Prices Rise for Corn, Wheat and Soybeans

Prices Rise for Corn, Wheat and Soybeans

Active investors weigh the effects on agriculture of inspections, weather and Trump’s odds for re-election

- Corn prices led a rally in agricultural futures after the release of weekly inspection data.

- Speculators remain largely net short in agricultural commodities.

- The weather outlook and Trump’s chances for re-election are in focus for investors.

Corn and soybeans rally on inspections data

Agricultural commodity futures rallied today after the United States Department of Agriculture (USDA) reported weekly data on grains inspection for export. Corn (/ZCU4) rose 2.56%, soybeans (/ZSQ4) gained 1.91% and wheat prices (/ZWU4) added 0.97%.

The data for the week ending Thursday, July 18, revealed that grains inspected or weighed for export came in at the top of trade estimates for corn and soybeans. Wheat exports were on the weaker side of estimates.

Corn inspections for the week totaled 970,000 metric tons, down from 1.1 million metric tons (MTs) the week before but still near the top end of trade estimates of 1.15 million MTs. Soybeans were at 327,061 MTs, up nearly double from the prior week, which is in the upper range of trade estimates. Wheat inspections were at 237,965 MTs, down from the previous week and below the trade estimates.

Weather in focus as USDA delivers crop progress report

The move comes as weather forecasts for August show above-normal probabilities for above-average temperatures across the major soybean and corn crop planting states of Minnesota, Iowa, Illinois and Indiana. The hotter temperatures may stress crops. If they do, we’ll see that data reflected in next week’s crop progress report.

The USDA’s crop progress report for the week ending July 21 crossed the wires this afternoon. It showed corn and soybean conditions remaining nearly unchanged from the week before. Spring wheat conditions were unremarkable, with excellent and good condition combined holding steady at 77%, and fair and poor combined dropping to 22% from 23%. The percentage of spring wheat rated very poor rose to 1% from 0%.

Trump trade in effect for agriculture products

Prices fell last week for corn, soybeans and wheat, following the failed assassination attempt on former President Donald Trump. The odds of a Trump presidency increased over the following days and betting odds predict he’ll win in November.

Investors expect Trump to return the United States to a tougher stance on China, mainly through tariffs. These tariffs would likely lead to retaliatory measures from China. Soybeans would likely be hardest hit, as they were from 2018 to 2019, when China placed retaliatory tariffs on soybeans. U.S. tariffs on China remained largely in place during the Biden administration.

China’s tariffs on U.S. soybeans remain at 25%, up from 3% before the trade war. In recent years, Brazil has filled much of the gap for China’s soybean appetite. China targeting soybeans with a harsher tariff rate is a possibility but not a certainty at this time. The U.S. didn’t inspect any soybeans bound for China in its inspection data for last week.

The possibility also exists that China could frontload agricultural imports ahead of a Trump presidency, which could benefit prices over the short term. U.S. soybean exports to China fell to $3.1 billion in 2018 from $12.2 billion the year prior. For 2023, soybean exports to China were at $15 billion, according to USDA data. Meanwhile, Brazil’s soybean exports to China have reached record-high levels, with first-half year sales totaling 34 million tons.

Short positioning in corn and soybeans

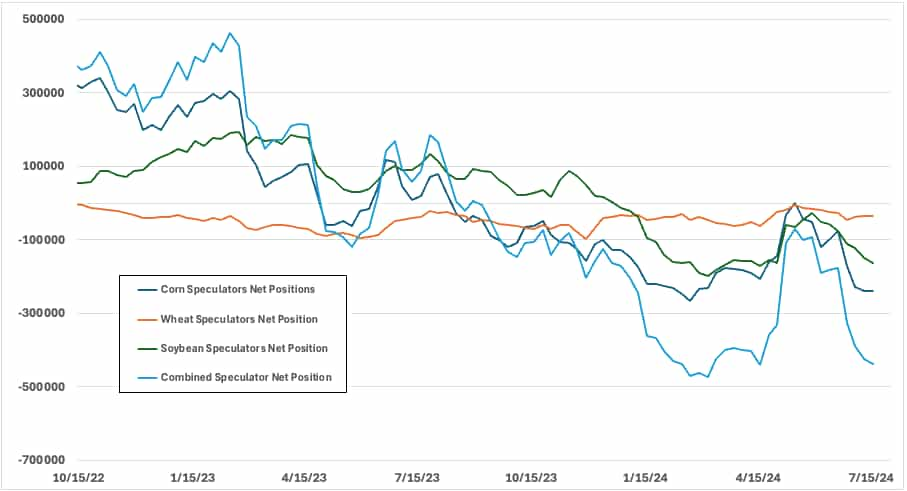

Speculators, mostly made up of managed money, trimmed corn shorts and added soybean shorts for the week ending July 16, according to Friday’s data from the Commodity Futures Trading Commission (CFTC).

The CFTC’s Commitments of Traders report (COT) showed noncommercial short positions in corn fell by 2,536 to 546,600 contracts; soybean non-commercial shorts increased by 22,248 to 296,755.

This puts soybean speculators at the most bearish net position since April, and corn near the most bearish since February.

Agricultural commodity traders will continue to monitor the weather and weekly export data until next month, when the focus will shift to the August WASDE report. July’s WASDE reduced soybean ending stocks.

Soybean technical outlook

Soybean prices for August (/ZSQ4) managed to close above the nine-day and 12-day exponential moving averages (EMAs) on a daily chart. Meanwhile, the MACD, short for moving average convergence/divergence, crossed above its signal line. Those developments are encouraging, but it may not be enough to signal a trend reversal. A close above the longer-term 21-day EMA would offer a better case for more technical strength. That said, traders may continue to sell into strength, as has been the case over the past couple of months.

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options before deciding to invest in options.