Our Fed Meeting Prediction: Higher for Longer

Our Fed Meeting Prediction: Higher for Longer

Oh, and don't expect a rate hike. Here's why.

- A recent uptick in inflation coupled with strong U.S. growth metrics is likely to yield a hawkish tone from Fed Chair Jerome Powell.

- The new Summary of Economic Projections and the infamous "dot plot" could reveal the Fed’s intent to stay “higher for longer.”

- The Federal Reserve will keep rates on hold this week.

The September Federal Reserve rate decision on Wednesday offers another opportunity for traders to gauge expectations around the final stages of the interest rate hike cycle. Since July, the last time the FOMC formally met, U.S. economic data has been quite resilient, with the Atlanta Fed GDPNow growth tracker pointing to a +4.9% annualized rate of real growth in 3Q’23.

What did Fed officials say between meetings?

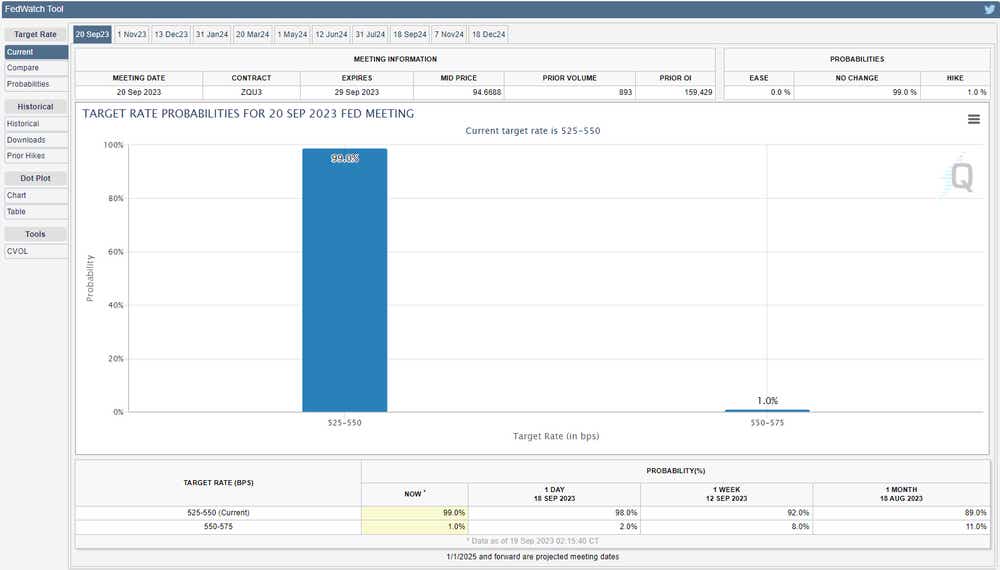

It makes sense that, even if the Fed holds rates (1% chance of a hike, per Fed funds futures (/ZQ), then it will be a ‘hawkish hold.’ Recent Fed-speak substantiates this point of view, particularly given its evolution between late-July and early-September.

July 30 – Kashkari (Minneapolis president) said that the outlook for inflation is “quite positive,” and there’s reason to believe that the economy will be “slowing” without a “recession.”

July 31 – Goolsbee (Chicago president) cheerfully said that the data on inflation is “fabulous news.”

Aug. 1 – Bostic (Atlanta president) proclaimed that “inflation is well off of its highs that we saw in the last year. And recent numbers have come in promising in ways that suggest that we might be seeing continued declines.”

Goolsbee warned about declaring victory over inflation too soon, as “we have seen progress for a short period before, like last summer, and that proved to be false improvements.”

Aug. 3 – Barkin (Richmond president) raised hopes of a “soft landing,” saying “there is still a plausible story that inflation normalizes in short order and the economy dodges additional trauma.”

Aug. 5 – Bowman (Fed governor) offered caution, noting “additional rate increases will likely be needed to get inflation on a path down to the FOMC’s 2% target.”

Aug. 7 – Williams (NY president) took an even-handed approach, saying “Whether we need to adjust it in terms of that peak rate - but also how long we need to keep a restrictive stance – is going to depend on the data.”

Aug. 8 – Harker (Philadelphia president) hinted that a pause in September may be the most likely outcome: “Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions, we have taken do their work.”

Aug. 10 – Daly (San Francisco president) suggested that the Fed has “more work to do.”

August 15 – Kashkari said that he wants “to see convincing evidence that inflation is well on its way back down to 2%.”

August 16 – The July FOMC meeting minutes are released, which noted that “most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy.”

August 22 – Barkin warned against the Fed changing its 2% inflation target before the goal was reached in the current cycle.

August 23 – Collins (Boston president) leaned into ‘higher for longer,’ noting “we may need additional increments, and we may be very near a place where we can hold for a substantial amount of time.”

Harker suggested that the FOMC has “probably done enough” in terms of raising rates in the near-term.

August 24 – Powell (Fed chair), in his remarks at Jackson Hole, said “we are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

Aug. 31 – Bostic argued for a pause, saying that “based on current dynamics in the macroeconomy, I feel policy is appropriately restrictive.”

Sept. 1 – Mester (Cleveland president), in her typically hawkish fashion, said “although there has been some progress, inflation remains too high.”

Sept. 5 – Mester said that interest rates may need to go “a bit higher” to stomp out inflation.

Waller (Fed governor) said “there is nothing that is saying we need to do anything imminent anytime soon.”

Sept. 6 – Collins preached patience as well, but also left the door open to another hike: “While we may be near, or even at, the peak for policy rates, further tightening could be warranted, depending on the incoming data.”

Sept. 7 – Williams continued to suggest that the data will determine what happens next, saying “we’ve got policy in a good place, but we’re going to need to continue to be data- dependent.”

One more hike, maybe?

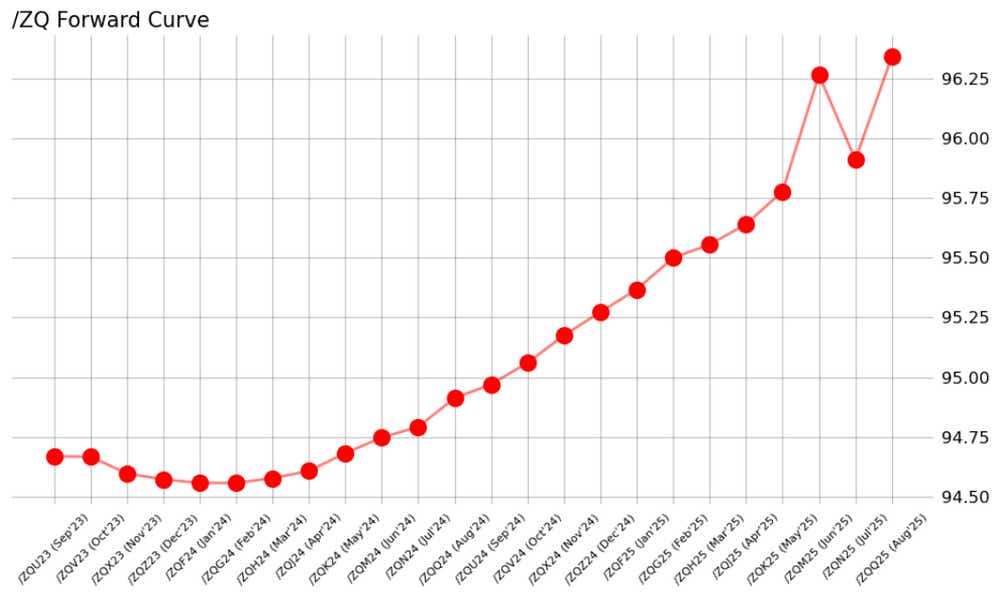

We can measure whether a Fed rate hike is being priced-in using Fed funds over a specific time horizon in the future to gauge where interest rates are headed. The chart below illustrates how markets see the Fed’s hike cycle playing out over the next few months.

/ZQ fed funds futures forward curve (September 2023 to August 2025)

According to the fed funds futures curve, there is a 99% chance that the FOMC holds rates at the September meeting. Expectations rise only marginally thereafter, however. Odds of an additional 25-bps rate hike are only 29% by November and 40% by December. In the highly likely event that the FOMC sits on its hands this month, there isn’t enough evidence to suggest that the hike cycle will be finished (particularly as inflation bites back).

With nearly six weeks until the following FOMC meeting Nov. 1, there is plenty of time for things to change and alter the outlook: a prolonged strike by United Auto Workers union or an extended U.S. government shutdown could undercut growth meaningfully, negating the need for an additional hike, for example.

Outcomes for markets

The September Fed meeting will produce a policy statement and a press conference from Fed Chair Powell. A new Summary of Economic Projections (growth, inflation, and unemployment rate forecasts plus the dot plot) will be revealed. It seems plausible, if not likely, that the growth and inflation forecasts for 2023 will be revised higher as a signal to markets that another rate hike this year is not off the table.

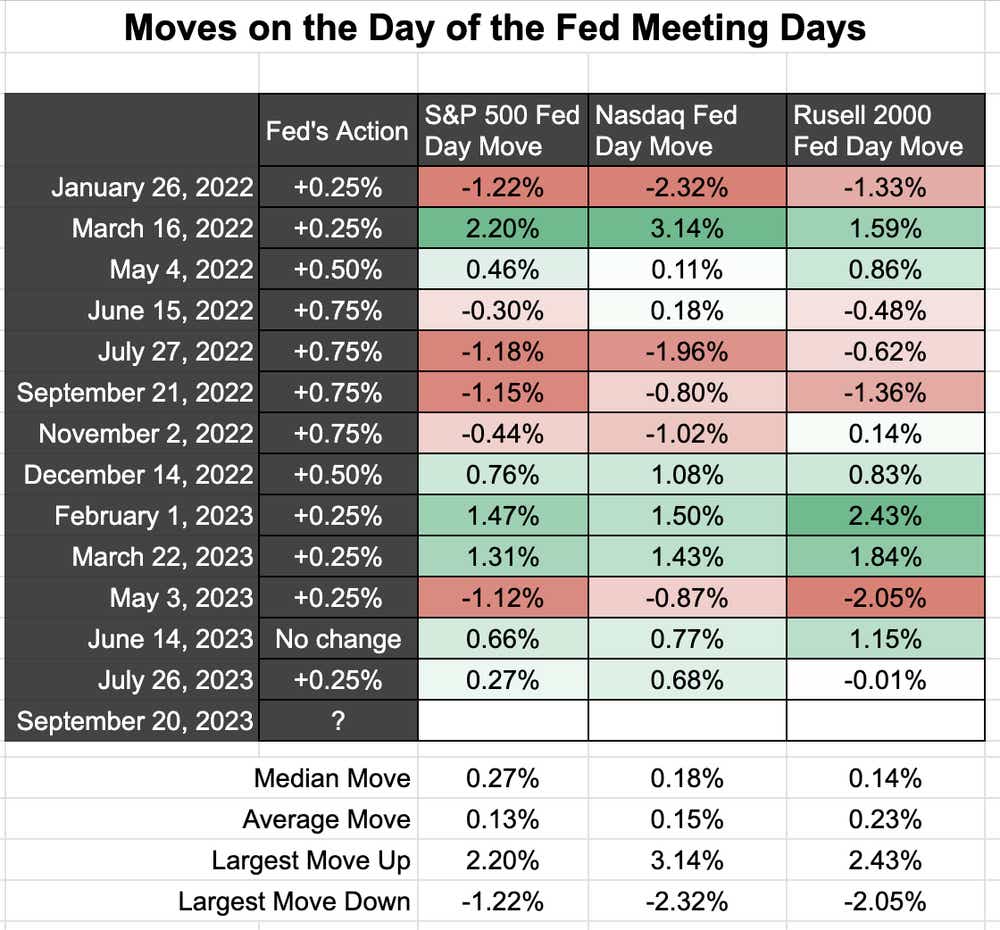

Will this reality translate into a substantial move across markets? Perhaps not. A look at the options market shows that the S&P 500 (/ES) is discounting less than a +/-1% move through the close on Wednesday, the Nasdaq 100 (/NQ) is expected to move just over +/1%, and the Russell 2000 (/RTY) is priced to move near +/-1.5%.

These expected moves would be less than or equal to moves we’ve seen from the major indices around recent Fed decisions, per the data below, compiled by Dr. Michael Rechenthin and Nick Battista in this week’s Cherry Picks (which if you’re not subscribed to, you can do so here).

The September FOMC meeting could bring about a healthy dose of intraday volatility for markets, from stocks to bonds to FX. But in terms of a significantly directional move that sets various asset classes upon new trends—thereby shaking them out of their summer slumber—that seems unlikely, as things stand right now.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices