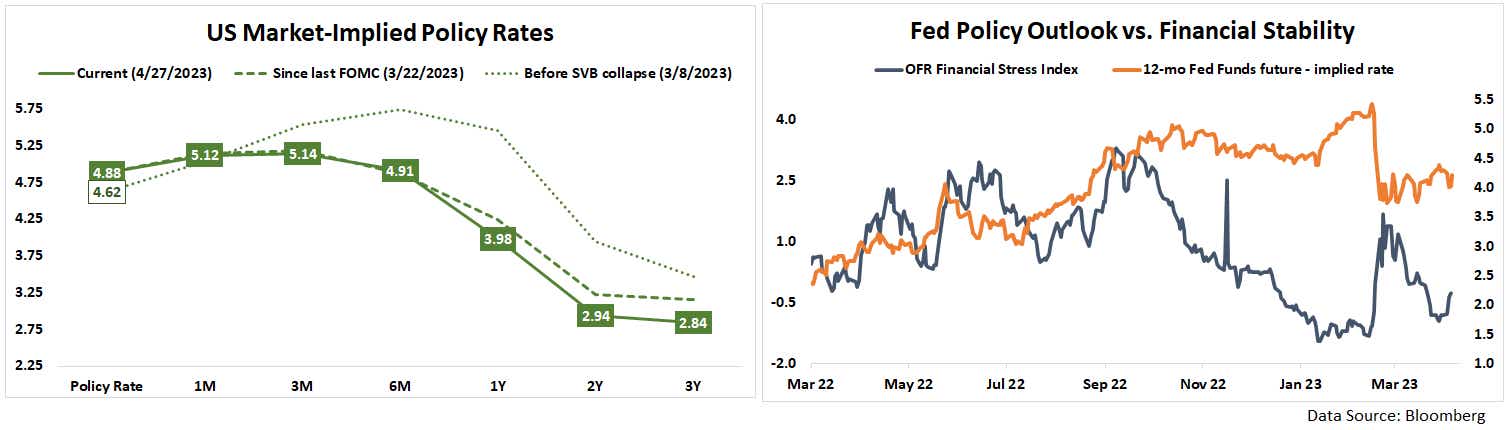

Softer data might have cheered markets as recently as a few months ago, when it could credibly stoke hope for a dovish adjustment in Fed rate hike odds. That seems to have stopped working. The priced-in policy path implied in rates futures has barely moved at all since the FOMC gathered for a its last meeting on March 22, just in the wake of the SVB-led banking crisis. Curiously, the standstill has persisted even as measures of credit stress returned to pre-crisis levels.

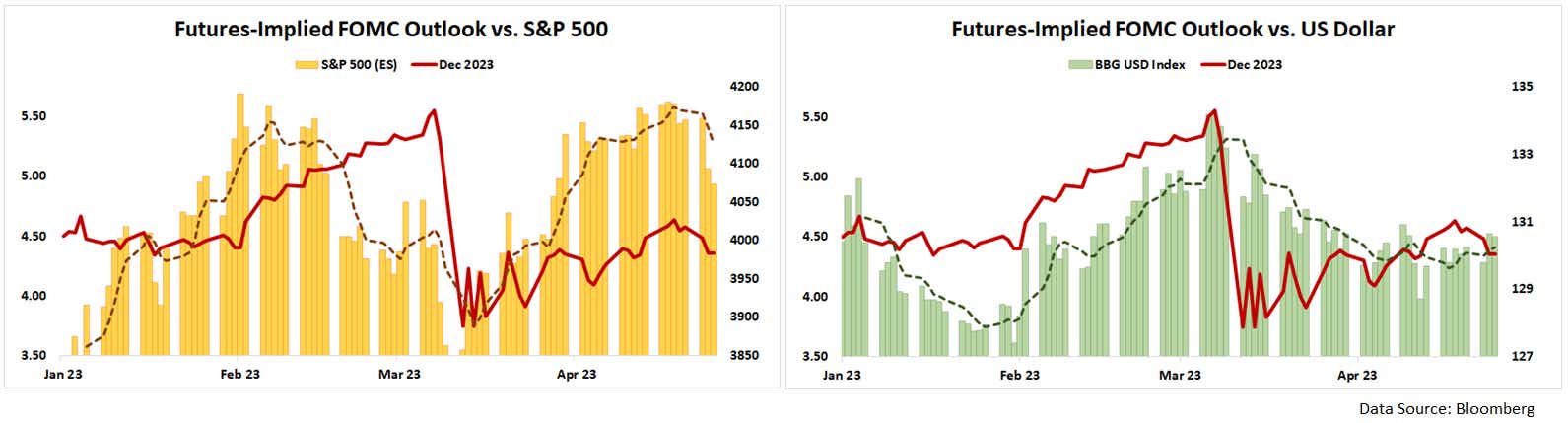

In the meantime, price action dynamics seem to suggest regime change is afoot. The bellwether S&P 500 stock index has moved lower alongside the Fed Funds rate implied in rates futures for the end of this year. What’s more, the US Dollar has cautiously gained in tandem. This is a stark change from trading patterns persisting since the start of 2022.

That dovish changes in the priced-in policy path now come with weaker shares and a stronger Greenback suggests that traders have moved on from fine-turning their view of the tightening path to focus on recession risk. Viewed through this lens, soft PCE numbers might be seen as a worrying sign of withering economic activity. They could thus lead Wall Street lower while safety-seeking capital heads for the liquidity haven of the US currency.

Ilya Spivak is the Head of Global Macro at tastylive, where he hosts Macro Money every week, Monday-Thursday.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices