2 Reports Indicate Recession May Be Looming

2 Reports Indicate Recession May Be Looming

By:Ilya Spivak

Stock markets are at risk if soft U.S. PMI data and a dovish Bank of Canada policy announcement warn of a contraction

- Stock markets expect inflation will be beaten without suffering recession.

- January PMI data may signal that U.S. economic resilience is unraveling.

- A dovish Bank of Canada meeting may emphasize risks to global growth.

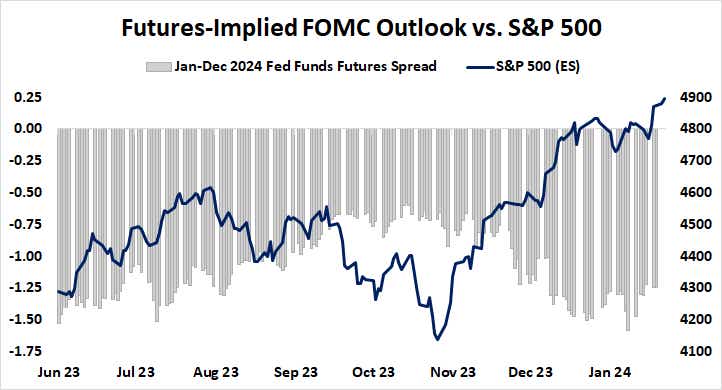

Wall Street is leading global stock markets higher even as the priced-in outlook for Federal Reserve monetary policy adjusts to a less-dovish setting. The bellwether S&P 500 index is up nearly 4% from the lows set in the first week of January. Impressively, the rally has played alongside a push higher in Treasury bond yields.

The move higher in rates played out as traders scaled back Fed stimulus bets. The markets now price in 123 basis points (bps) in interest rate cuts this year. That’s down from 158 bps just over a week ago. That amounts to dropping one standard-sized 25 bps rate cut from the baseline trajectory.

Markets are priced for a “soft landing” on growth and inflation

This implies that investors have arrived at two critical conclusions. First, the U.S. central bank has triumphed in its fight against inflation. Second, that victory will not come at the cost of acute pain for the economy. While quibbling over the definition of “recession” may resurface, stocks’ rise alongside yields implies markets are not pining for a lifeline.

Indeed, a markets-based measure of one-year inflation expectations by the Fed’s Cleveland branch has dropped to 2.4% in January from 3.1% in the prior month, marking a six-month low. As for growth, incoming purchasing managers’ index (PMI) data will now test investors’ optimism.

December marked two months of improvement for worldwide economic activity. The global composite PMI index rose to 51, implying the fastest pace of expansion since July. However, the pace of growth remains low in relative terms, tracking below the 12-month trend average. Resilience in the U.S. seems to be the main driver of performance.

Is the U.S. tilting the world economy toward recession?

January’s updates are expected to show contraction in Australia, the U.K. and the Eurozone, albeit at a slightly slower pace. Japan is projected to remain in stasis. As for the U.S., a slowdown to the weakest in four months is in view. With China still treading water, this hints that global growth is dangerously close to a standstill at the start of the year.

A monetary policy announcement from the Bank of Canada (BOC) may add to the sense that U.S. demand has run into headwinds. It will respond to an economy marked by a seventh month of contraction in December, according to last month’s PMI report. This comes with the biggest drop in new orders since mid-2020.

Nearly 80% of Canadian exports are heading across the country’s southern border, so the slump now underway may be warning that the U.S. is weaker than it seems. Taken together with the slowdown in January’s PMI report, a potent threat to the underlying logic keeping U.S. and global stock markets aloft may be brewing.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices