Prices Rise for Corn, Wheat and Soybeans

Prices Rise for Corn, Wheat and Soybeans

Active investors weigh the effects on agriculture of inspections, weather and Trump’s odds for re-election

- Corn prices led a rally in agricultural futures after the release of weekly inspection data.

- Speculators remain largely net short in agricultural commodities.

- The weather outlook and Trump’s chances for re-election are in focus for investors.

Corn and soybeans rally on inspections data

Agricultural commodity futures rallied today after the United States Department of Agriculture (USDA) reported weekly data on grains inspection for export. Corn (/ZCU4) rose 2.56%, soybeans (/ZSQ4) gained 1.91% and wheat prices (/ZWU4) added 0.97%.

The data for the week ending Thursday, July 18, revealed that grains inspected or weighed for export came in at the top of trade estimates for corn and soybeans. Wheat exports were on the weaker side of estimates.

Corn inspections for the week totaled 970,000 metric tons, down from 1.1 million metric tons (MTs) the week before but still near the top end of trade estimates of 1.15 million MTs. Soybeans were at 327,061 MTs, up nearly double from the prior week, which is in the upper range of trade estimates. Wheat inspections were at 237,965 MTs, down from the previous week and below the trade estimates.

Weather in focus as USDA delivers crop progress report

The move comes as weather forecasts for August show above-normal probabilities for above-average temperatures across the major soybean and corn crop planting states of Minnesota, Iowa, Illinois and Indiana. The hotter temperatures may stress crops. If they do, we’ll see that data reflected in next week’s crop progress report.

The USDA’s crop progress report for the week ending July 21 crossed the wires this afternoon. It showed corn and soybean conditions remaining nearly unchanged from the week before. Spring wheat conditions were unremarkable, with excellent and good condition combined holding steady at 77%, and fair and poor combined dropping to 22% from 23%. The percentage of spring wheat rated very poor rose to 1% from 0%.

Trump trade in effect for agriculture products

Prices fell last week for corn, soybeans and wheat, following the failed assassination attempt on former President Donald Trump. The odds of a Trump presidency increased over the following days and betting odds predict he’ll win in November.

Investors expect Trump to return the United States to a tougher stance on China, mainly through tariffs. These tariffs would likely lead to retaliatory measures from China. Soybeans would likely be hardest hit, as they were from 2018 to 2019, when China placed retaliatory tariffs on soybeans. U.S. tariffs on China remained largely in place during the Biden administration.

China’s tariffs on U.S. soybeans remain at 25%, up from 3% before the trade war. In recent years, Brazil has filled much of the gap for China’s soybean appetite. China targeting soybeans with a harsher tariff rate is a possibility but not a certainty at this time. The U.S. didn’t inspect any soybeans bound for China in its inspection data for last week.

The possibility also exists that China could frontload agricultural imports ahead of a Trump presidency, which could benefit prices over the short term. U.S. soybean exports to China fell to $3.1 billion in 2018 from $12.2 billion the year prior. For 2023, soybean exports to China were at $15 billion, according to USDA data. Meanwhile, Brazil’s soybean exports to China have reached record-high levels, with first-half year sales totaling 34 million tons.

Short positioning in corn and soybeans

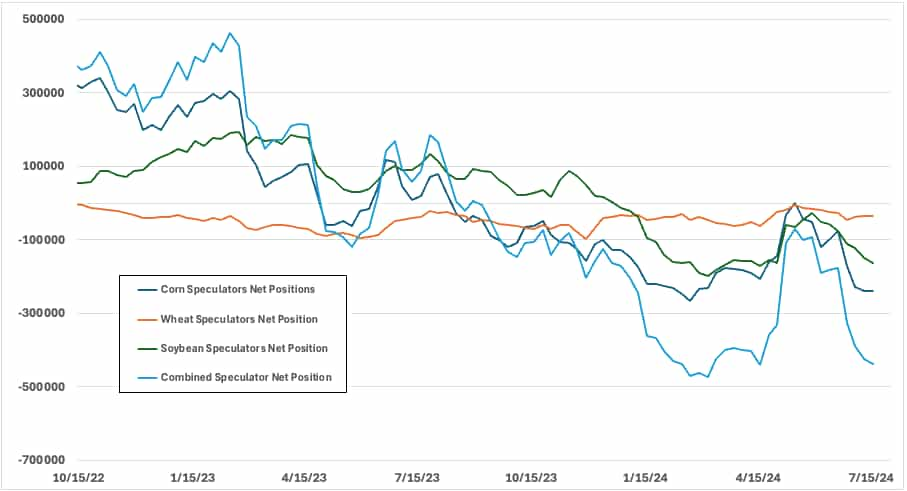

Speculators, mostly made up of managed money, trimmed corn shorts and added soybean shorts for the week ending July 16, according to Friday’s data from the Commodity Futures Trading Commission (CFTC).

The CFTC’s Commitments of Traders report (COT) showed noncommercial short positions in corn fell by 2,536 to 546,600 contracts; soybean non-commercial shorts increased by 22,248 to 296,755.

This puts soybean speculators at the most bearish net position since April, and corn near the most bearish since February.

Agricultural commodity traders will continue to monitor the weather and weekly export data until next month, when the focus will shift to the August WASDE report. July’s WASDE reduced soybean ending stocks.

Soybean technical outlook

Soybean prices for August (/ZSQ4) managed to close above the nine-day and 12-day exponential moving averages (EMAs) on a daily chart. Meanwhile, the MACD, short for moving average convergence/divergence, crossed above its signal line. Those developments are encouraging, but it may not be enough to signal a trend reversal. A close above the longer-term 21-day EMA would offer a better case for more technical strength. That said, traders may continue to sell into strength, as has been the case over the past couple of months.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.

tastylive content is created, produced, and provided solely by tastylive, Inc. (“tastylive”) and is for informational and educational purposes only. It is not, nor is it intended to be, trading or investment advice or a recommendation that any security, futures contract, digital asset, other product, transaction, or investment strategy is suitable for any person. Trading securities, futures products, and digital assets involve risk and may result in a loss greater than the original amount invested. tastylive, through its content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon or risk tolerance. tastylive is not in the business of transacting securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs), comparisons, statistics, or other technical data, if applicable, will be supplied upon request. tastylive is not a licensed financial adviser, registered investment adviser, or a registered broker-dealer. Options, futures, and futures options are not suitable for all investors. Prior to trading securities, options, futures, or futures options, please read the applicable risk disclosures, including, but not limited to, the Characteristics and Risks of Standardized Options Disclosure and the Futures and Exchange-Traded Options Risk Disclosure found on tastytrade.com/disclosures.

tastytrade, Inc. ("tastytrade”) is a registered broker-dealer and member of FINRA, NFA, and SIPC. tastytrade was previously known as tastyworks, Inc. (“tastyworks”). tastytrade offers self-directed brokerage accounts to its customers. tastytrade does not give financial or trading advice, nor does it make investment recommendations. You alone are responsible for making your investment and trading decisions and for evaluating the merits and risks associated with the use of tastytrade’s systems, services or products. tastytrade is a wholly-owned subsidiary of tastylive, Inc.

tastytrade has entered into a Marketing Agreement with tastylive (“Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’s brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade. tastytrade and Marketing Agent are separate entities with their own products and services. tastylive is the parent company of tastytrade.

tastyfx, LLC (“tastyfx”) is a Commodity Futures Trading Commission (“CFTC”) registered Retail Foreign Exchange Dealer (RFED) and Introducing Broker (IB) and Forex Dealer Member (FDM) of the National Futures Association (“NFA”) (NFA ID 0509630). Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances as you may lose more than you invest.

tastycrypto is provided solely by tasty Software Solutions, LLC. tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc. Neither tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero.

© copyright 2013 - 2026 tastylive, Inc. All Rights Reserved. Applicable portions of the Terms of Use on tastylive.com apply. Reproduction, adaptation, distribution, public display, exhibition for profit, or storage in any electronic storage media in whole or in part is prohibited under penalty of law, provided that you may download tastylive’s podcasts as necessary to view for personal use. tastylive was previously known as tastytrade, Inc. tastylive is a trademark/servicemark owned by tastylive, Inc.

Your privacy choices