U.S. GDP and PCE Compete with BOJ, BOC and ECB Meetings: Macro Week Ahead

U.S. GDP and PCE Compete with BOJ, BOC and ECB Meetings: Macro Week Ahead

By:Ilya Spivak

Stocks, bonds, currencies, and commodities face a blistering dose of back-to-back event risk shaping how global central banks will deal with cooling inflation and the risk of recession.

- All eyes on how the Japanese yen reacts as the BOJ sticks to its dovish guns.

- Central banks in Canada and the Eurozone may be inching toward rate cuts.

- How markets treat U.S. GDP and PCE data may foreshadow FOMC response.

Financial markets seem to have broken from a well-worn trading pattern.

An upswell in Federal Reserve interest rate cut bets had stocks and bonds soaring in November and December while the U.S. dollar fell. These moves seemed to run out of steam at the start of 2024 as expectations stabilized, with key markets mostly range bound as investors reconsidered.

Last week, equities managed a decisive upward break even as rate cut expectations cooled. Traders shaved off a full rate cut from the total they had priced into Fed Funds futures for the year ahead. That pushed Treasury yields upward. Nevertheless, the bellwether S&P 500 and the tech-heavy Nasdaq 100 jumped to record highs.

This seems to suggest that a different narrative is beginning to take shape. Here are the macro waypoints shaping what that story is likely to be in the week ahead.

Bank of Japan (BOJ) monetary policy meeting

Japan’s central bank is widely expected to keep the levers of monetary policy unchanged at this month’s meeting.

That is likely to put the spotlight on the policy statement as well as the press conference with Bank of Japan Governor Kazuo Ueda following the official announcement. The response from the Japanese yen may prove to be telling for markets at large.

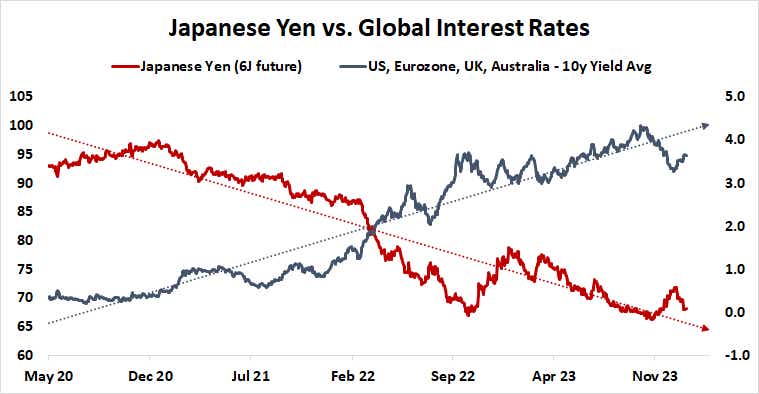

Last week, consumer price index (CPI) data showing softening inflation left the yen unscathed. The currency continued to hold up as bond yields marched higher, defying what is usually a headwind. If it is well-supported as the central bank signals it is in no hurry to change things, the underlying strength for a significant move higher may be in place.

Purchasing managers index (PMI) data

A first look at January’s purchasing managers index (PMI) surveys will help gauge the trajectory of global economic growth.

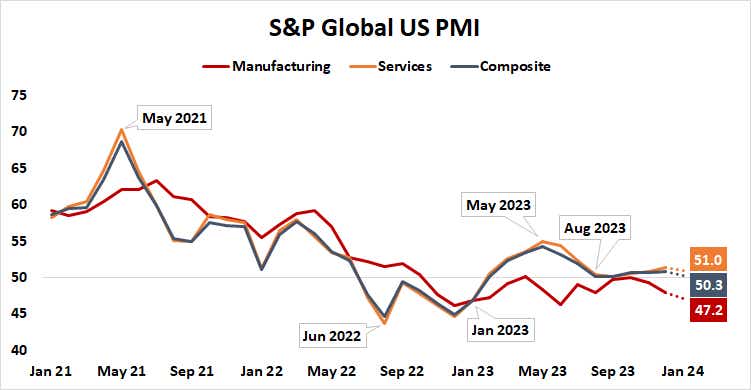

The U.S. edition is likely to command particular attention as speculation about next steps at the Federal Reserve continues to swirl. It is expected to show economic activity slowing to the weakest in four months.

The markets are likely to be happiest with an outcome reinforcing the “slow and steady” status quo defining the U.S. business cycle since August. That would keep Fed rate cuts on the table without sounding the alarm on a recession. An eye-catching surprise in either direction that seems to upset this status quo is likely to jolt stock markets.

Bank of Canada (BOC) monetary policy meeting

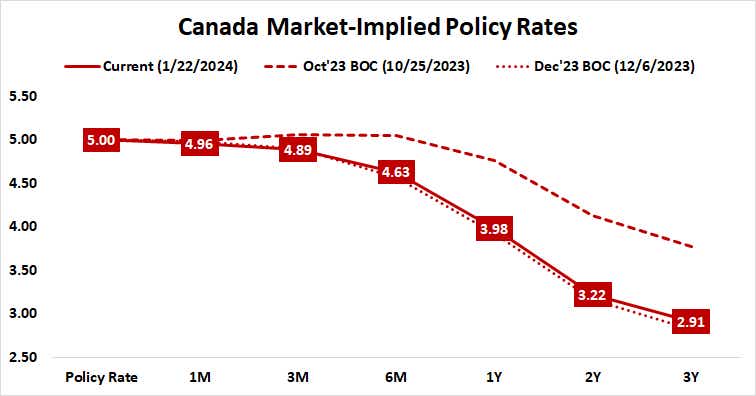

Canada’s central bank is expected to keep its target interest rate on hold at 5%. Markets are pricing in the start of interest rate cuts no later than June, with three 25-basis-point (bps) reductions in view by the end of the year. The probability of a fourth one stands at a considerable 61%.

Policymakers’ tone and guidance may be a telling window into U.S. conditions. Leading PMI data showed Canadian economic activity shrank for a seventh consecutive month in December, and the pace of contraction accelerated. New orders posted the biggest drop since mid-2020.

That is a troubling sign. Nearly 80% of Canadian exports are heading across the country’s southern border, so the slump now underway may be warning that demand in the U.S. is weaker than it seems. If a concerned BOC responds with a dovish stance that dials up stimulus bets, a parallel adjustment may echo into the Fed policy outlook.

European Central Bank (ECB) monetary policy meeting

The ECB is expected to hold back action at January’s meeting of the Governing Council even as markets prepare for the start of an easing cycle in the second half of the year. The first 25 bps cut is expected to appear by June, though an earlier April move carries a hefty probability of 68%. Five cuts, a total of 125 bps or 1.25%, are priced in for 2024.

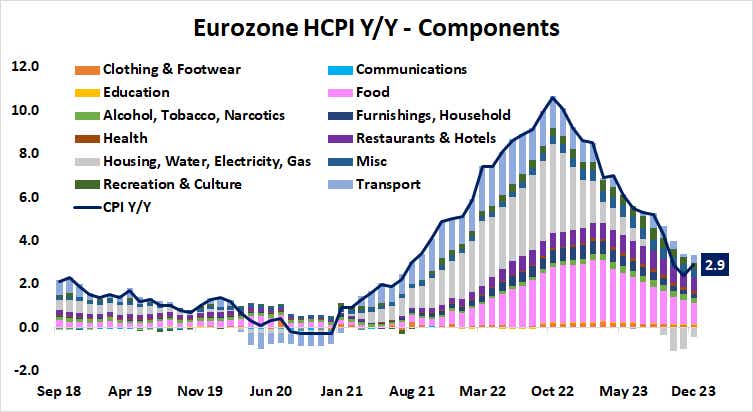

The Eurozone economy is almost certainly in recession and inflation is helpfully declining. Factoring out the outsized contribution from food and an uplift from rebasing energy costs where the price of fuel is becoming less of a drag on the headline figure, prices a tantalizingly close to the 2% objective.

ECB President Christine Lagarde and company have been resisting the admission that rate cuts are approaching. They’ve signaled that hikes have likely ended but argue that a turn in the opposite direction is more distant than the markets are expecting. The euro may slide if the central bank’s defiance appears to be wearing thin as 2024 gets underway.

U.S. PCE inflation and Q4 gross domestic product (GDP) data

The “slow and steady” view of the U.S. economy is likely to get some support from December’s personal consumption expenditure (PCE) inflation data, the Fed’s favored price growth measure. The headline rate is expected to hold steady at 2.6% year-on-year, but the more closely watched core gauge is seen edging helpfully lower to 3% to mark the lowest reading since March 2021.

Meanwhile, the first look at fourth-quarter U.S. GDP data is expected to show that output growth slowed to annualized pace of 2.3% in the final three months of 2023. That would be a significant climbdown from the heady 4.9% expansion recorded in the third quarter.

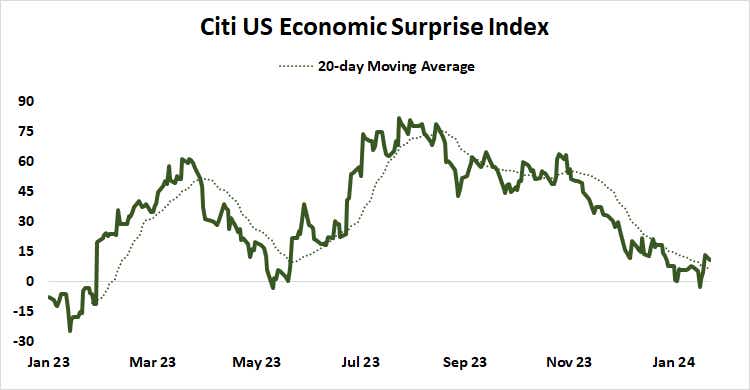

U.S. economic data outcomes have converged on consensus forecasts in recent months, according to analytics from Citigroup. This argues results that are relatively in line with expectations, and thereby unlikely to trigger significant repricing of the Fed policy outlook.

With that in mind, it may be most interesting to see where price action defaults across key benchmark assets – U.S. equity indices, Treasury yields, gold, and the U.S. dollar – after GDP and PCE statistics hit the tape. That might help set the tone for what to expect when the Federal Open Market Committee (FOMC) gathers for next week’s much-anticipated meeting.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive(for options traders), and tastyliveTending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices