Off the Charts: 0DTE Options Volume, Penny Stocks, Panic Stock Buying, Jobs Data Divergence and GME’s Wild Week

Off the Charts: 0DTE Options Volume, Penny Stocks, Panic Stock Buying, Jobs Data Divergence and GME’s Wild Week

The S&P 500 up 1.30% for the month so far

Each week, buy-side and sell-side analysts produce reams of charts and data visualizations to help contextualize price action across asset classes.

These data can help shape one’s thinking, offering evidence for increased conviction or criticism about currently held beliefs. Likewise, they may offer insight into relative risk/reward opportunities in various markets.

These are the five charts that had an impact on my views on markets this week.

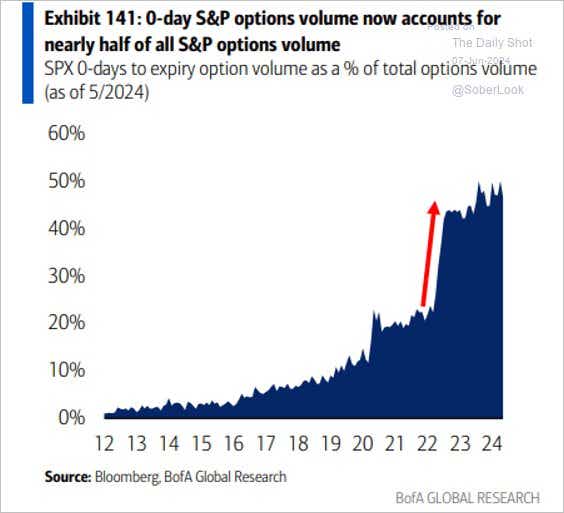

1) 0DTE options volume continues to surge

Takeaways: Investors typically use the options market for hedging purposes, which is why longer-dated SPX volumes are heavier for puts than for calls. Such is not the case for 0DTE options: volumes are split evenly between calls and puts, suggesting that hedging is not the objective–chasing intraday market direction is instead.

Trade implications: In recent months, an increasing frequency of late day moves seemingly came out of nowhere. It’s possible that the heavy trading volumes in 0DTE options late in the day could be causing a "tail wags the dog" type of situation, whereby the underlying SPX is moving because of option dealers being forced to adjust their books rapidly ahead of the close. Either way, 0DTEs can’t be ignored–see what Tom Sosnoff has to say.

2) Retail trading is truly back

Takeaways: From the Financial Times: “Seven of the top 10 most traded US equities in May, as measured by the number of shares bought and sold, are penny stocks worth less than $1, according to CBOE Global Markets data supplied to the Financial Times. None of the companies are profitable. The huge volumes in so many little-known stocks suggest a renewed appetite among retail investors for cheap names in which they believe they can quickly make a lot of money.”

Trade implications: Cynics of the equity market rally in recent months have pointed to concentration among tech stocks and valuations that are starting to resemble the late 90s. But perhaps the biggest sign of the times, more so than the rally in cryptocurrencies or the reemergence of Roaring Kitty—is that penny stock trading is hitting record volumes. When speculative excesses pile up in financial markets, retail traders tend to take extreme risks hoping to strike it rich quickly. It also means that sentiment is at an extreme; equity market bulls beware.

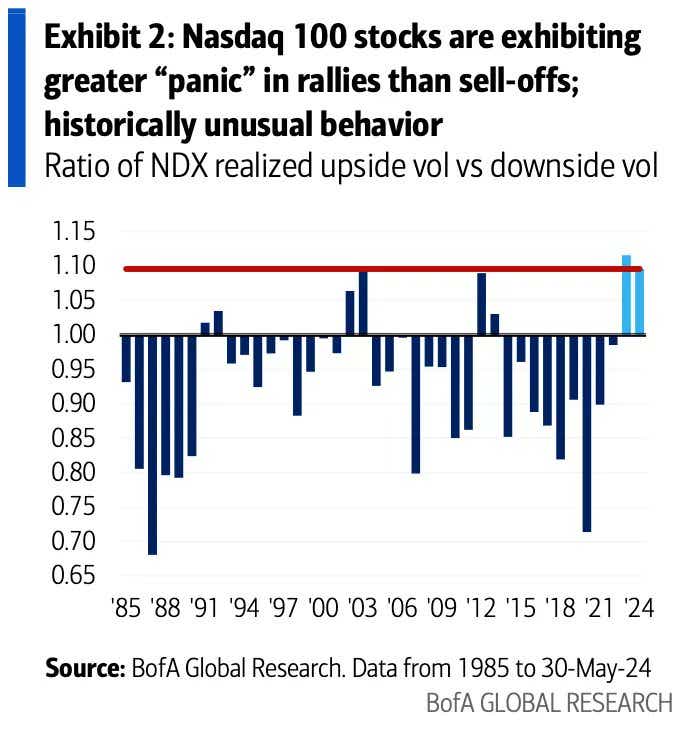

3) Panic buying in stocks?

Takeaways: The asymmetric volatility phenomenon stipulates that equity market volatility tends to be higher in falling markets than in rising markets. In normal times, this would be illustrated by the ratio of upside volume to realized downside volume coming in at 1.00 or below. That hasn’t been the case for each of the past two years.

Trade implications: Market participants bought stocks in a panic in 2023 and 2024. Why? Because they’re underinvested. There’s too much cash on the sidelines. A still-solid U.S. economy with the prospect of a Fed rate cut cycle beginning in a few months remains a tantalizing scenario for equity bulls in the short term. All of this explains why the downside has been muted in 2023 and 2024 while upside moves have tended to be explosive. There’s no reason for this to change.

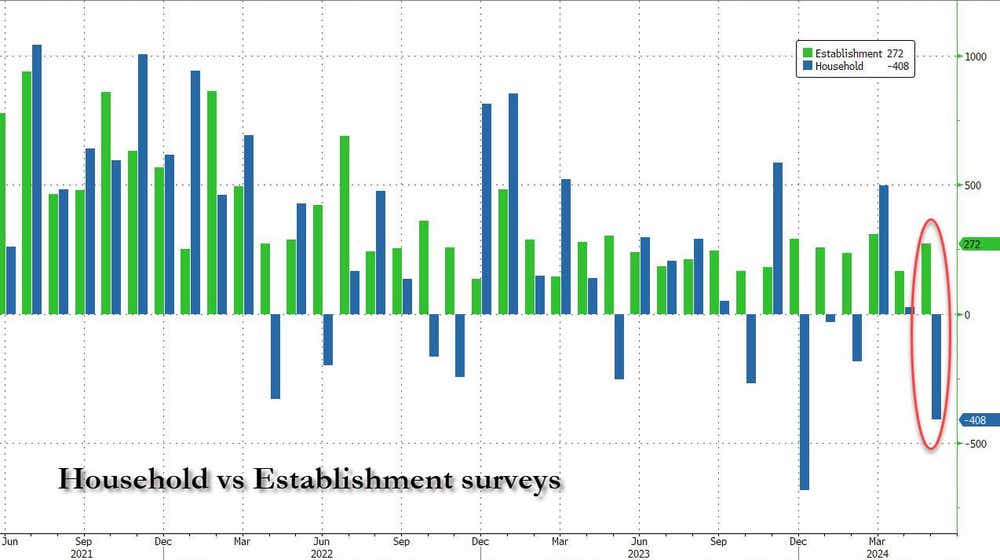

4) U.S. jobs data divergence

Takeaways: “The unemployment rate ticked up to 4%. That occurred as the participation rate slipped back to 62.5% (tied for the lowest level since February of last year). That is because the household survey showed a job loss of 408k. A difference of almost 700,000 between the two versions of this report," writes Peter Tchir, head of macro strategy at Academy Securities.

Trade implications: The May U.S. jobs report offered no clear signal, and there were plenty of reasons to be concerned. The wages component pushed off a near-term expectation for Fed rate cuts, but the bump higher in the unemployment rate saw a third full rate cut for 2025 get discounted. As for goldilocks, this report was not, as it has undercurrents of stagflationary pressures. While everyone in the market is waiting to put on a bull steepener, the fact of the matter is that a bull flattener may be more appropriate.

5) GameStop’s wild week

Takeaways: Keith Gill’s Reddit posts over the weekend outlined a near $300 million position, which surged as high as $900 million notionally overnight. GameStop (GME) management announced a share sale plan for up to 75 million shares, diluting prices. A livestream event from Keith Gill on Friday, June 7 cleared up any speculation about outside financial support, but it was not enough to bolster GME, which was down over -40% at a point on Friday.

Trade implications: Stay away! This is an irrational, illiquid market.

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime, Monday-Thursday. @cvecchiofx

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices