U.S. Jobs Data Comes in Below Expectations

U.S. Jobs Data Comes in Below Expectations

Moderating U.S. Jobs Growth Lifts Stocks, Bonds

- The U.S. economy added 187,000 jobs in July, below the forecast of 200,000.

- The unemployment rate (U3) dropped to 3.5% from 3.6%, the latest indication the Fed’s rate hikes are succeeding in bringing down inflation without upending the labor market.

- Investors in stocks and bonds are breathing a sigh of relief after overheating concerns arose in recent days.

Market update: S&P 500 down 1.61% month-to-date

The U.S. economy continues to exhibit strength within the labor market, as the July U.S. jobs report showed. The nonfarm payrolls reading produced a headline gain of 187,000 vs. the consensus forecast of 200,000, while the prior reading was revised lower from 209,000 to 185,000. The household employment survey showed the unemployment rate (U3) dropped to 3.5% from 3.6%.

Despite the miss relative to expectations on headline jobs growth, the figures are more than sufficient to keep the U.S. labor market on solid footing. According to the Atlanta Fed Jobs Calculator, the U.S. economy needs to add only 98,000 jobs per month through the rest of 2023 to keep the unemployment rate at 3.6% or lower.

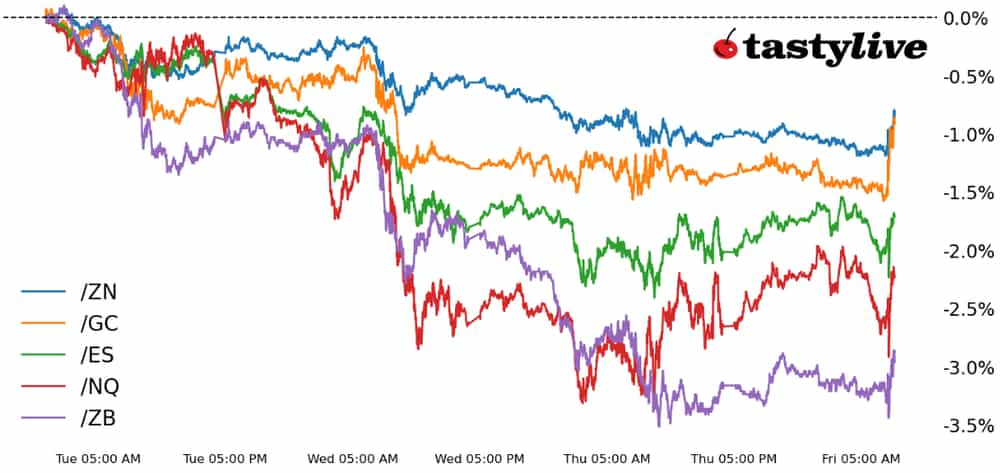

Call it déjà vu, but the price action leading into the July U.S. jobs report was eerily similar to that preceding the June U.S. jobs report, released right after the July 4 holiday. In early July, markets got spooked by a string of hot U.S. economic data, including the ADP Employment Change report, not dissimilar from what happened this week. And as in early July, the release of the official government measure today provided some solace as the numbers the Federal Reserve cares about most did not signal any imminent overheating of the U.S. labor market.

The net result has been a rebound in U.S. equity futures, led by /NQ, while bonds across the curve have stopped bleeding. Both /ZN and /ZB, which produced outsized losses in recent days, are rallying off their lows, giving room for /GC and /SI to post modest gains as well.

If markets respond to the July U.S. jobs report in a manner similar to what happened after the June U.S. jobs report, it’s possible we’ve seen the lows for the month in both stocks and bonds.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices