Rolling Options - How, When & Why to Roll Call Options

Rolling Options - How, When & Why to Roll Call Options

The timely adjustment of positions can be a critical aspect of successful options trading strategies.

tastylive has produced extensive research that suggests active management of winning positions can help traders maximize potential profit.

However, in a probability game such as derivatives trading, it’s inevitable that some trades will be tested by adverse market movement. In this latter case, there are strategies that traders can utilize in order to defend or redeploy capital.

One popular method of trading challenged or losing positions is the concept of "rolling," which was recently discussed on an episode of Know Your Options.

On this particular segment, hosts Liz and Jenny delve deeper into why traders roll as well as some tastylive research that helps illustrate how traders can successfully navigate troubled waters.

The process of "rolling" an option can involve a winning position, a losing position, a long premium position, or a short premium position. Pretty much any position can be "rolled."

Rolling involves an adjustment in the strike of an option position, an adjustment in duration of the position, or both. A roll involves closing one position in favor of opening another, often similar, position.

For example, a covered call position could be "rolled" by buying in the short strike in the front month (to close) and then selling the same strike in another month (to open). Completing this process means that the covered call has been rolled forward.

The decision to roll can come about in several ways.

Using the covered call example, the decision may come about simply because time has passed and expiration is approaching. The hypothetical short option looks likely to finish out-of-the-money, meaning a trader can re-deploy the position going forward by rolling (to another expiration month).

If a trader's outlook and risk appetite remains the same, the covered call is a solid example of a position that a trader might roll into another expiration month. As the front month contract loses value and produces profit for the trader, the risk-reward balance starts to shift toward closing the front month contract in favor of opening another short position in another month with more "meat on the bone" (i.e. a bigger credit).

However there are other, slightly more complicated, reasons for rolling positions.

When positions are challenged from a profit and loss perspective, traders may also choose to roll those positions into different strikes or expiration months if their conviction and outlook on the trade remains the same. In this case, a trader is typically confident in their belief that the position will eventually move in their favor - given more time.

Looking at another example, let's consider a hypothetical trader that is short the $10 strike put in XYZ stock, which is trading at $12/share.

If XYZ experiences a downdraft and trades closer to $10.50, the short $10 strike put is now under pressure. In this case, the trader has the option to "roll" his put into a different strike within the same expiration month, or roll the short put into another expiration month.

This is assuming of course the trader doesn't elect to close the position altogether.

The decision to roll is therefore dependent on a trader's ongoing outlook, which will affect the course of action taken. Knowing when or if to roll is consequently a highly subjective situation - and one that usually benefits from experience.

On their show Know Your Options "Rolling Best Practices," Liz and Jenny explore some examples that can help traders better understand their choices when experiencing adverse market movement.

Liz and Jenny highlight two basic techniques that traders often use when rolling spreads - especially in situations of adversity:

1) roll the untested side closer to the money (same expiration)

2) roll the tested side out in time (different expiration)

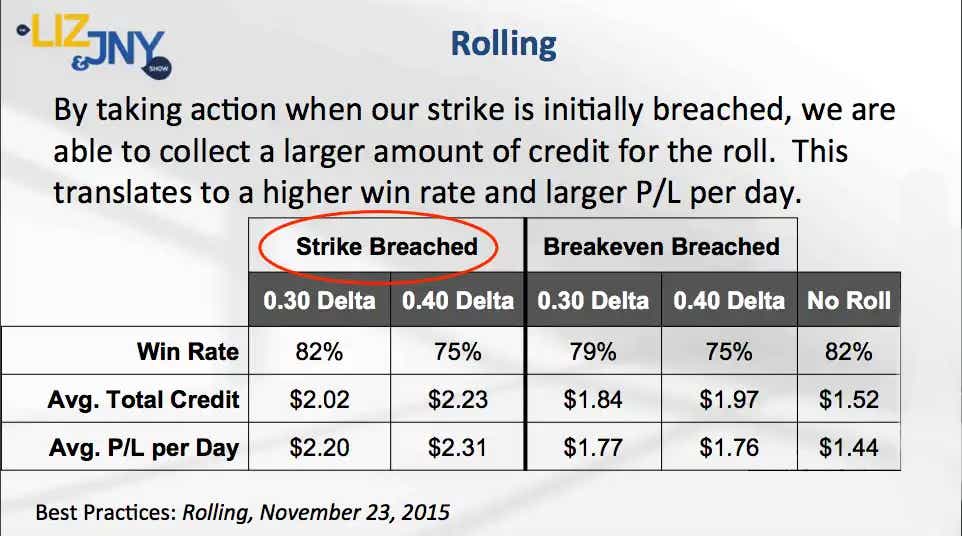

The hosts present tastylive research that suggests an optimal time to roll a trade may be when the strike in one side of the position is breached (i.e. tested side). For example, if one were short a $10 put, a "breach" would occur when the stock trades $9.99 or lower.

The reason to roll at this time is supported by the fact that premiums will be higher than when the stock is trading above the strike. Higher premiums translate to higher credits, which in turn generally translate to higher win rates.

As seen in the graphic below, win rate percentages and credits go up when trades are rolled after the strike is breached - as opposed to when the breakeven is breached (based on tastylive research presented on Best Practices November 23, 2015):

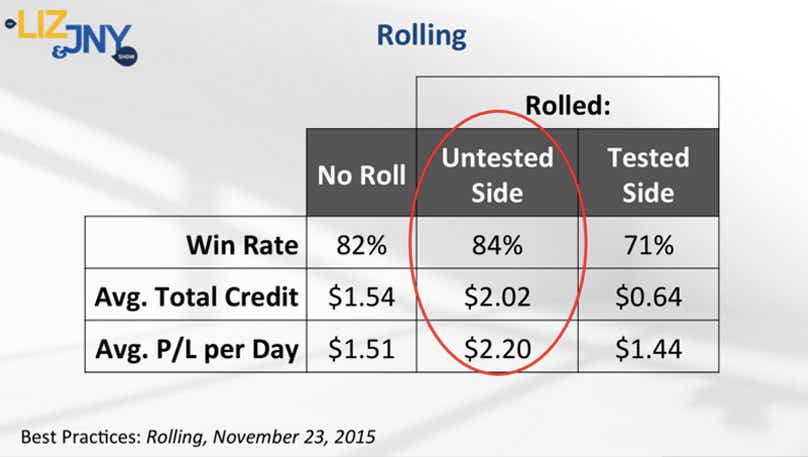

Further research by the tastylive network suggests that rolling the untested side of the trade closer to at-the-money on average produces a higher win rate, as opposed to rolling the tested side of the trade or not rolling at all.

This information is shown in the chart below:

In the case where expiration is looming in the near future, a trader may need to roll a position into another expiration month (assuming their outlook remains the same and they wish to maintain the same risk profile). Often times, a trader will roll out into the same strike, although this choice is subjective and based on risk appetite and outlook.

tastylive research suggests that rolling to the same strike will indeed be the more optimal choice, on average, over time.

Rolling is without question one of the more advanced aspects of trading options. The decision to do so involves many components and varies greatly by situation and market conditions.

We invite you to expand your knowledge on the subject by watching the full episode of Know Your Options focusing on rolling when your schedule allows.

Please don't hesitate to contact us with any questions or feedback on rolling at support@tastylive.com if you require additional information.

Your input affects future programming on the tastylive financial network and is greatly appreciated!

Sage Anderson has an extensive background trading equity derivatives and managing volatility-based portfolios. He has traded hundreds of thousands of contracts across the spectrum of industries in the single-stock universe.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices