U.S. Recession Watch: Now or Later?

U.S. Recession Watch: Now or Later?

Inflation is slowing, but deflation may become a risk and the labor market may deteriorate

The U.S. economy has sustained solid growth through 2Q ’24 and into 3Q ’24.

The odds of a U.S. recession in 2024 are beginning to increase, however.

Federal Reserve officials are focusing more and more on the deterioration in the labor market.

The U.S. economy may be turning. After a remarkable run of resilience in the post-COVID era, cracks in the foundation are starting to appear. Inflation is decelerating, but has shifted to a place where deflation may become a risk. The labor market is showing signs of momentum in the wrong direction.

That’s not to say the recession is here; there’s not enough evidence to suggest that now. After all, the Atlanta Fed 3Q ’24 GDPNow forecast sits at 2.9%* (real terms, annualized), while the Cleveland Fed Inflation Nowcast shows headline CPI (consumer price index) at 3% year over year (y/y) for July and 2.7% y/y in August; both remain above the Fed’s medium-term target of 2%.

Nevertheless, recession concerns are all anyone is focusing on in markets. This lens was afforded to traders by none other than Federal Reserve Chair Jerome Powell himself, when on July 31, in his post-Federal Open Market Committee meeting press conference, indicated the committee saw risks as “balanced,” a sign policymakers were less concerned about inflation and more concerned about the labor market.

Let’s explore whether or not the recession is here—or if it’s coming at all.

No recession: Not now, not Immediately

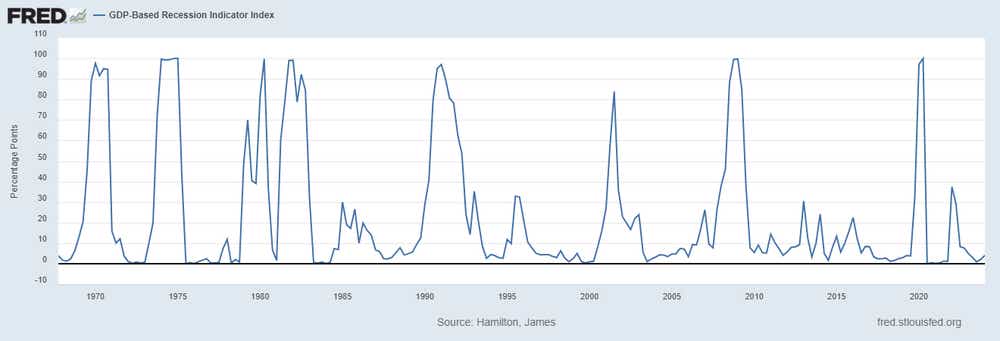

1) GDP-based Recession Indicator Index

This index measures the probability the U.S. economy was in a recession during the indicated quarter, and it corresponds to the probability (measured in percent) that the underlying true economic regime is one of recession based on the available data. If the value of the index rises above 67% that is a historically reliable indicator the economy has entered a recession. Once this threshold has been passed, if it falls below 33% that is a reliable indicator that the recession is over. The index currently sits at 4%.

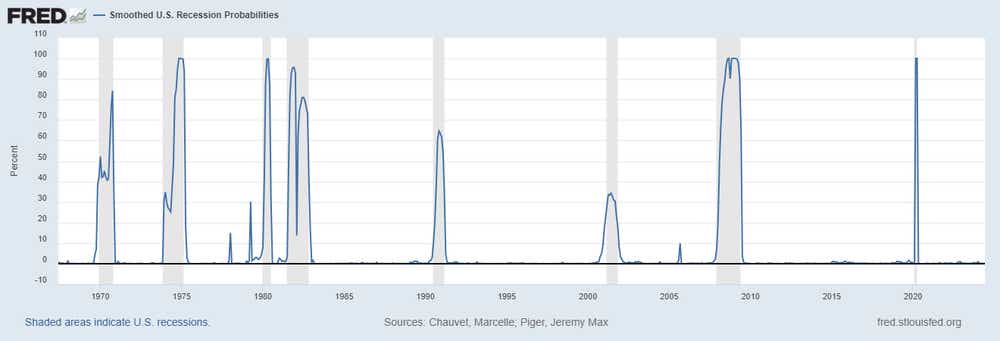

2) Smoothed US Recession Probabilities

Smoothed recession prob for the U.S. are derived using four monthly coincident variables: NFP employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales. The index is currently 0.16.

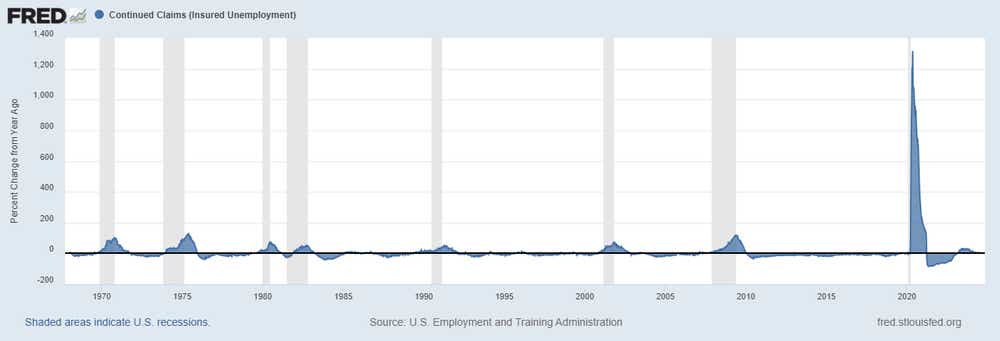

3) Continuing Jobless Claims

Continued claims, also referred to as insured unemployment, is the number of people who have already filed an initial claim and who have experienced a week of unemployment and then filed a continued claim to claim benefits for that week of unemployment. Continued claims data are based on the week of unemployment, not the week when the initial claim was filed. In previous recessions, the year-over-year change in continuing claims typically exceeded 20%; it is currently 4.4%.

Yes Recession: It May Have Already Begun

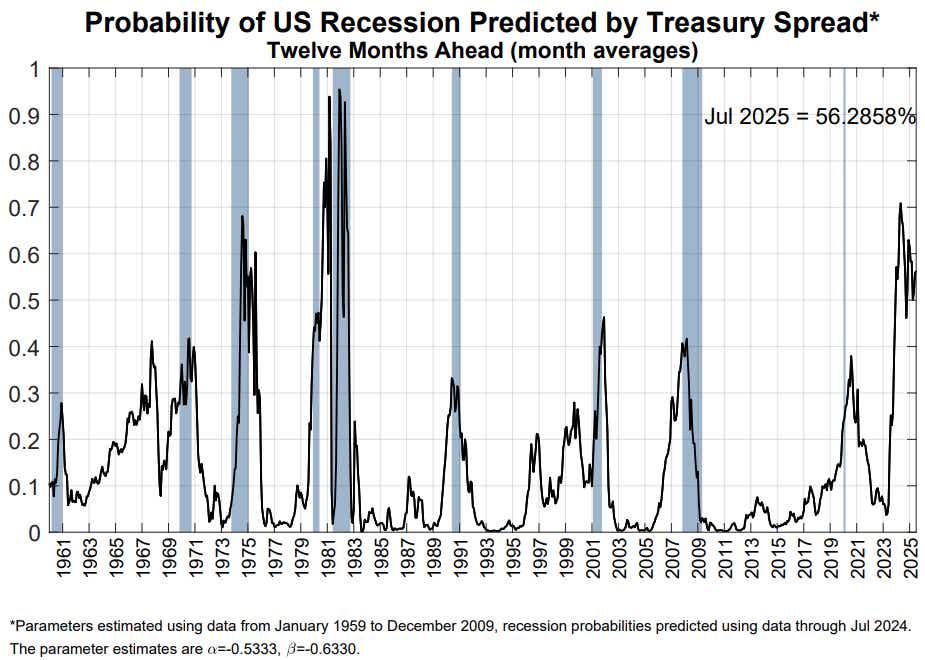

1) NY Fed 3m10s spread

Parameters are estimated using data from January 1959 to December 2009, and recession probabilities are predicted using data through June 2023. The parameter estimates are α=-0.5333, β=-0.6330. As of Aug. 7, the bond market was implying a 56.3% chance of a recession within the next 12 months.

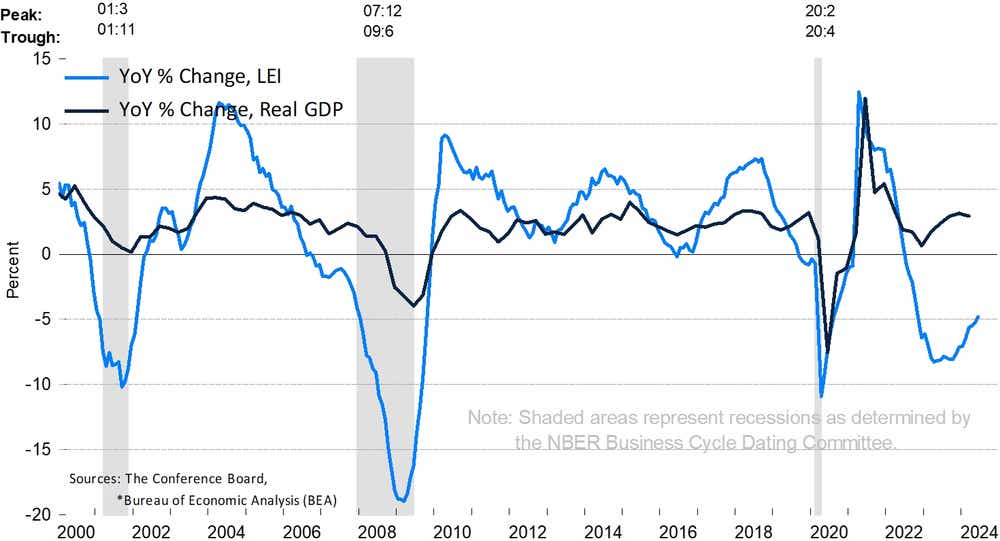

2) Conference Board Leading Economic Index

The LEI is comprised of 10 indicators that cover a wide range of economic activity, including job growth, housing construction and stock prices. The index is designed to provide a broad-based look at the health of the economy and can be used to predict turning points in the business cycle.

3) The Sahm Rule

The Sahm recession indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.5% or more relative to the minimum of the three-month averages from the previous 12 months. It currently sits at 0.53%.

Signal or noise?

U.S. equity markets peaked this month on Aug. 1 at 10 a.m. EDT, when the July U.S. Institute for Supply management (ISM) purchasing managers’ index (PMI) showed unexpected weakness. Fears swelled on Aug. 2, when the July U.S. nonfarm payrolls report came in weaker than expected—and the unemployment rate jumped enough to trigger the Sahm rule.

If only to underscore how sensitive markets are right now to the recession conversation—after all, that determines whether the Fed is cutting for good (inflation is defeated without killing the labor market!) or for bad (inflation is defeated because the labor market was killed)—look no further than the reaction to the most recent U.S. jobless claims report: The S&P 500 (/ESU4) rallied +2.56% from Thursday, Aug. 8 at 8:30 a.m. EDT through the close at the end of the week.

There are two conclusions. First, the recession isn’t here … yet. The economy is slowing, and the odds of further deterioration are increasing. However, and perhaps more important for the immediate future, the fact that there is such intense focus on answering the question of “is the U.S. economy in a recession?” suggests financial markets will remain highly data-dependent over the next few weeks.

As of the time of writing, 39 days remain until the next FOMC meeting: That’s two CPI releases as well as one more NFP report, not to mention the Jackson Hole Economic Policy Symposium and all the twists and turns of the presidential election cycle. Historically, the August to October window produces the biggest increase in volatility all year. So, traders should expect continued volatility over the next few weeks, which caters neatly to the tastytrader methodology.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2025 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.